#cash-for-houses-in-foreclosure

Text

We Buy Houses in Dallas, Tx., With Tenants

We Buy Houses in Dallas, Tx., With Tenants

“We buy houses in Dallas,” and we can help you find that excellent investment opportunity, especially if you’re looking to generate passive income. However, it’s important to remember that it can come with some challenges and risks. For instance, you need to be aware of the lease agreement terms, including the rent amount, any special conditions, the expiration date, and the tenants’ rights to…

View On WordPress

#analyzing-a-real-estate-deal#analyzing-my-homes-value#appraisal-in-dallas#attract-multiple-offers-in-a-sellers-market#avoid-foreclosure-in-dallas#behind-on-mortgage-payment#buy-home-fast-in-garland#buy-my-cedar-hill-tx-home-fast#buy-my-cedar-hill-tx-house-fast#buy-my-dallas-home#buy-my-dallas-house#buy-my-foreclosure-home-in-dallas#buy-my-foreclosure-house#buy-my-foreclosure-house-in-dallas#buy-my-home-fast-in-cedar-hill#buy-my-home-fast-in-cedar-hill-tx#buy-my-home-fast-in-Dallas#buy-my-home-fast-in-garland#buy-my-home-fast-in-grand-prairie#buy-my-home-fast-in-mesquite#buy-my-home-fast-in-oak-cliff#buy-my-home-for-cash-fast#buy-my-home-for-cash-in-dallas#buy-my-home-in-cedar-hill-tx#buy-my-home-in-dallas#buy-my-home-in-foreclosure-in-dallas#buy-my-home-in-garland-tx#buy-my-home-in-grand-prairie#buy-my-home-in-grand-prairie-tx#buy-my-home-in-mesquite

0 notes

Text

#Pre-Foreclosure in Galveston County#we buy houses galveston#sell my house galveston#cash home buyers in galveston#sell my house fast galveston tx

0 notes

Text

If you're thinking of selling your house in San Antonio TX, now might be a good time. But before you put your home up for sale, it's essential to know what to expect in the current market. Every season has its advantages and disadvantages. So which is the best or worst time of year to sell your house? Here’s what you need to know.

#sell your house in san antonio#sell my home fast for cash#sell my home fast#sell your home before foreclosure#sell your Texas home#selling your home in San Antonio TX

0 notes

Text

7.Understanding the benefits of We Buy Homes For Cash

Many people are realizing the benefits of selling their home quickly for cash. People who have been thinking about selling their house fast have been in a difficult situation and have been worrying about the time, energy and money needed to sell their home. With the help of "We Buy House For Cash" services they can quickly get rid of their property with minimal effort and expense.

In today's competitive market, homeowners are encouraged to find the best ways to sell their property to get top dollar. For homeowners who want to quickly and safely move on with their lives, We Buy Houses For Cash can offer a quick and profitable solution. This method eliminates the need to go through lengthy listing processes, wait times, and other details that can complicate the traditional selling process.

We Buy Houses for Cash has many benefits. It is extremely convenient for sellers as the transaction usually takes less than one to two months. In addition, the homeowner doesn't need to make any repairs or renovations to the property in order to make it more attractive to potential buyers. Furthermore, no legal fees or commissions need to be paid.

Buyers can also choose the best house for http://edition.cnn.com/search/?text=mortgage their needs with the "We Buy Houses For Cash” approach. Furthermore, they can also avoid the problem of buyers no-showing during an inspection, as the entire transaction is handled over the phone or via mail.

This type of sale has one of the greatest advantages: buyers get cash upon closing the deal. Sellers don't have the luxury of waiting for months for the money to be paid. Additionally, if the homeowner is facing foreclosure, then the We Buy Houses For Cash approach can provide a reprieve from this situation.

We buy houses for cash, making the whole process much easier for sellers. They don't have to spend time dealing with realtors or worry about all the paperwork involved in the sale. They need to give the company some basic information about their property and they will get a guarantee offer in a matter of days.

Speed & Convenience

The fact that we buy houses for cash services offer a fast and convenient way of selling a home is a great benefit to homeowners. They don't have to worry about lengthy negotiations or financial institutions' paperwork. In addition, they no longer need to wait months until they finally receive the proceeds from the sale.

We Buy Houses For Cash is a convenient service that allows homeowners to move quickly without having to deal with the hassles of traditional home selling. The company also arranges for closings to be held at their offices, which can help homeowners avoid having to travel far to attend.

Lastly, with We Buy Houses For Cash services, homeowners don't have to worry about making costly repairs or renovations needed to make their home attractive to potential buyers. All they have to sell my house fast virginia do is provide basic information to receive a guaranteed offer within days.

Peace of mind

One of the greatest benefits of We Buy Houses for Cash is the peace-of-mind they offer sellers. They will take away the stress of listing a home, as well as all the uncertainty that comes with traditional methods of selling.

We Buy Houses For Cash services guarantee that the seller will receive a certain amount of cash, unlike traditional home sales. This means there won't be any surprises at the closing. The transaction is also protected by a secure system that keeps all public records safe.

Buyers can receive a guaranteed offer within 24hrs. Once the deal is closed, they no longer have to worry about any future problems. This way, everyone involved will be sure that everything goes as planned.

Selling a home can be a daunting task, and We Buy Houses For Cash services provide a fast and easy way for homeowners to get rid of their property quickly. They can help you sell your home quickly and efficiently, while also being reliable, reliable, and dependable.

The Advantages

Our We Buy Houses For Money services offer many advantages over traditional methods for selling a house. One of the most important ones is the speed in which the entire transaction can be completed. This type of sale also eliminates the need for extensive listing and waiting times, as well as the burden of paying for legal costs and commissions.

This approach is attractive to homeowners because it doesn't require costly repairs or renovations. Buyers get their money on the same day and don't have to wait for months to receive the funds. This allows them to move quickly.

Sellers can feel confident knowing that the "We Buy Houses For Cash” approach will ensure that they receive the agreed-upon amount. Furthermore, all public records related to the sale will be kept secure, completely avoiding the need to worry about future problems or complications.

Overall, We Buy Houses For Cash services are a great option for homeowners who need to sell their house quickly and securely. They are faster and more reliable than traditional methods, and they can eliminate the need for costly repairs or renovations.

Contacting We Buy Houses For Cash is the first step in selling your home. Homeowners will provide some basic information about their property, and the company will arrange for an inspection. Once all this information is received, the buyer will make a proposal and, if accepted, the closing date will be set.

Both buyers and sellers find the "We Buy Houses For Cash” process extremely efficient and convenient. Buyers get their money from the deal on the same day, and sellers don't need to worry about extensive listing and waiting times, as well as legal fees and commissions. This makes this approach attractive for those who want to move quickly and safely.

We Buy Houses For Cash companies will also ensure that all public records related to the sale are kept secure, so that both buyers and sellers don't have to worry about any kind of complications or future problems. This type of sale is also safer because all transactions are done over a secure network.

Finally, homeowners don't need to worry about making repairs or renovations to the property in order to make it attractive to potential buyers. This makes it much easier and more convenient for all parties.

1 note

·

View note

Text

Wait! Before You Sell Your Home For Cash, Take A Look At This.

The idea that you don't have to wait for months to list and close on your property is appealing to many stressed-out sellers because an increasing number of companies are making cash offers on homes and improving the experiences for sellers utilising the most recent technologies. You might think about selling your cash for houses if convenience and speed are your main priorities while moving.

0 notes

Photo

Want to sell your house for cash? Check out the detail about how we calculate the cash offers and help you sell your house faster.

For More Info: Sell House Cash Buyer Charlotte NC

#Inherited Property Capital Gains Charlotte NC#Squatter Rights Charlotte NC#How Much Does It Cost To Sell A House Charlotte NC#Avoid Foreclosure Charlotte NC#Who Pays Closing Costs Charlotte NC#Sell A house In Probate Charlotte NC#Sell My House Without Realtor Charlotte NC#Sell House Cash Buyer Charlotte NC#Sell House Cash Charlotte NC#How To Sell House Fast Charlotte NC#Companies Who Buy Houses For Cash Charlotte NC#Cash Offer On A House Charlotte NC

0 notes

Video

vimeo

Myrtle Beach Home Buyers is a company that has been buying homes in Myrtle Beach for many years. We buy houses fast and they are the experts to call when you need to sell your house quickly. With our help, you will get top dollar for your house and be able to move on with your life.

Myrtle Beach Home Buyers

2305 N Oak St, Ste A, Myrtle Beach, SC 29577

(843) 507–5058

My Official Website: https://www.myrtlebeachhomebuyers.com/

Google Plus Listing: https://www.google.com/maps?cid=2901766317835857912

Our Other Links:

foreclosure help: https://www.myrtlebeachhomebuyers.com/stop-foreclosure-in-myrtle-beach/

sell house for cash: https://www.myrtlebeachhomebuyers.com/how-do-i-sell-my-house-in-myrtle-beach/

Service We Offer:

selling property

buying houses

Real Estate services

Follow Us On:

Facebook: https://www.facebook.com/mbhousebuyers

Twitter: https://twitter.com/MyrtleBuyers

Pinterest: https://www.pinterest.com/MyrtleBeachHomeBuyersSC/

Instagram: https://www.instagram.com/myrtlebeachhomebuyers/

#we buy houses fast#we buy houses myrtle beach#sell house for cash#foreclosure help#prevent foreclosure

0 notes

Link

The organization you choose and its reputation are always important when you want to quickly sell a house for cash in Florida. At this point, hpinvestment.com comes into picture. Over the course of our more than 25 years

#quickly sell a house for cash#sell my home quickly#sell my house for cash#sell your home#Sell Property#sell my property online#avoid foreclosure

0 notes

Video

youtube

Utah Close Fast Cash Home Buyers can buy your house quickly. We buy houses Salt Lake City UT and all surrounding counties and areas! Our team in experienced home buyers who can buy your house without any hassle or waiting.

Utah Close Fast Cash Home Buyers

741 Murray Taylorsville Rd Unit B, Taylorsville, UT 84123

(801) 755-3865

My Official Website: https://www.utahclosefast.com/

Google Plus Listing: https://maps.google.com/maps?cid=12163945803856344979

Our Other Links:

sell my house in Salt Lake City: https://www.utahclosefast.com/sell-your-house/

stop foreclosure Salt Lake City: https://www.utahclosefast.com/avoid-foreclosure-salt-lake-utah/

Service We Offer:

selling property

buying houses

Real Estate services

Follow Us On:

Facebook: https://www.facebook.com/utahclosefast/

Twitter: https://twitter.com/utah_close_fast

Pinterest: https://www.pinterest.com/utahclosefastut/

Instagram: https://www.instagram.com/utahclosefast/

Linkedin: https://www.linkedin.com/in/eric-douros-b49b9846

#we buy houses in salt lake city#we buy houses salt lake city ut#sell my home fast salt lake city#sell my house for cash salt lake city#stop foreclosure salt lake city

0 notes

Link

Our company sells houses fast in Wichita KS without asking you to do any repairs! Cash for houses can help you meet a closing deadline if you're under a deadline. ICT House Buyers buy houses in any condition and offer cash for houses in Wichita KS.

#companies that buy houses wichita ks#we buy houses wichita ks#we buy ugly houses wichita ks#sell my house fast wichita ks#cash for houses wichita ks#avoid foreclosure Wichita KS#cash home buyer wichita ks

0 notes

Text

Gorgeous 1925 English Tudor style home in New Rochelle, New York is a foreclosure. It has 4bds, 4ba, $999K. But, the bank will only accept a buyer with cash or a renovation loan.

Look at this gorgeous woodwork. It is well worth the price, but there's not much reno to do. Why would you want to change this? The only thing I see is a dirty floor. It looks like it's been freshly painted.

I wish they would've taken a closeup of that magnificent fireplace. Look at the doors on the left and the leaded stained glass windows.

Look at this. A couple stairs up to the hallway, thru this beautiful shelving. Look at the artwork above the window, also.

I hesitate to call this amazing area a sun porch, b/c it's too sophisticated, but it could be one. It's enclosed, so it's not a loggia.

It has a typically English Tudor ceiling in this room and the wood paneling is so beautiful

The eat-in kitchen and cabinets are in good shape. Looks like there's a new dishwasher with the protective film still on.

What a great pantry.

I don't know what this room is, but it's nice and appears to have a closet and an outside door.

I wonder if the lift works.

Here's a nice large bedroom. Maybe it's the primary.

That bath needs some work. Weird toilet cubby.

Here's another nice room.

This one's a nice shape.

This bath is fine.

This is lovely up here. It's a finished attic, but has the duct work exposed.

This bath is perfectly fine, too. This house doesn't need a reno loan to completely modernize it, though, that would be a shame. Hope they don't paint the wood white and the walls gray.

The grounds need some clean up and this is the garage. Wow, look how fancy the floor was. The property measures .37 acre.

119 notes

·

View notes

Text

We Buy Houses in Oak Cliff, Run Your Numbers

We Buy Houses in Oak Cliff,

When reviewing offers from buyers for your house remember “we buy houses in Oak Cliff,” as it is important that you know how to correctly run the numbers. Just because an offer looks good on paper, doesn’t mean it is the best choice for you. Learn more about how to crunch the numbers in our latest post by We Buy Houses Cash Dallas!

While the highest offer might appear to be the best, this isn’t…

View On WordPress

#analyzing-a-real-estate-deal#analyzing-my-homes-value#appraisal-in-dallas#attract-multiple-offers-in-a-sellers-market#avoid-foreclosure-in-dallas#behind-on-mortgage-payment#buy-home-fast-in-garland#buy-my-cedar-hill-tx-home-fast#buy-my-cedar-hill-tx-house-fast#buy-my-dallas-home#buy-my-dallas-house#buy-my-foreclosure-home-in-dallas#buy-my-foreclosure-house#buy-my-foreclosure-house-in-dallas#buy-my-home-fast-in-cedar-hill#buy-my-home-fast-in-cedar-hill-tx#buy-my-home-fast-in-Dallas#buy-my-home-fast-in-garland#buy-my-home-fast-in-grand-prairie#buy-my-home-fast-in-mesquite#buy-my-home-fast-in-oak-cliff#buy-my-home-for-cash-fast#buy-my-home-for-cash-in-dallas#buy-my-home-in-cedar-hill-tx#buy-my-home-in-dallas#buy-my-home-in-foreclosure-in-dallas#buy-my-home-in-garland-tx#buy-my-home-in-grand-prairie#buy-my-home-in-grand-prairie-tx#buy-my-home-in-mesquite

0 notes

Text

Wall Street Journal goes to bat for the vultures who want to steal your house

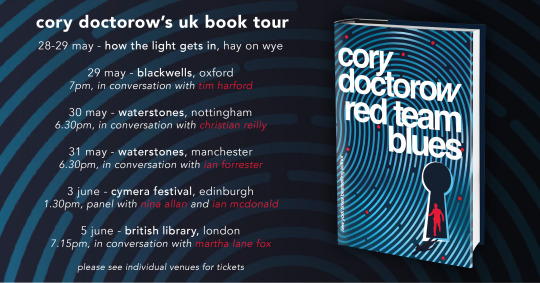

Tonight (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Tomorrow (June 6), I’m on a Rightscon panel about interoperability.

The tacit social contract between the Wall Street Journal and its readers is this: the editorial page is for ideology, and the news section is for reality. Money talks and bullshit walks — and reality’s well-known anticapitalist bias means that hewing too closely to ideology will make you broke, and thus unable to push your ideology.

That’s why the editorial page will rail against “printing money” while the news section will confine itself to asking which kinds of federal spending competes with the private sector (creating a bidding war that drives up prices) and which kinds are not. If you want frothing takes about how covid relief checks will create “debt for our grandchildren,” seek it on the editorial page. For sober recognition that giving small amounts of money to working people will simply go to reducing consumer and student debt, look to the news.

But WSJ reporters haven’t had their corpus colossi severed: the brain-lobe that understands economic reality crosstalks with the lobe that worship the idea of a class hierarchy with capital on top and workers tugging their forelacks. When that happens, the coverage gets weird.

Take this weekend’s massive feature on “zombie mortgages,” long-written-off second mortgages that have been bought by pennies for vultures who are now trying to call them in:

https://www.wsj.com/articles/zombie-mortgages-could-force-some-homeowners-into-foreclosure-e615ab2a

These second mortgages — often in the form of home equity lines of credit (HELOCs) — date back to the subprime bubble of the early 2000s. As housing prices spiked to obscene levels and banks figured out how to issue risky mortgages and sell them off to suckers, everyday people were encouraged — and often tricked — into borrowing heavily against their houses, on complicated terms that could see their payments skyrocket down the road.

Once the bubble popped in 2008, the value of these houses crashed, and the mortgages fell “underwater” — meaning that market value of the homes was less than the amount outstanding on the mortgage. This triggered the foreclosure crisis, where banks that had received billions in public money forced their borrowers out of their homes. This was official policy: Obama’s Treasury Secretary Timothy Geithner boasted that forcing Americans out of their homes would “foam the runways” for the banks and give them a soft landing;

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

With so many homes underwater on their first mortgages, the holders of those second mortgages wrote them off. They had bought high-risk, high reward debt, the kind whose claims come after the other creditors have been paid off. As prices collapsed, it became clear that there wouldn’t be anything left over after those higher-priority loans were paid off.

The lenders (or the bag-holders the lenders sold the loans to) gave up. They stopped sending borrowers notices, stopped trying to collect. That’s the way markets work, after all — win some, lose some.

But then something funny happened: private equity firms, flush with cash from an increasingly wealthy caste of one percenters, went on a buying spree, snapping up every home they could lay hands on, becoming America’s foremost slumlords, presiding over an inventory of badly maintained homes whose tenants are drowned in junk fees before being evicted:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

This drove a new real estate bubble, as PE companies engaged in bidding wars, confident that they could recoup high one-time payments by charging working people half their incomes in rent on homes they rented by the room. The “recovery” of real estate property brought those second mortgages back from the dead, creating the “zombie mortgages” the WSJ writes about.

These zombie mortgages were then sold at pennies on the dollar to vulture capitalists — finance firms who make a bet that they can convince the debtors to cough up on these old debts. This “distressed debt investing” is a scam that will be familiar to anyone who spends any time watching “finance influencers” — like forex trading and real estate flipping, it’s a favorite get-rich-quick scheme peddled to desperate people seeking “passive income.”

Like all get-rich-quick schemes, distressed debt investing is too good to be true. These ancient debts are generally past the statute of limitations and have been zeroed out by law. Even “good” debts generally lack any kind of paper-trail, having been traded from one aspiring arm-breaker to another so many times that the receipts are long gone.

Ultimately, distressed debt “investing” is a form of fraud, in which the “investor” has to master a social engineering patter in which they convince the putative debtor to pay debts they don’t actually owe, either by shading the truth or lying outright, generally salted with threats of civil and criminal penalties for a failure to pay.

That certainly goes for zombie mortgages. Writing about the WSJ’s coverage on Naked Capitalism, Yves Smith reminds readers not to “pay these extortionists a dime” without consulting a lawyer or a nonprofit debt counsellor, because any payment “vitiates” (revives) an otherwise dead loan:

https://www.nakedcapitalism.com/2023/06/wall-street-journal-aids-vulture-investors-threatening-second-mortgage-borrowers-with-foreclosure-on-nearly-always-legally-unenforceable-debt.html

But the WSJ’s 35-paragraph story somehow finds little room to advise readers on how to handle these shakedowns. Instead, it lionizes the arm-breakers who are chasing these debts as “investors…[who] make mortgage lending work.” The Journal even repeats — without commentary — the that these so-called investors’ “goal is to positively impact homeowners’ lives by helping them resolve past debt.”

This is where the Journal’s ideology bleeds off the editorial page into the news section. There is no credible theory that says that mortgage markets are improved by safeguarding the rights of vulture capitalists who buy old, forgotten second mortgages off reckless lenders who wrote them off a decade ago.

Doubtless there’s some version of the Hayek Mind-Virus that says that upholding the claims of lenders — even after those claims have been forgotten, revived and sold off — will give “capital allocators” the “confidence” they need to make loans in the future, which will improve the ability of everyday people to afford to buy houses, incentivizing developers to build houses, etc, etc.

But this is an ideological fairy-tale. As Michael Hudson describes in his brilliant histories of jubilee — debt cancellation — through history, societies that unfailingly prioritize the claims of lenders over borrowers eventually collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Foundationally, debts are amassed by producers who need to borrow capital to make the things that we all need. A farmer needs to borrow for seed and equipment and labor in order to sow and reap the harvest. If the harvest comes in, the farmer pays their debts. But not every harvest comes in — blight, storms, war or sickness — will eventually cause a failure and a default.

In those bad years, farmers don’t pay their debts, and then they add to them, borrowing for the next year. Even if that year’s harvest is good, some debt remains. Gradually, over time, farmers catch enough bad beats that they end up hopelessly mired in debt — debt that is passed on to their kids, just as the right to collect the debts are passed on to the lenders’ kids.

Left on its own, this splits society into hereditary creditors who get to dictate the conduct of hereditary debtors. Run things this way long enough and every farmer finds themselves obliged to grow ornamental flowers and dainties for their creditors’ dinner tables, while everyone else goes hungry — and society collapses.

The answer is jubilee: periodically zeroing out creditors’ claims by wiping all debts away. Jubilees were declared when a new king took the throne, or at set intervals, or whenever things got too lopsided. The point of capital allocation is efficiency and thus shared prosperity, not enriching capital allocators. That enrichment is merely an incentive, not the goal.

For generations, American policy has been to make housing asset appreciation the primary means by which families amass and pass on wealth; this is in contrast to, say, labor rights, which produce wealth by rewarding work with more pay and benefits. The American vision is that workers don’t need rights as workers, they need rights as owners — of homes, which will always increase in value.

There’s an obvious flaw in this logic: houses are necessities, as well as assets. You need a place to live in order to raise a family, do a job, found a business, get an education, recover from sickness or live out your retirement. Making houses monotonically more expensive benefits the people who get in early, but everyone else ends up crushed when their human necessity is treated as an asset:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Worse: without a strong labor sector to provide countervailing force for capital, US politics has become increasingly friendly to rent-seekers of all kinds, who have increased the cost of health-care, education, and long-term care to eye-watering heights, forcing workers to remortgage, or sell off, the homes that were meant to be the source of their family’s long-term prosperity:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

Today, reality’s leftist bias is getting harder and harder to ignore. The idea that people who buy debt at pennies on the dollar should be cheered on as they drain the bank-accounts — or seize the homes — of people who do productive work is pure ideology, the kind of thing you’d expect to see on the WSJ’s editorial page, but which sticks out like a sore thumb in the news pages.

Thankfully, the Consumer Finance Protection Bureau is on the case. Director Rohit Chopra has warned the arm-breakers chasing payments on zombie mortgages that it’s illegal for them to “threaten judicial actions, such as foreclosures, for debts that are past a state’s statute of limitations.”

But there’s still plenty of room for more action. As Smith notes, the 2012 National Mortgage Settlement — a “get out of jail for almost free” card for the big banks — enticed lots of banks to discharge those second mortgages. Per Smith: “if any servicer sold a second mortgage to a vulture lender that it had charged off and used for credit in the National Mortgage Settlement, it defrauded the Feds and applicable state.”

Maybe some hungry state attorney general could go after the banks pulling these fast ones and hit them for millions in fines — and then use the money to build public housing.

Catch me on tour with Red Team Blues in London and Berlin!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/04/vulture-capitalism/#distressed-assets

[Image ID: A Georgian eviction scene in which a bobby oversees three thugs who are using a battering ram to knock down a rural cottage wall. The image has been crudely colorized. A vulture looks on from the right, wearing a top-hat. The battering ram bears the WSJ logo.]

#pluralistic#great financial crisis#vulture capitalism#debts that can’t be paid won’t be paid#zombie debts#jubilee#michael hudson#wall street journal#business press#house thieves#debt#statute of limitations

129 notes

·

View notes

Note

Don’t you think the maturity difference between Rafe and Barry is a little weird? I mean Barry lives alone and sells drugs while Rafe is so dependent on his dad. And isn’t the age difference also a little strange?

I don’t mean this as hate just genuinely asking.

Canonically? Not even a little bit.

Almost everything about Barry is speculation. How old is he? We don't actually know because the show never confirms it, if he celebrates his 24th birthday in season 4 we can't argue he's actually 27 just because fandom says he is. He refers to the trailer(s) as his, but does he own them? Were they passed down when his parents died or were they foreclosures or is he renting or did he scrounge up enough cash to buy the property? Again, we don't know.

In the first episode, Rafe and Barry clearly know each other but they aren't chummy. When Rafe gets himself into trouble he runs to Barry both to get high and to get help from someone who's just as loose with their morals as he is, and in turn Barry gets money. I won't say what formed between them is platonic because that would be a lie but I also don't think it was intentional, especially on Barry's part.

Is there a power imbalance? I don't really think so.

Does Barry appear to have way more life experience? Yeah!

I think that's something Rafe would be attracted to (no matter how he views Barry; as a partner or a friend or a brother, etc.) because he thrives on guidance.

And yes, Rafe is mentally ill and struggling with addiction while his father neglects and physically abuses him. He wants affection and reassurance and help which he has outright asked for only to be told very coldly to "man up."

(and I want to take a second to point out so it's not glossed over that RAFE IS AN ADDICT. Rafe needs to get high often, drugs require money, Ward gives it to him. In what world would Rafe have the capacity to turn away offerings that carry little to no expectations from him? Houses, cars, money, etc., it's provided for him so what's the point of going to school or working hard like Barry has to?)

At such an uncertain time in his young life it makes sense, at least to me, Rafe would be trying his hardest for approval. Especially with Sarah pulling away from the family and potentially making room for him to weasel his way into Ward's unfeeling heart.

So I don't think Rafe's relationship with his father should be used as an example of why he's unfit for a relationship with someone more stable.

If anything, I feel Barry and Rafe's lives would be better together, mainly because I feel Rafe would be pushed to get help and have the support to do it.

okay, but

In fanfiction? Where they're dating or fucking? Sure, the age difference is a little off.

As someone in their mid-twenties I sure as shit wouldn't date someone with 'teen' in their age.

BUT I think it's fair to assume Barry The Drug Dealer didn't have the greatest moral compass to begin with, worsening after time with Rafe.

Would he take advantage of Rafe's vulnerability? depends on what I'm writing, but probably, yeah, at least in the beginning. Would he use Rafe for status or money? same thing, probably in the right circumstances.

There's probably more I could say but I feel like I'm rambling and I'm not sure I'm doing a good job at answering this anyway.

But thank you for asking (:

#was this the answer you wanted?#lmk#cause i feel like way better people could've gotten this ask and given you a satisfying answer#i originally just answered with “rafe and barry are evil so it doesn't matter!! <3” but that felt dismissive#tbh if y'all don't agree with something#tell me because i barely remember whats canon and what i just made up in my noggin#rafebarry

14 notes

·

View notes

Text

Robert Villeneuve West Nipissing - Is Multifamily Real Estate A Good Investment?

Robert Villeneuve West Nipissing: During these economically challenging times, people look for genuine investment opportunities. They want to invest in stable and low-risk schemes that offer them high returns. These kinds of opportunities take a lot of work to come by today.

Robert Villeneuve West Nipissing, a multifamily real estate expert, points out why you should own this type of real estate.

You can outsource the management of the property to some experts. This will afford you quality time.

You can buy such properties without investing any of your money. It is easier to get loans for condos or apartments than for a family home. You can easily cover cash needs by raising some private money.

You can safeguard far better leverage of your time and energy. You can maintain a 12-unit apartment over 12 individual homes.

Valuation of income properties is done based on the profit they make. You can raise its value by increasing the rent and lowering the expenses incurred in maintaining them. You will start to appreciate the use of time and money.

There is less risk. You have a massive number of tenants and hence have many proceeds streams. Apartments are intended for business. In the case of a property, if you lose a tenant, you begin paying all the costs from your pocket.

In the case of multifamily homes, it’s pretty simple to raise the money. For instance, if you borrow 1M dollars, this now becomes non-recourse finance, meaning the asset is the only security to the bank for the loan, and you are not liable.

There’s a steep fall in subprime lenders of the loan. There are many people out there who can’t fulfil the terms and conditions for houses for which they raised loans, and as a result, there is a rise in foreclosures. There’s definitely a good demand for rentals.

As we discussed above, you have an excellent return assured for the investment if you go ahead and purchase multifamily real estate. A multifamily apartment is a perfect start if you are searching for a suitable investment venture. If you want to know more about multifamily real estate, you can ask for guidance from experts like Robert Villeneuve.

22 notes

·

View notes

Text

The Process of Selling Your House for Cash Explained

Selling your house for cash can be a fast and convenient way to get the money you need, but it can also be a complex process. This article will explain the steps involved in selling your house for cash, including how to prepare your home for sale, how to find a cash for houses buyer, and what to expect during the closing process.

0 notes