#bet broker uk

Note

AC6 College AU? Rusty plays the lacrosse, Raven is either a programmer or an engineer major, Ayre is an AI made by him, and Freud is one of the faculty members.

i've actually thought about a college AU!

Well, technically, a university AU bc I'm from the UK and college is a diff thing entirely to uni. Also I have no idea what American uni culture is like LMAO (idek what lacrosse is, rusty would be good at football or rugby tho) BUT ANYWAYS my idea for it was:

RUSTY: an undergraduate taking the BSc (Hons) in Ecology and Conservation (not sure if it's different outside of UK, but an "honours degree" is more difficult than a standard degree, and is more attractive to employers as a result). He's got an avid interest in ecology and zoology, and has plans to be a conservationist upon graduating.

621: He's actually a professor at the university, but looks so young that most mistake him as a student if they're not in his department. He teaches ethical hacking and cyber security, and has several rumours about him, such as he used to be a notorious hacker who was eventually caught and strongarmed into working for the government in lieu of a prison sentence, and now spends his time teaching the next generation, etc, etc. Is it true? Who knows...

WALTER: He's the university librarian, and everyone is scared of him because he's so stern and always has this aura of intensity, even when just checking a book out for someone. For some reason he's on very good terms with 621... many people theorise on their history, because Walter's also very good with computers... everyone is also aware that Walter and Michigan are a thing bc those guys ain't subtle in the slightest.

FREUD: He teaches sport science and students either love him or hate him. He's like the human personnification of marmite. He's very enthusiastic about health and remaining in peak condition, and he expects his students to give 110% in his classes. He's always butting heads with Snail, who's in the same department as him. People take bets on how long it'll take for them to fight in the parking lot and who would win (Freud has 'is insane' strength but Snail would be powered by sheer rage that has been repressed for x amount of years).

IGUAZU: He works in the on-campus cafe as a barista. He's surly and curt but makes the best damn coffee in the city so no one really complains about it. He seems to know 621 and has some kind of hate-love relationship with him? It's complicated. He yells at 621 every time he walks into the cafe but also knows his order off by heart so it's very hmmm (more fuel for the rumour mills).

MICHIGAN: He teaches War Studies and History, and while he's a pretty demanding professor, most students love his energetic style of teaching. Many assume him to be a red and blue blooded American on account of his bombastic personality, American accent and insisting on being called Michigan - he's actually French and the estranged son of a well-known billionaire. It's Michigan's deepest darkest secret.

AYRE: Every so often 621 will have a guest speaker in his classes who calls in remotely (and voice only) called Ayre. He says she's an "old work colleague" and they're both very vague about what work they were colleagues in, but people enjoy Ayre's guest appearances as she's very friendly - in direct contrast to the very taciturn and almost cold 621.

O'KEEFFE: He works in HR, but most students joke that he's more of an information broker than anything. Though he acts put upon, he's willing to help out students trying to navigate the byzantine beaucracy of university paperwork and how to squeeze out as much as possible from their loans or signposting people to things that can help them. He's easily bribed with coffee and cigarettes, but honestly, he'd help out even without a bribe... very much one of those people who look gruff and unfriendly on the outside, but actually a good person underneath it all.

FLATWELL: He owns a bakery just outside of university grounds that's popular with the students. One of the reasons Rusty chose this univeristy to do his degree: his Uncle lives just outside of it, and was willing to house him, letting Rusty save money for dormitory and food and stuff. Seems to have some ~history~ with O'Keeffe in HR...

UH THOSE ARE THE MAIN CHARACTERS/ROLES and the plot would be Rusty crossing paths with 621 and thinking him very cute (621 would be the type to dress in cardigans and wear glasses), and also a fellow student... is totally unaware that he's a faculty member from an entirely different department. Tl;dr after some flirting and a few dates, Rusty only realises that 621 is a faculty member when he mentions off hand about needing to go back early to mark papers.

Rusty: oh you're... a TA? helping out in your last year?

621: no i teach

Rusty:

Rusty: wait how old are you-

In this I'm thinking Rusty would be in his mid-twenties, and 621 would be in his late thirties. So, about a 10 year gap between them, give or take a year.

But yeah. Coughs. That's.... that's my university au idea... mmhm. yeah...

#armored core#armored core 6#all i do at work is think of random aus tbh#if i had access to my computer at work i'd probably write even more fic than i do now...#lies down#sighs#armored core......

15 notes

·

View notes

Text

The eye-glazing scam of Medicare drug plans

CORRECTION: An earlier version of this article erroneously claimed Simon Lovell had passed away; I misremembered my contribution to a 2015 medical fundraiser for Mr Lovell as a contribution to a funeral expenses fundraiser. My sincere apologies to Mr Lovell (and I’m delighted to learn I was wrong!).

Indie bookstores can change your life. In 2007, I wandered into NYC’s St Marks’ Bookstore (RIP) and picked up a book from the recommended table: “How to Cheat at Everything,” by Simon Lovell, and I learned how to spot a scam. It’s a skill I use every day, especially when analyzing how corporate America works the US government:

https://memex.craphound.com/2007/02/02/how-to-cheat-at-everything/

I grew up in countries — Canada, the UK — with universal health care and now I live in the US. The NHS and OHIP aren’t perfect, but neither set off my scam-meter the way that the American system does. The whole thing is a scam, top to bottom.

Here’s a key lesson from Lovell’s book: “complexity in a proposition bet is only there to make it harder for you to figure out the odds.” In other words, if a grifter at a bar tells you that they’ll pay you 3:1 if you can do X, and 5:1 if you can do Y, and 9:1 if you can do X and Y, all of those different payouts are solely there to confuse you.

If you want to see this in action, just visit any casino and ask a croupier to explain the craps payout lines to you, and try to do the odds in your head while you get that explanation. What’s the least-worst bet on the craps table? (There are no good bets on a craps table). Without a spreadsheet and several hours of analysis, you probably can’t know.

The flamboyant, mind-clouding complexity in US health care starts with health insurance. Insurance, after all, is just a proposition bet: “If you contract this illness, we pay this much; if you need this drug, we pay this much. Pay an extra $20/month, and we’ll reduce your co-pay by this much, but only once you’ve covered your deductible. Pay $3/month more and your deductible goes down by this much. Oh, and here’s your HSA, which will accrue tax-free savings you can use for some of this. What’s a before-tax dollar worth? Sorry, that’s another spreadsheet.”

You’d think that government health insurance — Medicare and Medicaid — would be immune to this kind of gamesmanship, but you’d be wrong. When you become Medicare-eligible, you still need to buy a drug plan. Those drug plans are provided via private-sector companies like Humana. They are a scam.

Twice a year, Medicare has an “open enrollment” period, just like other US insurers. During open enrollment, you are encouraged to use the Medicare Plan Finder to sort through all the different plans. You feed in your prescriptions, it pops out a recommendation. You can even talk it over with a trusted broker before you pick. It feels like a straightforward transaction, but it’s still a scam.

Here’s how the scam works. Remember that you can only change plans twice a year. Given that, you’ve likely assumed that once you choose a plan, its rates remain constant for that duration: if you agree to pay $X for your prescriptions from January to June, then the pharma plan operator is agreeing only to charge you $X over that period, right?

Wrong. As Susan Jaffe writes for Kaiser Health News, even though you guarantee that you will use your pharma plan provider for the next six months, your pharma plan provider makes no guarantees to you about how much that will cost you.

https://khn.org/news/article/medicare-drug-plan-prices-open-enrollment-rise/

Jaffe opens with the story of retired construction accountant Linda Griffith, who signed up for a Humana plan last December that promised her a $70.09 co-pay for her monthly prescription, but when the plan kicked in a month later, Humana cranked the price up to $275.90.

This isn’t an anomaly. As an AARP study found, the pharma plan providers routinely lower their payouts to something close to list-price just before open enrollment, so that the plan-shopping tools show that they’re a good deal, then, as soon as the open enrollment closes and patients are locked in, they crank the prices up.

https://blog.aarp.org/thinking-policy/prices-for-most-top-medicare-part-d-drugs-have-already-increased-in-2022

These companies will tell you that they’re bargaining hard with the pharma companies to get prices down, and they are, but only so that they can shift a larger proportion of the scam’s winnings from pharma, to pharma benefit managers, to insurers. You don’t share in the bounty. You are the bounty.

https://pluralistic.net/2020/12/11/number-eight/#erisa

For decades, Democrats have been campaigning to repeal the law that prohibits Medicare from directly negotiating with pharma companies, but they’ve failed — thanks to Republicans, and thanks to sellouts in the Democratic caucus, like Cory Booker, who says he’s not going to let his pharma industry donors dictate his votes anymore:

https://www.statnews.com/2019/02/12/cory-booker-presidential-run-pharmaceutical-industry-ties/

Meanwhile, the scammers continue to add complexity to the proposition bet and use the obscuring effect of all those bizarre odds to cloud our ability to calculate the odds. Some drug plans have six tiers of benefits, each with their own co-pay (a flat fee per prescription) and/or co-insurance (a percentage of the drug price). Sometimes it’s cheaper not to use your insurance to buy drugs at all, because the cash price is lower than the co-pay.

There is no amount of plan-tinkering that can substitute for allowing Medicare to directly negotiate with pharma companies and set a price, the way all the other national health-care plans do. There’s a reason Americans pay 200–400% more for their prescriptions than Canadians.

https://www.gao.gov/products/gao-21-282

An insurance plan that you can’t change, but the insurer can? That is a scam that’s visible from orbit. Any insurer that does this is permanently disqualified from being trusted with anyone’s health. It doesn’t matter how many tiers are offered, or how many rebates, or what the co-pay is. It doesn’t matter how many price-comparison tools there are. If the insurer can change the payout at will and you can’t change insurers when they do, all of that stuff is just window-dressing, lines on the craps table, there to distract you while you’re ripped off.

Image:

Chris Martin (modified)

https://www.flickr.com/photos/cjmartin/11331819423

CC BY 2.0:

https://creativecommons.org/licenses/by/2.0/

Christine Dela Cerna (modified)

https://commons.wikimedia.org/wiki/File:Various_pills.JPG

CC BY-SA 3.0:

https://creativecommons.org/licenses/by-sa/3.0/deed.en

[Image ID: A craps table surrounded by excited gamblers; amid the casino chips are various pharma tablets, some spilling out of a pill bottle.]

132 notes

·

View notes

Text

Operation Fortune: Ruse de Guerre (2023) Review

If there is anyone who can say the word “f***ing” so eloquently it is Jason Statham. It’s like Samuel L. Jackson’s signature “motherf***er” line - it just works!

Plot: Elite spy Orson Fortune must track down and stop the sale of a deadly new weapons technology wielded by billionaire arms broker Greg Simmonds. Reluctantly teamed up with some of the world's best operatives, Fortune and his crew recruit Hollywood's biggest movie star, Danny Francesco, to help them on their globe-trotting mission to save the world.

Yet again our dear fellow British filmmaker Guy Ritchie attempts to kickstart another spy espionage franchise, and once again it seems his attempt is faltered, in this case with Operation Fortune suffering a year long delay of its release due to its distribution company going into administration, as well as the little fact of that little war between Russia and Ukraine making it kind of awkward to release a movie where Ukrainians are the bad guys. I mean, how was Guy Ritchie supposed to predict that the Russian invasion of Ukraine was gonna happen?? It was so unexpected. It wasn’t as if this conflict was going on since 2014 or anything. Regardless, we finally see the release of this film, to which I myself am really happy about, as personally I really do enjoy Guy Ritchie’s movies. From his stylish direction to an almost poetically Shakespearian way he manages to write swear words as if they were song lyrics; his movies have always been really enjoyable. So now another spy espionage with Jason Statham in the lead? Why the heck now, let’s gooo!

Immediately what I can say I really admired about Operation Fortune is that it doesn’t set out to be another massive action blockbuster on the level of those Fast & Furious flicks or even the more recent James Bond outings. Instead it happily exists on a much more smaller scale, and much better for it. Here in the UK this film bypassed cinemas and went for a straight to streaming release via Prime Video, and that works for the movie’s benefit as this is the kind of simple easy-watch entertainment one can relax to on a weekend evening, with some good laughs, a decent amount of action thrills and a very likeable game cast. My dear fiancée even observed that she found this movie to be absolutely “delightful”. I get what she means - this crime caper really breezes through its content with Guy Ritchie’s trademark sharp wit in the dialogue, and all the talent involved seem to all be having an utterly splendid time.

Jason Statham is always a safe bet when it comes to having an action star in your movie. He’s charming, elegant, yet got that enough brutishness to make him feel like the one in control of the room. And his passive delivery of lines make for some very amusing moments. Aubrey Plaza is as sarcastic as ever, and Cary Elwes has such a deep yet wonderful sounding voice. Like this man could read me an audiobook any day of the week - just saying! Hugh Grant is highly entertaining as the eccentric billionaire, and shows that the recent partnership between him and Guy Ritchie working together is so far a solid 100% success.

Overall Operation Fortune is very much for the fans of Guy Ritchie and Jason Statham. If you like them then this is a safe bet of an entertaining if forgettable watch, but at the end of the day Ruse de Guerre works as a wonderful light popcorn flick.

Overall score: 6/10

#operation fortune#guy ritchie#jason statham#aubrey plaza#cary elwes#bugzy malone#eddie marsan#josh hartnett#hugh grant#prime video#operation fortune ruse de guerre#operation fortune review#2023#2023 in film#2023 films#movie#film#movie reviews#film reviews#spy#spy espionage#action#crime#thriller#comedy#ruse de guerre

3 notes

·

View notes

Text

Check out the List of Meta Trader 5 Brokers Offering Different Trading Options and Capabilities

MetaTrader 5, a multi-functional trading platform, is used by brokers to trade more than just forex. This forex trading platform is most popular amongst advanced and day traders using the platform over the web, on desktops, or as a mobile app. Check out the list of MetaTrader 5 brokers on ForexUK to choose the best.

#forex trading course#trading forex for beginners#trading forex beginners#metatrader#metatreader 5 brokers#spread betting brokers

1 note

·

View note

Text

Foxane.com review – is Foxane a scam or a good Forex broker?

Foxane is yet another reason why we always advise caution when it comes to Forex brokers – the company is not actually licensed, or fit, to be offering the services it does. It cannot bring about anything but losses for you – so investing with it is quite the terrible idea. If you need more information on Foxane, read on – we have exposed all of the broker’s failings in the review below – but before we get into it, we would like to make a small disclaimer:

Opening an account with Foxane at the time of writing is not possible – any attempt to do so leads to the following error page:

This is quite the display of incompetence on Foxane’s part – but considering what we have to say about the broker, it might also be a blessing in disguise – after all, if Foxane does not open accounts, it cannot take anyone’s money!

Is Foxane a legitimate broker?

Absolutely not – the broker does not have a license. It also hails from one of the shadiest offshore jurisdictions out there – that of St. Vincent and the Grenadines. Here is what the broker’s address seems to be:

If it seems we are harsh towards St. Vincent, that is because the county has a well-earned reputation as a scam haven – you see, it does not regulate its Forex markets in any capacity. Therefore, scammers of all kinds set up shop there, so they can run their schemes unopposed. And even if a company from the country is not running a scam, there are no guarantees that it is licensed to deal on the Forex markets – these firms usually go under in a couple weeks and take their clients’ deposits with them.

Contrast that to a stricter jurisdiction – the UK, for example – companies from it are required to report on a daily basis on open and closed trades, to make sure they cannot engage in any kind of market manipulation. And to protect their clients from the volatility of the markets, the UK demands that all brokers participate in guarantee funds, which pay out up to 85 000 pounds per affected client if the company goes under.

There are many more polices the UK has in place and many more requirements brokers need to comply with – but, as you can see, trading with licensed brokers simply makes more sense than using the services of offshore ones like Foxane!

Can I make money with Foxane?

No – since Foxane is unlicensed, you cannot turn a profit with it. Once again, a regulated broker would be a safer bet. There is also the issue of the company’s Terms and Conditions that are incredibly vague – check out what Foxane has to say about the fees it charges:

These fees are not available anywhere on the broker’s website – and yet, it threatens its clients with legal action over them! An open clause like that can have Foxane charge you as much as it wants to – even tax you through the nose if it wants to. Let’s also take a look at the broker’s policy on bonuses:

It states that ones of over 10% of the deposited amount might bring about additional terms and conditions – we cannot know what these are for certain, but brokers that offer bonuses mainly do so to restrict client withdrawals – Foxane might insist that accounts credited with a bonus need to achieve a certain turnover to withdraw, for example.

What leverage does Foxane have available?

Foxane provides access to a leverage of up to 1:400 – much higher than what most regulators allow traders to make use of nowadays. Most brokers that have such high-leverage trading available are simply looking to gain more clients – so be careful when you see it in the wild!

What is the minimum deposit with Foxane?

Foxane sets its minimum deposit to the audacious $1000 – meanwhile, legitimate brokers out there readily open micro accounts for no more than $10 nowadays!

What trading software is available with Foxane?

Foxane supposedly has a web-based platform available – but, since we were unable to make an account with the broker, we have no idea what that software looks like or how it stacks up to industry standard Metatrader 5!

What deposit methods does Foxane accept?

Foxane accepts deposits via Bitcoin and credit cards – be extremely careful when paying with crypto, as these deposits are never eligible for chargebacks!

1 note

·

View note

Text

Top Forex Brokers of 2023: A Review of Their Features and Services

Introduction:

With a daily trading volume of over $6 trillion, the Forex market is one of the world's largest and most liquid financial markets. With such a vast market, finding the right Forex broker can be a challenging task. There are a plethora of options available, each with its own set of features and services. This article will review the top 10 Forex trading platforms of 2023. Providing you with all the essential information to make an informed decision.

IG:

IG is a UK-based broker with over 45 years of experience in the industry. They offer access to over 17,000 financial markets, including Forex, CFDs, and cryptocurrencies. IG is a regulated broker, ensuring the safety and security of client funds. Their platform is user-friendly, offering advanced charting tools and a range of trading indicators. IG also provides educational resources, including webinars and trading guides, to help traders develop their skills.

CMC Markets:

CMC Markets is a UK-based broker that has been operating for over 30 years. They offer a range of financial products, including Forex, CFDs, and spread betting. CMC Markets is a regulated broker, ensuring client funds are protected. CMC Markets also provides educational resources, including webinars and trading guides, to help traders develop their skills.

eToro:

eToro is a social trading platform that enables traders to replicate successful traders' trades. They offer a range of financial products, including Forex, stocks, and cryptocurrencies. eToro is a regulated broker that ensures the safety and security of client funds. Their platform is user-friendly, with a range of tools for the both beginners and advanced traders. eToro also provides educational resources, including webinars and trading guides, to help traders develop their skills.

Pepperstone:

Pepperstone is an Australian-based broker that has been operating for over ten years. They offer a range of financial products, including Forex, CFDs, and cryptocurrencies. Pepperstone is a regulated broker, ensuring the safety and security of client funds. Pepperstone also provides educational resources, including webinars and trading guides, to help traders develop their skills.

XM:

XM is a Cyprus-based broker that has been operating for over ten years. They offer a range of financial products, including Forex, CFDs, and commodities. Their platform is user-friendly, with many tools and indicators for advanced traders. XM is a regulated broker, ensuring the safety and security of client funds. XM also offers learning resources, such as webinars and trading guides, to help traders improve their potential.

Forex.com:

Forex.com is a US-based broker that has been in the industry for over 20 years. They offer a range of financial products, including Forex, CFDs, and cryptocurrencies. Forex.com is a regulated broker, ensuring the safety and security of client funds. Forex.com also provides educational resources, including webinars and trading guides, to help traders develop their skills.

FXTM:

FXTM is a Cyprus-based broker that has been operating for over 10 years. They offer a range of financial products, including Forex, CFDs, and cryptocurrencies. FXTM is a regulated broker, ensuring the safety and security of client funds. FXTM also provides educational resources, including webinars and trading guides, to help traders develop their skills

AvaTrade:

AvaTrade is an Irish-based broker that has been operating for over 15 years. They offer a range of financial products, including Forex, CFDs, and cryptocurrencies. AvaTrade is a regulated broker, ensuring the safety and security of client funds. AvaTrade also provides educational resources, including webinars and trading guides, to help traders develop their skills.

Plus500:

Plus500 is a UK-based broker that has been operating for over ten years. They offer a range of financial products, including Forex, CFDs, and cryptocurrencies. Plus500 is a regulated broker that ensures the safety and security of client funds. Plus500 also provides educational resources, including webinars and trading guides, to help traders develop their skills.

IC Markets:

IC Markets is an Australian-based broker that has been operating for over ten years. They offer a range of financial products, including Forex, CFDs, and cryptocurrencies. IC Markets is a regulated broker that ensures the safety and security of client funds. IC Markets also offers educational materials. It includes webinars and trading guides to assist traders in improving their skills.

Conclusion:

Given the abundance of options, selecting the best Forex broker can be a tough task. Yet, by considering the features and services offered by each broker, you can narrow down your options. Then find the one that best suits your trading needs. The top Forex brokers list of 2023 reviewed in this article are all regulated and provide educational resources to help traders develop their skills. The choice of a Forex broker depends on your trading style and preferences. So, take the time to search and make an informed conclusion. Get a detailed report about these best online forex brokers from Trading Critique. Visit our website today and join the learners' community.

0 notes

Text

The people that defend Hassan Piker will never not come off to me as people bent down on their knees in front of him trying to talk with their mouth full.

And I realize that’s harsh but I’ll put it in plain text.

He has stated that the US deserved 9/11. He only walked this back a little when he realized how fucked up it was for him to say it, and a lot of his audience pushed back. Fuck half of his audience agreed with it.

He ran a smear campaign against PewDiePie who’s entire schtick is satire and being goofy. He’s also not American so he doesn’t know our cultural norms. And yet, many people including Hasan dragged him across the coals. Also leaned into the Nazi allegations against Pewds.

He is a Champaign Socialist. He gets rich off of preaching socialism and communist, meanwhile getting filthy rich off of the lie he is selling. Even going so far as to buy an expensive ass house and expensive cars. Even travel a lot. Ah yes very socialist of you to use capital gains in an extravagant way white your viewers all just eat up your propaganda.

He is pro war. He is 100% for the war in Ukraine and actively talks about how we just “Can’t leave them on their own” despite the fact that we (The US) and the UK are the REASON they have not had a cease fire (A neutral country president has gone on record saying he brokered a peace pact between the two countries until the US and UK told Ukraine not to negotiate). We are printing money by the truckload that we don’t have, and sending so much weaponry that we are whittling down our own reserves. And yet Hassan is totally fine with that. (Meanwhile not saying a DAMN THING about the genocide in china against their Muslim Population.)

He lies, smears, and slanders people often by misrepresenting them on his streams and his viewers eat that shit up. Then go out and actively harass the people he mentions (Which if I was a betting man I'd say he’s more than fine with if you asked him in private.)

He spreads cultural Marxism which we know is tearing this country to shreds and he personally doesn’t care. Mostly because he profits off of it. He also insulates his viewers into believing that any person to the right of Stalin is far right. Which for reference, here is a political spectrum test of WHERE Stalin is.

Which of course one of the only people further left than him was Mao. So if you think that Authoritarian Communism and Socialism are good, then you CLERARLY have never opened a history book.

My point is this. I think Hassan is a crappy person. I think he either believes the bullshit he pushed and just lives a cushy life at the top because he thinks he deserves it. Or he’s a grifter who lies and profits off of his lies.

And it’s funny too. I commented on a video with him in it, that I like the content creator that made the video Hasan was in. Which was the only reason I watched some of it. And like clock work, his C-sucking groupies came in high on copium with what I about expected. Here were the initial comments.

The next one of course being after I made the above points. Though in far less words.

Followed by this.

The of course this when I didn’t take issue with being compared to Peterson at all.

And of course my response to which he had no come back at all.

And that’s a huge thing I also take issue with. People have this insane hive mind mentality where if you don’t agree with them 100% culturally, you magically become far right. And mind you, I didn’t insult this person. I did however say my peace about Hassan. And he went right for, as expected, “Sniveling Conservative”. Yeah.....because my left libertarian ass is TOTALLY a conservative. For context on the political spectrum test I am 2 rungs left, and 3 rungs down into libertarian. But for real I’m never going to be a communist. And that ISN’T the criteria for what makes a person left wing. It SHOULDN’T be. And yet here we are. With a man who is fine pushing this Stalin is a moderate propaganda, and letting his viewers run with that shit. Hell that sad part is I AM in favor of social programs. I’m just not in favor of handouts to laze f*cks who abuse the system. Or the systems we have now where our government agencies line their pockets pretending to help solve the issues. Meanwhile these marxists assholes are demanding the government have MORE and more power. I’m sorry that me being against big brother, all powerful Jack boot, full control government isn’t something I care for. Because no matter who is in charge of that. Eventually it will lead to mass death.

Long story short. Look to my response to that guy. These are they types of people that claim that going to college makes you smarter than everyone else. That the longer you stay the more intelligent you are then everyone else. Peterson, his politics aside, is a man that has been in academia for decades. The man has written papers hand over fist into the 100′s if not 1000′s. Many have been used for years in further research. He even was an instructor at Harvard. According to these types, this man should be the top of the intelligence food chain. However, because his politics are wrong, he’s “clearly stupid”. Which is it you lunatics? Does education make you smart or not? And before you say, “Oh well he is an exception”, he’s not the only person I’ve seen that claim levied against. Robert Malone. A Medal winning Doctor who pioneered MRNA research. Even winning awards. However, after he came out with a very clear cut statement, he was ruthlessly smeared and more or less pushed into a box of, “Covid Vaccine Denier”. However this only because he questioned the amount of work put into the shots. Which mind you, makes sense if you consider the company we were FORCED to take the shot from had been buried in the LARGEST lawsuits in US history for idk, malfeasance, lying about safety protocols, lying about negative affects of medications they made even going so far as hiding them. Yeah no I’d be pretty skeptical too.

But that’s my point. If you go against the cultural marxists in any way shape or form, you are labeled as a conservative, far right, neo nazi, nazi, trump supporting, blah blah blah blah blah. How about make a valid argument? Or is that too hard to ask. I view people like Hassan as awful human being that take advantage of people. They will lie, cheat and steal. And then when they are on the top, they will pretend to care, while they are sipping expensive Sake in japan. Where he will proceed to shit talk the US. Every country has it’s issues. Every country has HUGE issues in some areas. And Hassan, having the balls to vote to make all our problems worse, meanwhile preaching the shit tearing the culture of this country apart? The man literally got all whiney about the Hogwarts Legacy game saying he couldn’t play it because of online bullies. “HEY HASSAN! DID IT EVER OCCUR TO YOU THAT MAYBE YOU ARE A ROOT CAUSE OF THAT BULLSHIT?!?!? Did it ever cross your mind that the bullshit you push day in and day out about race and marxism is WHY we are here now? Of course it never crossed your mind. That would imply you were intelligent.

1 note

·

View note

Text

Best FCA Regulated Forex Brokers

Best FCA Regulated Forex Brokers

The FCA (former FSA) is an important global regulatory agency that gives out licenses and keeps an eye on UK based brokerage firms. On this page you will find the best FCA regulated Forex Brokers based upon our independent research and through feedback from our users. In the course of our research we look at security, product quality and reliability of these brokers.To get more news about fsa regulated forex brokers, you can visit wikifx.com official website.

One of the best known names in the forex industry, FXCM offers an impressive range of technology, tools and research. With a history of over 20 years, FXCM has been a pioneer in bringing online currency trading into the mainstream. In its early days, the company introduced innovations such as automated trading and flexible position sizing.

Over the past decade FXCM faced a number of challenges, notably when the Swiss National Bank (SNB) unexpectedly raised the peg on EUR/CHF in 2015, resulting in a major loss for the company. FXCM has bounced back and is currently owned by Jefferies Financial Group, a financial services giant with assets of over $87 billion.

FXCM shines with its broad range of trading platforms and tools for advanced traders and strategy developers. As an innovator in the world of retail forex trading with over 20 years of experience, this broker also has an industry leading range of research and educational resources.

Tickmill was founded in 2014 and is regulated by the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC) and the Seychelles Financial Services Authority (FSA).

The broker provides more than 80+ CFD instruments to trade on covering Forex, Indices, Commodities and Bonds through three core trading accounts called the Pro Account, Classic Account and VIP Account. They also offer a demo trading account and Islamic swap-free account.

Founded in 2010, IronFX provides its services via four entities: Notesco Financial Services Ltd (Cyprus), Notesco UK Limited (UK), Notesco (SA) Pty Ltd (South Africa), and Notesco Limited (Bermuda).

The broker offers the highly popular MetaTrader 4 platform. Traders have seven types of accounts to choose from. Three accounts offer the option to choose between the fixed and the floating spread. There is an Islamic Account option for four types of accounts.

IronFX offers a high number of forex pairs, commodities, and indices. The cryptocurrency offering is also interesting. The number of available stocks is medium. There are plenty of options for deposits and withdrawals. Traders can use various base currencies.FxPro gives you access to a buffett of trading platforms. Choose between MT4, MT5, cTrader Pro, and FxPro Edge. As the name implies, FxPro Edge is made specifically for foreign exchange. Most orders on FxPro are executed within 13 milliseconds. FxPro is currently in beta, meaning it is a new app and may have some bugs.

CMC Markets is a multi-asset class spread betting and CFD broker with over 30 years of experience, regulated by the UK’s Financial Conduct Authority (FCA) and thus offering segregated funds and a high level of security and safety. The CMC Group is a publicly-traded company on the London Stock Exchange.

The broker offers 3 different trading accounts: spread betting, CFD and Corporate accounts. Each account offers users to trade on more than 9,000+ trading instruments covering Indices, Forex, Cryptocurrencies, Commodities, Shares and Treasuries with spread betting offering commission-free trading and CFD and Corporate accounts offering commission-based trading on Shares only.

Users can trade on the MetaTrader 4 trading platform and on the broker’s own, proprietary, web-based Next Generation platform for web and mobile trading. The Next Generation platform is feature-rich with 115 technical indicators and drawing tools, 12 chart types and a pattern recognition tool. The broker also offers news and analysis from their own market analysts, as well as education, webinars and seminars.

1 note

·

View note

Text

How To Pick The Best Cyptocurrency Brokerage.

When choosing cryptocurrency brokers, it is crucial to conduct preliminary research. There are a number of factors to consider, including the fees the brokerage charges, the level of customer service offered, and the broker’s overall reputation.

Another important factor to consider is the cryptocurrency platform the brokerage uses. Some brokers offer both cryptocurrency and traditional stock trading platforms, while others focus exclusively on cryptocurrencies. It’s important to find a broker that offers the features and accessibility you need to execute your trades successfully.

eToro

6 Best Cryptocurrency Brokers In Australia And Canada

eToro

Founded:2007. eToro is a multi-asset brokerage business and social trading platform that specializes in financial and copy trading services. Registered offices are located in Cyprus, Israel, the United Kingdom, the United States, and Australia.

Pros

Low minimum investment

Offers access to more than 30 cryptocurrencies

User-Friendly Platform

Social investing- You can imitate the track records of other great traders.

Cons

No crypto-to-crypto trading

High Trading Fees

Avatrade

This is a one-stop shop for a wide range of financial asset classes, including forex, stocks, commodities, indices, and cryptocurrencies. The broker is based in Dublin, Ireland, and has regional offices in Australia, South Africa, China, Japan, France, Spain, and Italy.

Offers access to more than 55 cryptocurrencies

The AvaTradeGO app may be more convenient for some people than MetaTrader 4’s simplicity of use.

Eightcap

Eightcap is one of the most affordable Australian forex brokers. The account opening procedure was quick and simple, with free deposits and withdrawals available via a user-friendly interface.

Eightcap, a multi-award-winning Forex and derivatives broker based in Melbourne, Australia, was founded in 2009 and offers CFDs on stocks, currencies, indices, commodities, and cryptocurrencies.

SpreadEx

Spreadex is a well-known online brokerage business that specializes in spread betting and online trading. You may gain quick access to the markets for spread betting and trading CFDs on a very amazing array of financial instruments across a number of asset classes, including forex, crypto, and so on, using the broker’s own web-based trading platform and smart mobile applications.

Minimum Deposit: $0

Axitrader

There are a total of 53 currency pairs accessible for trading, as well as CFDs. Devoted to seeing you succeed in the long run. Fundamental tools, training materials, trade knowledge, and professional coaching to help you grow over time

Axi is governed by a number of financial regulators throughout the world, including the UK’s Financial Conduct Authority (FCA), Australia’s Securities and Investments Commission (ASIC), and the Dubai Financial Services Authority (DFSA).

Ovalx

It is a global commerce platform in the sense that it operates in 190 countries, including those in Africa and Europe. The United Kingdom, Germany, Australia, South Africa, Thailand, and China are among Ovalx’s primary markets.

Minimum Deposit: 100

Cryptocurrency Brokers Fees

Crypto brokers’ fees can vary a lot, but some common fees are usually around 0.25% of the traded value. This means that if you are trading $1,000 worth of cryptocurrency, you might pay $25 in fees. Fees can also increase if you are trading in high-volume assets. Some brokers also charge a fee for withdrawing funds.

Is a Cryptocurrency Broker Trustworthy?

Cryptocurrency brokers are a popular way to invest in digital currencies. But are they trustworthy?

The short answer is that some cryptocurrency brokers are more trustworthy than others.

Some cryptocurrency brokers have been around for a while and have a good reputation. These brokers are usually the ones that offer the most comprehensive trading platforms and have the best customer service.

Other cryptocurrency brokers are new and may not have as much experience. They may not have as many trading platforms or may have less-than-excellent customer service.

If you’re looking for a cryptocurrency broker to invest in, it’s important to do your research and find one that you trust

0 notes

Link

☑️How to Open A Pinnacle Account From the UK 👇 https://efirbet.com/en/pinnacle/how-to-bet-from-the-uk/

0 notes

Text

House Sales Collapse as UK Lenders Withdraw Mortgage Offers

Deals for house purchases are collapsing after lenders pulled mortgage offers in response to soaring interest rates.

Smaller lenders such as Kensington, Accord Mortgages and Hodge were among those to say they were withdrawing products Tuesday. That follows the decision by Lloyds Banking Group Plc -- the UK’s biggest mortgage provider -- on Monday to halt some offers, while Virgin Money UK Plc temporarily stopped offering home loans to new customers.

Major firms weighed in later Tuesday. HSBC Holdings Plc told brokers it was removing new mortgage products for the rest of the day while Nationwide Building Society announced that it was increasing rates across product ranges starting Wednesday. Banco Santander SA said it was removing some products and increasing rates on many others.

Get Wall Street Journal and Bloomberg Digital Subscription 5-years $89

Jessica Anderson, a 33-year-old who works in publishing, was set to buy a house in Walthamstow, east London, with her husband until the seller pulled out last week.

“We’re in an uncertain position where we’re not sure whether it still stands,” she said, regarding the couple’s mortgage offer. “Since the approval there have been two interest rate increases.”

Traders are betting the Bank of England will raise its key interest rate to 5.9% by September next year, compared with 0.1% a year ago, sending home loan costs spiraling for the 1.8 million people who need to remortgage next year.

A series of unfunded tax cuts from new Chancellor of the Exchequer Kwasi Kwarteng has rocked the pound and UK gilts, and forced the BOE to issue an emergency statement pledging to lift rates “as much as needed” to control inflation.

Buy The New York Times+Wall Street Journal 5-Year Digital Subscription, and take 77% off

Analysts at Credit Suisse said in a note that house prices “could easily fall 10% to 15%.”

Some hopeful housebuyers have had their mortgage offers fall through, according to Loubie Vaughan, founder of estate agent FG Consultants. She said one buyer had £900,000 ($969,120) in cash to buy a £1.4 million house in Camden, north London, but that the deal is now in doubt.

“I told him to sit tight and see how it plays out,” she said. “There’s no point running around like headless chickens when we don’t know what’s going to happen.”

Vaughan added that she expects house prices to fall despite Kwarteng cutting stamp duty, a tax on housing transactions, last week. Property Log, an extension that tracks home price changes on portal Rightmove, said Monday saw the biggest number of price cuts it’s recorded since it began tracking them more than four years ago.

Left Stranded

“There will obviously be people who are left stranded,” said Ray Boulger, a manager at loan broker John Charcol. “Some lenders have given no notice, and with some we are getting emails during the day saying rates are being pulled at 5 p.m. There will be undoubtedly be people in the process of securing their mortgage who will miss the boat.”

So-called “chains” of multiple house purchases, where each buyer is dependent on the sale of their existing home, may starting collapsing when any one of the deals falls through, Boulger added.

Between Friday morning and Tuesday morning the number of residential mortgage products on the UK market fell 9% to 3,596 from 3,961, according to data compiled by Moneyfacts Group Plc. Atom Bank has lifted its rates by 1% on some mortgage offers and withdrawn others.

Get a 5-years subscription to the WSJ and Barrons Digital News for $89

The systems at some lenders are unable to cope with a flood of applications because everyone is trying to fix in at current rates, said Andrew Montlake, managing director at mortgage broker Coreco. Bigger lenders are now being overwhelmed as other firms temporarily withdraw from the market.

“My nerves are shot,” said Hannah Fearn, 40, a freelance writer in south London and another hopeful housebuyer. “Our mortgage offer lasts until mid January and we have just put in another best and final offer but if we don’t get this particular house I’m not sure what we’ll do.”

It’s unclear what will happen to the market next. If the Bank of England leaves interest rates unchanged for two or three weeks then lenders will have more certainty and more mortgage products will return, said Geoffrey Yu, a senior strategist at Bank of New York Mellon Corp. in London. “But if the pound falls again there is a greater chance of a BOE reaction, and affordability will just decline further,” he said.

Read the full article

0 notes

Text

Buying Debt Assets With the Help Of Debt Network

If you have been looking at how to buy debt in UK, a list of processes needs to be undertaken. The debt buyer may take help from others to buy the right debt and earn extra income for themselves.

Even the companies that buy your debt in UK ensure that the asset portfolio is high-quality. Going after a default case of debt repayment will put a person at a loss, so make the right choice by undertaking the following steps.

Choose the Right Deal

Choosing the right deal is very important so that the investment bears fruit in the future. The filtering tool makes it easy to recognize how to purchase bad and good debt. After a few deals, it will become clear what to bet on.

Analyze and Strategies

After selecting the loan portfolio to bet on, check the payment histories, and data file on loan agreements. Reviewing the portfolio analysis is mandatory to be on the safe side.

Submit the bidding Tract

After reviewing the portfolio sale packet, the debt purchaser can buy a one-time competitive triple blind bid. It ensures that nobody else can see the request done by you and offers a seamless experience on how to purchase bad debt in UK easily. Such integrity helps to protect the investment in underwriting and valuation.

Goodbye Thought

After making the negotiation, then the contract term can be executed seamlessly. Once the deal is sealed, the debt buyer gets to fund the seller and securely make the payment for the portfolio. So, take the plunge and opt for the service of the debt broker to gain access to the best information on how to buy debt in UK.

For more details about How To Purchase Bad Debt in UK Please visit our website: everchain.net

0 notes

Text

Capital Index (UK) plunges into loss in 2021 as market volatility fades

Capital Index (UK) plunges into loss in 2021 as market volatility fades

Capital Index (UK) Limited, a London-based CFD and spread betting broker, ended 2021 with revenue of £1.7 million. The figure is down more than 29 per cent compared to £2.44m the previous year. general. Considering interest and other expenses, the company’s loss before tax for the year was £300,389 out of a profit of £108,650 collected in 2020.

The net loss after tax came at £238,796.

“2021 has…

View On WordPress

0 notes

Text

Surprise inflation rebound sank UK100, early cut hopes fade

The FTSE 100 (UK100) dropped sharply on Wednesday as investors dialed back hopes of an early cut in interest rates following a surprise rise in UK inflation. At the close, London's blue-chip index was down 1.5% at 7,446, while the broader FTSE 250 shed 1.7% to end the day at 18,864.

The UK’s annual rate of consumer price inflation (CPI) increased for the first time in 10 months in December, rising to 0.4% from November's more-than-two-year low of 3.9%, which contrasted with expectations for a drop to 3.8%. A sharp rise in tobacco and alcohol prices caused by an increase in government duty and a bigger impact from seasonal air fare rises contributed to the CPI shock.

UK100 H1

The data led Goldman Sachs to increase its year-end 2024 target for headline UK inflation to 2.0% year-on-year, up from 1.8% previously. “As such, while today's print slows the disinflation process that had been underway in preceding months, we continue to expect inflationary pressures to recede going forward,” Goldman’s economists said.

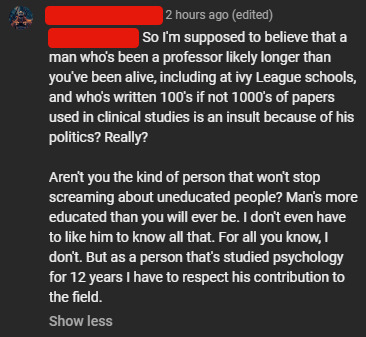

Sluggish GDP figures from China and comments from central bank officials in Europe and the US dampening rate moves also combined with the UK CPI beat to send equities lower. Miners and oil & gas shares were the main fallers, dropping by between 2% and 4%, hurt by the weak data from top consumer China.

Broker comment also blighted oil major Shell, down 2.4% after UBS moved its rating to 'neutral' from 'buy' and cut its price target. And commodities firm Glencore dropped 4.4% after Deutsche Bank downgraded its stance to ‘hold’ from ’buy’ with the German bank citing several near-term earnings and strategy headwinds.

GBPUSD H1

Also among the fallers, betting firm 888 Holdings lost 1.5% as it forecast its 2024 profit to be at the lower end of market expectations. But shares in pubs operator Mitchells & Butlers rose 3.5%, topping the FTSE 250 gainers, as it said it expects annual profit before tax towards the top end of estimates. On currency markets, GBP strengthened after the CPI data as interest rate hike expectations declined.

Futures implied a roughly 60% chance that the Bank of England would start to cut rates by mid-May, down from just over 80% late on Tuesday. GBP added 0.2% versus the USD to 1.2666 and nearly 0.4% against the euro to 1.166.

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

Financial Spread Betting - nonetheless a tax efficient way to gear up your portfolio

Some operators of spread betting platforms are no so

large that they are now listed on the London Stockmarket.

Conditions vary from country to country but the

rationale behind this type of trading is the possibility to leverage up a tiny

sum of money to control a disproportionately massive quantity of shares or

other fiscal instruments in a extremely tax effective method.( In the Uk, bets

are free of each stamp duty and Capital Gains Tax). It also affords the

possibility to make money from anything that is falling in cost. On the

downside, the leverage element ensures that any losses are also

disproportionately huge compared with the sum of money laid out.

Even though technically classed as gambling, economic

spread betting is not regulated in the United kingdom by the Gambling Commission but by the

Economic Providers Authority who are probably a lot more inclined to regard it as

speculation.

Spread betting can be used to back one's hunches in

all sorts of monetary instruments this kind of as shares, commodities and currencies.

Many investors use it to hedge completely paid up investments in these markets.

In its simplest type, a spread bet is a wager that an

instrument is going to go up or down in price tag by a enough margin to cover

the “spread” or variation amongst the purchasing and marketing price. This margin is

the revenue accruing to the operator of the spread betting platform which has

been selected. The company concerned is successfully acting like a bookmaker and

undertaking to honor your bet if it comes good.

To illustrate how a spread bet may possibly operate in practice,

let's presume our bettor expects Vodafone shares to rise from their current

cost of 170p to promote and 171p to purchase. http://encounterghosts.com/compliments-of-pick-3-number-limits/ If he was to acquire, say, 1,000 shares in

the stockmarket, this would value £17,one hundred plus stamp duty and broker's

commission, let's say a total of £17,200.

Rather, our spread bettor elects to “control” the

exact same sum of shares utilizing a spread bet. If his picked spread betting company is

quoting 170p to sell and 171p to get, he opens a Purchase bet at 171p for £100 per

point. If the shareprice subsequently moves to 180 p to sell, anyone who had

physically bought one,000 shares at 172p like charges, would have created £800

revenue on a £17,200 outlay or four.6 %.

Meanwhile, our intrepid spread bettor has cleared

£900. The spread betting company he used would have asked for a deposit or “

margin “ of the underlying worth to cover any losses and, let's presume on a

quite marketable share like Vodafone, this margin requirement was ten % or £

1,710. He has therefore cleared a very healthful 53% return on his real outlay

without incurring any tax liability. This clearly demonstrates the rewards of

leverage or “gearing” when things go properly.

The other side of the coin is that, if the shareprice

had fallen by ten% instead, the spread bettor would either have to select to

accept a reduction of £1,710 or deposit another 10% margin in anticipation of a

value recovery.

0 notes

Text

Foxane.com review is Foxane a scam or a good Forex broker?

Foxane is yet another reason why we always advise caution when it comes to Forex brokers – the company is not actually licensed, or fit, to be offering the services it does. It cannot bring about anything but losses for you – so investing with it is quite the terrible idea. If you need more information on Foxane, read on – we have exposed all of the broker’s failings in the review below – but before we get into it, we would like to make a small disclaimer:

Opening an account with Foxane at the time of writing is not possible – any attempt to do so leads to the following error page:

This is quite the display of incompetence on Foxane’s part – but considering what we have to say about the broker, it might also be a blessing in disguise – after all, if Foxane does not open accounts, it cannot take anyone’s money!

Is Foxane a legitimate broker?

Absolutely not – the broker does not have a license. It also hails from one of the shadiest offshore jurisdictions out there – that of St. Vincent and the Grenadines. Here is what the broker’s address seems to be:

If it seems we are harsh towards St. Vincent, that is because the county has a well-earned reputation as a scam haven – you see, it does not regulate its Forex markets in any capacity. Therefore, scammers of all kinds set up shop there, so they can run their schemes unopposed. And even if a company from the country is not running a scam, there are no guarantees that it is licensed to deal on the Forex markets – these firms usually go under in a couple weeks and take their clients’ deposits with them.

Contrast that to a stricter jurisdiction – the UK, for example – companies from it are required to report on a daily basis on open and closed trades, to make sure they cannot engage in any kind of market manipulation. And to protect their clients from the volatility of the markets, the UK demands that all brokers participate in guarantee funds, which pay out up to 85 000 pounds per affected client if the company goes under.

There are many more polices the UK has in place and many more requirements brokers need to comply with – but, as you can see, trading with licensed brokers simply makes more sense than using the services of offshore ones like Foxane!

Can I make money with Foxane?

No – since Foxane is unlicensed, you cannot turn a profit with it. Once again, a regulated broker would be a safer bet. There is also the issue of the company’s Terms and Conditions that are incredibly vague – check out what Foxane has to say about the fees it charges:

These fees are not available anywhere on the broker’s website – and yet, it threatens its clients with legal action over them! An open clause like that can have Foxane charge you as much as it wants to – even tax you through the nose if it wants to. Let’s also take a look at the broker’s policy on bonuses:

It states that ones of over 10% of the deposited amount might bring about additional terms and conditions – we cannot know what these are for certain, but brokers that offer bonuses mainly do so to restrict client withdrawals – Foxane might insist that accounts credited with a bonus need to achieve a certain turnover to withdraw, for example.

What leverage does Foxane have available?

Foxane provides access to a leverage of up to 1:400 – much higher than what most regulators allow traders to make use of nowadays. Most brokers that have such high-leverage trading available are simply looking to gain more clients – so be careful when you see it in the wild!

What is the minimum deposit with Foxane?

Foxane sets its minimum deposit to the audacious $1000 – meanwhile, legitimate brokers out there readily open micro accounts for no more than $10 nowadays!

What trading software is available with Foxane?

Foxane supposedly has a web-based platform available – but, since we were unable to make an account with the broker, we have no idea what that software looks like or how it stacks up to industry standard Metatrader 5!

What deposit methods does Foxane accept?

Foxane accepts deposits via Bitcoin and credit cards – be extremely careful when paying with crypto, as these deposits are never eligible for chargebacks!

0 notes