#Mortgage Protection Medical Exam

Text

The Benefits of Offering Group Insurance to Your Employees

In today's competitive job market, attracting and retaining top talent is a priority for businesses. Apart from offering competitive salaries and perks, providing comprehensive benefits packages plays a crucial role in this endeavor. One such benefit that stands out is group insurance. Let's delve into why offering group insurance to employees is a strategic move that benefits both parties involved.

The Benefits of Group Insurance to Employees:

1. Affordability: Group insurance plans typically offer lower premiums compared to individual policies, as the risk is spread across a larger pool of employees. This affordability makes it accessible to a broader range of employees, including those who might not otherwise be able to afford individual coverage.

2. Comprehensive Coverage: Group insurance often includes a range of coverage options, such as health, dental, vision, and life insurance. This comprehensive coverage provides employees with peace of mind, knowing that they and their families are protected against various risks.

3. No Medical Underwriting: Unlike individual insurance policies that may require medical underwriting, group insurance often comes with no such requirements. This means that employees with pre-existing conditions can still qualify for coverage, eliminating a significant barrier to obtaining insurance.

4. Convenience: Group insurance is typically provided through the employer, making it convenient for employees to enroll and manage their coverage. They can often make changes to their plans during open enrollment periods or in the event of qualifying life events.

The Benefit of Group Life Insurance:

Group life insurance is a valuable component of a comprehensive benefits package. Here's why:

1. Financial Protection for Loved Ones: In the unfortunate event of an employee's death, group life insurance provides financial support to their beneficiaries. This can help cover funeral expenses, outstanding debts, mortgage payments, and ongoing living expenses, easing the financial burden during a difficult time.

2. No Medical Exam Required: Group life insurance typically does not require a medical exam for enrollment, making it accessible to employees regardless of their health status. This ensures that all employees have the opportunity to secure life insurance coverage for themselves and their loved ones.

3. Supplemental Coverage: Employers may offer the option for employees to purchase additional life insurance coverage beyond the basic amount provided. This allows employees to tailor their coverage to their individual needs and circumstances, providing added peace of mind.

The Benefit of Employer-Employee Insurance:

Employer-employee insurance, often referred to as group insurance, fosters a mutually beneficial relationship between employers and employees. Here's how:

1. Enhanced Recruitment and Retention: Offering competitive benefits, including group insurance, can help employers attract top talent and retain valuable employees. In a job market where benefits play a significant role in job satisfaction, a robust insurance package can set employers apart from their competitors.

2. Improved Employee Well-being: Access to comprehensive insurance coverage promotes employee well-being by ensuring they have the support they need to maintain their health and financial security. Healthy and satisfied employees are more engaged, productive, and less likely to seek opportunities elsewhere.

3. Cost Savings for Employers: While offering group insurance incurs costs for employers, the benefits outweigh the expenses in the long run. By promoting preventive care and early intervention, insurance coverage can help reduce healthcare costs associated with untreated illnesses and injuries.

What is a GRP Benefit?

GRP, or Group Retirement Plan, is a type of employee benefit that helps employees save for retirement. Employers may contribute to these plans, and employees often have the option to make contributions through payroll deductions. GRP benefits provide employees with a tax-advantaged way to save for retirement, helping them secure their financial future.

In conclusion, offering group insurance to employees is a strategic investment for employers that yields numerous benefits. From providing affordable and comprehensive coverage to enhancing recruitment and retention, group insurance fosters a positive work environment where employees feel valued and supported. Click here to explore how implementing group insurance can benefit your business and your employees!

0 notes

Text

Exploring Gerber Life Insurance: Coverage Options and Benefits

Introduction:

Gerber Life Insurance Company has been providing financial protection and security to families for decades. With a range of coverage options tailored to different needs and budgets, Gerber Life Insurance offers peace of mind to policyholders. In this comprehensive guide, we will explore the various coverage options and benefits provided by Gerber Life Insurance, helping you make informed decisions about your insurance needs.

Understanding Gerber Life Insurance:

Gerber Life Insurance offers a variety of insurance products designed to meet the diverse needs of individuals and families. Whether you're seeking coverage for final expenses, income protection, or long-term financial security, Gerber Life Insurance has options to suit your requirements. From term life insurance to whole life insurance and beyond, Gerber Life Insurance provides flexible solutions to safeguard your loved ones' futures.

Coverage Options:

Term Life Insurance: Gerber Life offers term life insurance policies that provide coverage for a specified period, typically ranging from 10 to 30 years. These policies offer affordable premiums and a death benefit payout to beneficiaries if the insured passes away during the policy term. Term life insurance is an excellent option for individuals seeking temporary coverage to protect against financial obligations such as mortgage payments, education expenses, or income replacement.

Whole Life Insurance: Gerber Life's whole life insurance policies offer lifelong coverage with guaranteed premiums and a guaranteed death benefit. Additionally, whole life policies accumulate cash value over time, which policyholders can access through policy loans or withdrawals. Whole life insurance provides permanent protection and can serve as a valuable component of a comprehensive financial plan, offering stability and security for the insured and their beneficiaries.

Guaranteed Life Insurance: Gerber Life's guaranteed life insurance is designed for individuals who may have difficulty obtaining traditional life insurance due to health issues or other factors. These policies do not require a medical exam or health questionnaire, making them accessible to almost anyone. Guaranteed life insurance provides coverage for final expenses, such as funeral costs, and offers peace of mind knowing that loved ones will be financially protected.

Benefits of Gerber Life Insurance:

Affordability: Gerber Life Insurance policies are designed to be affordable, making financial protection accessible to families on any budget. With competitive premiums and flexible payment options, Gerber Life Insurance ensures that individuals and families can secure the coverage they need without breaking the bank.

Guaranteed Acceptance: Gerber Life's guaranteed life insurance offers coverage without the need for a medical exam or health questionnaire. This feature ensures that individuals who may have health issues or pre-existing conditions can still obtain the protection they need, providing peace of mind to policyholders and their families.

Cash Value Accumulation: Whole life insurance policies from Gerber Life accumulate cash value over time, providing a source of tax-deferred savings. Policyholders can access this cash value through policy loans or withdrawals to cover financial needs such as education expenses, home repairs, or supplemental retirement income.

Family Protection: Gerber Life Insurance offers policies with death benefits that provide financial protection to beneficiaries in the event of the insured's passing. This coverage ensures that loved ones are taken care of financially, allowing them to maintain their standard of living and pursue their goals and dreams.

Customer Service: Gerber Life Insurance is committed to providing excellent customer service to policyholders. With a dedicated team of insurance professionals, Gerber Life ensures that policyholders receive personalized attention and assistance throughout the life of their policy.

Conclusion:

Gerber Insurance offers a range of coverage options and benefits designed to meet the diverse needs of individuals and families. Whether you're seeking temporary protection with term life insurance, lifelong coverage with whole life insurance, or guaranteed acceptance with guaranteed life insurance, Gerber Life has options to suit your requirements. With affordable premiums, guaranteed acceptance, cash value accumulation, and dedicated customer service, Gerber Life Insurance provides peace of mind and financial security to policyholders and their families. By exploring the coverage options and benefits provided by Gerber Life Insurance, you can make informed decisions to protect your loved ones' futures.

0 notes

Text

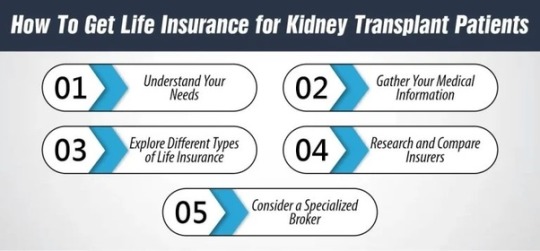

Life Insurance for Kidney Transplant Patients: Securing a Future for Every Customer

Kidney transplantation is a life-saving procedure for individuals suffering from end-stage renal disease (ESRD). While this medical intervention offers a new lease on life, it also prompts concerns about financial security, particularly regarding life insurance. Many kidney transplant patients worry about their insurability due to their medical history. However, understanding the options available can provide reassurance and help secure a stable financial future.

Challenges Faced by Kidney Transplant Patients:

Kidney transplant recipients often face difficulties obtaining life insurance coverage due to their medical condition. Insurers typically assess the risk associated with an applicant's health before providing coverage. For individuals with a history of ESRD and kidney transplantation, insurers may perceive a higher risk of mortality or health complications, leading to potential coverage denials or exorbitant premiums.

Importance of Life Insurance for Kidney Transplant Patients:

Despite the challenges, life insurance is crucial for kidney transplant patients to protect their loved ones financially. Life insurance provides a safety net that can cover funeral expenses, outstanding debts, mortgage payments, and provide financial support for dependents in the event of the policyholder's death. Without adequate coverage, surviving family members may face financial hardships, exacerbating an already challenging situation.

Options for Kidney Transplant Patients:

While traditional life insurance policies may be difficult to obtain, several alternatives cater specifically to individuals with pre-existing medical conditions, including kidney transplant recipients. These options include:

Guaranteed Issue Life Insurance: Guaranteed issue life insurance policies are available to individuals regardless of their health status. These policies do not require a medical exam or health questionnaire, making them accessible to kidney transplant patients. However, premiums for guaranteed issue policies are generally higher, and coverage amounts may be limited compared to traditional policies.

Simplified Issue Life Insurance: Simplified issue life insurance policies require minimal medical underwriting and may be more affordable than guaranteed issue policies. While applicants are not subjected to a comprehensive medical exam, they may need to answer a few health-related questions. Simplified issue policies offer quicker approval processes and higher coverage limits than guaranteed issue policies.

FOR MORE DETAILS PLEASE VISIT:

Life Insurance for Kidney Transplant Patients: Secure Future

0 notes

Text

Navigating the Waters of Term Life Insurance: Finding the Cheapest Options with Stevejonesperez

In the realm of life insurance, term life insurance stands out as a popular choice for individuals seeking affordable coverage to protect their loved ones financially. Term life insurance provides coverage for a specified period, offering a straightforward and budget-friendly option for those looking to safeguard their family's future. At Stevejonesperez, we understand the importance of finding the right insurance solution that fits your needs and budget. Join us as we navigate the waters of term life insurance and explore the cheapest options available to you.

Understanding Term Life Insurance

Term life insurance is a type of life insurance policy that provides coverage for a set period, typically ranging from 10 to 30 years. Unlike whole life insurance, which offers coverage for the insured's entire life and includes a savings component, term life insurance is purely designed to provide a death benefit to beneficiaries if the insured passes away during the term of the policy.

Why Choose Term Life Insurance?

Term life insurance is often favored for its simplicity and affordability. It allows individuals to secure a significant amount of coverage for a fraction of the cost compared to other types of life insurance. Term life insurance policies offer fixed premiums for the duration of the term, making budgeting easier and more predictable. Additionally, term life insurance can be an ideal choice for individuals with specific financial obligations, such as mortgage payments or children's education expenses, that will diminish over time.

Finding the Cheapest Term Life Insurance Options

When searching for the cheapest term life insurance options, there are several factors to consider:

1. Coverage Amount

The amount of coverage you choose will directly impact the cost of your term life insurance policy. Determine your coverage needs based on factors such as your income, debts, expenses, and future financial obligations. While it's essential to ensure adequate coverage for your beneficiaries, opting for a higher coverage amount will naturally result in higher premiums.

2. Term Length

The length of the term you select will also influence the cost of your term life insurance policy. Shorter terms typically come with lower premiums, as they provide coverage for a shorter period. However, it's essential to choose a term length that aligns with your financial goals and the duration of your financial obligations.

3. Health and Lifestyle Factors

Your health and lifestyle play a significant role in determining the cost of your term life insurance policy. Insurers typically require applicants to undergo a medical exam and assess factors such as age, medical history, tobacco use, and overall health. Maintaining a healthy lifestyle and addressing any underlying health issues can help lower your premiums.

4. Compare Quotes

Shopping around and comparing quotes from multiple insurance providers is crucial to finding the cheapest term life insurance options. At Stevejonesperez, we leverage our extensive network of insurance carriers to help you access competitive quotes tailored to your specific needs and budget. Our experienced agents will guide you through the process and help you find the best coverage at the most affordable price.

5. Consider Riders and Add-Ons

Riders and add-ons are additional features that can be included in your term life insurance policy for an extra cost. While these options may provide valuable benefits, such as accelerated death benefits or coverage for critical illnesses, they can also increase the overall cost of your policy. Consider your priorities and weigh the pros and cons of adding riders to ensure they align with your needs and budget.

Conclusion

Term life insurance offers a cost-effective solution for individuals looking to protect their loved ones financially. By understanding your coverage needs, comparing quotes, and considering factors such as coverage amount, term length, health, and lifestyle, you can find the cheapest term life insurance options that suit your budget and provide peace of mind. At Stevejonesperez, we're committed to helping you navigate the complexities of life insurance and secure the best coverage at the most affordable price. Contact us today to explore your options and take the first step towards protecting your family's future with term life insurance.

0 notes

Text

Purpose of Term Insurance

The purpose of term insurance is very unique in life insurance category. Unfortunately many people dont know the important,details and purpose of term insurance in our nation. Term insurance serves several important purposes for a family, acting as a financial safety net during unforeseen circumstances. Here’s how it benefits a family:

Income Replacement: The primary purpose of term insurance is to replace the income of the breadwinner in case of their untimely demise. This ensures that the family’s standard of living is maintained and that they can continue to afford necessities such as housing, food, and healthcare without financial strain.

Debt Protection: It helps in covering outstanding debts such as a mortgage, personal loans, or car loans. This prevents the family from facing the burden of debts and possibly losing assets that were collateral for those debts.

Educational Expenses: Term insurance can also ensure that children’s educational expenses are taken care of, allowing them to pursue their studies without financial hurdles, even in the absence of the earning member.

Estate Planning: It can be used as a tool for estate planning, providing the necessary liquidity to heirs to settle estate taxes or equalize inheritances without having to sell off assets.

Wealth Transfer: Term insurance can be strategically used to leave a legacy for the next generation or to donate to a charity, ensuring that the policyholder’s wishes are fulfilled even after their demise.

Business Protection: For families involved in business, term insurance on a key person can help in the continuity of the business by providing the necessary funds to overcome the loss of the key individual and find a replacement.

Peace of Mind: Beyond financial aspects, having term insurance offers peace of mind, knowing that loved ones will be financially secure in case of any eventuality. This emotional reassurance is invaluable for both the policyholder and their family.

Affordability: Term insurance is relatively inexpensive compared to other life insurance products, which means families can secure a larger coverage amount at a lower premium, making it an efficient way to manage risk.

In essence, term insurance is a crucial component of a comprehensive financial plan, offering protection and security to a family during times of greatest need. It’s a straightforward way to ensure that your family’s future is safeguarded, even in your absence.

what are the types of term insurance policies

Term insurance policies come in various forms, each designed to meet different needs and preferences. Understanding the types helps in choosing a policy that best aligns with individual or family requirements. Here are the main types of term insurance policies:

Level Term Insurance:

The most straightforward type of term insurance, where the death benefit (the amount paid out upon the policyholder’s death) and the premium remain constant throughout the policy term.

The death benefit increases over the term at a predetermined rate or percentage, which can be a way to adjust for inflation or increasing financial responsibilities. However, premiums may also increase.

Decreasing Term Insurance:

Opposite to increasing term insurance, the death benefit decreases over time, typically aligned with the decreasing liability or loan amount, such as a mortgage. Premiums usually remain constant.

Convertible Term Insurance:

This policy allows policyholders to convert their term insurance into a permanent life insurance policy (such as whole life or universal life) without a medical exam, within a specific period. It’s suitable for those whose coverage needs may change over time.

Renewable Term Insurance:

Offers the option to renew the insurance policy without undergoing a medical examination at the end of the term, though premiums may increase based on the age of the insured at renewal.

Return of Premium Term Insurance:

If the policyholder survives the policy term, this policy returns the premiums paid for the coverage, either partially or fully. This type of policy is more expensive than a traditional term policy.

Group Term Insurance:

Often offered by employers or associations as part of a benefits package, this provides term coverage to a group of people under one policy. Individual proof of insurability is typically not required, making it an easy and cost-effective option for employees or members.

TROP (Term with Return of Premium):

Similar to return of premium term insurance, TROP policies refund the premium paid if the policyholder outlives the policy term. This type can be seen as a hybrid, offering both death benefit protection and a form of savings return.

Each type of term insurance has its benefits and limitations, and the choice among them should be based on individual financial goals, coverage needs, and other factors like affordability, age, and health status. It’s crucial to carefully assess these factors and possibly consult with a financial advisor to select the most suitable term insurance policy.

0 notes

Text

What Is Term Insurance? How Does It Work, and What Are the Types?

Term insurance is a vital component of financial planning, offering protection and peace of mind to individuals and their families. In this blog post, we'll delve into the fundamentals of term insurance, explore its workings, and discuss the different types available in the market.

What is Term Insurance?

Term insurance is a type of life insurance that provides coverage for a specific period, known as the "term." Unlike other life insurance policies, term insurance does not accumulate cash value over time.

Instead, it offers pure death benefit protection, ensuring that your loved ones receive a lump sum payment in the event of your untimely demise during the policy term.

However, if you survive the term, there is no maturity/survival benefit or any refunds. In other words, if you do not get your money back, your sum assured will lapse along with the policy. This is usually the case with basic or level term plans.

How Does Term Insurance Work?

The functioning of term insurance is relatively straightforward. Here's how it typically works:

Selecting Coverage Amount and Term: As a policyholder, you choose the coverage amount (death benefit) and the duration of the policy term based on your financial obligations, such as mortgage payments, children's education expenses, and outstanding debts.

Paying Premiums: You pay regular premiums to the insurance company to keep the policy active. Premiums can usually be paid monthly, quarterly, semi-annually, or annually, depending on your preference.

Coverage Period: If you pass away during the term of the policy, your beneficiaries receive the death benefit specified in the policy. However, if you survive the term, the policy typically expires, and there is no payout.

Death Benefit Payout: A term insurance policy’s death benefit payout is tax-free, so your family will get the entire sum assured amount in the event of your passing. This amount, upon payment, can be used for anything like paying off medical bills, loans, living expenses, etc.

Types of Term Insurance Plans

Term insurance comes in various forms, each catering to different needs and preferences. Here are some common types:

Level Term Insurance: In this type of policy, the death benefit and premiums remain fixed throughout the term. It offers predictability and stability, making it a popular choice for many individuals.

Decreasing Term Insurance: Also known as mortgage protection insurance, the death benefit decreases over time, usually in line with a specific outstanding debt such as a mortgage. Premiums, however, remain constant. These are the cheapest term plans.

Increasing Term Insurance: Here, the sum assured increases by a certain amount or percentage every year. Premiums usually remain the same and these plans are designed to consider inflation and other changing circumstances.

Term Plan with Return of Premium (TROP): These work the same as a level term plan, but they offer survival benefits. So, when the matures/expires, you are offered a return payment of all the premiums you have paid during the policy's term.

Convertible Term Insurance: Convertible term policies offer the flexibility to convert the policy into a permanent life insurance policy without the need for a medical exam. This option provides an opportunity to adapt to changing financial circumstances or insurance needs over time.

Conclusion

Term insurance serves as a cornerstone of financial planning by providing affordable and straightforward protection for individuals and their families. Understanding its mechanics and the various types available empowers individuals to make informed decisions that align with their specific needs and goals. Moreover, on top of getting a proper understanding of term insurance and its types, it is also important to choose financially stable and reputable life insurance providers like Tata AIA when buying your term insurance plans. This ensures your family gets their due payments on time without any delays.

0 notes

Text

Term Life Insurance in Mississauga

Introduction

Life is full of uncertainties, and it's essential to be prepared for the unexpected. One way to ensure financial security for your loved ones is through term life insurance. In Mississauga, InsLyf offers comprehensive term life insurance solutions that provide peace of mind and protection. In this blog post, we'll delve into the importance of term life insurance, the key features of InsLyf's offerings, and why it's crucial for Mississauga residents to consider this form of coverage.

Understanding Term Life Insurance

Term life insurance is a straightforward yet powerful financial tool that provides a death benefit to your beneficiaries if you pass away during the policy term. Unlike permanent life insurance, such as whole or universal life, term life insurance offers coverage for a specific period, typically 10, 20, or 30 years. This makes it an affordable option, perfect for those who want to secure their family's financial future without committing to lifelong premiums.

Why is Term Life Insurance Important?

Financial Security: In the unfortunate event of your passing, your loved ones will receive a tax-free lump sum payment from the insurance policy. This financial cushion can help cover living expenses, mortgage payments, education costs, and other essential bills.

Debt Protection: If you have outstanding debts, like a mortgage, car loan, or personal loans, term life insurance ensures that your loved ones won't be burdened with these obligations.

Income Replacement: Your family's financial stability largely depends on your income. Term life insurance provides a source of income replacement, ensuring your family can maintain their standard of living after you're gone.

Peace of Mind: Life is unpredictable, and no one can foresee when tragedy might strike. Having term life insurance offers peace of mind, knowing that your family is protected in the event of the unexpected.

Key Features of InsLyf's Term Life Insurance in Mississauga

InsLyf is a trusted provider of term life insurance in Mississauga, known for its customer-centric approach and a range of benefits. Here are some of the key features that make InsLyf stand out:

Customized Coverage: InsLyf understands that one size doesn't fit all. They work closely with their clients to tailor term life insurance plans that meet individual needs and budget constraints.

Competitive Premiums: InsLyf offers some of the most competitive premiums in Mississauga. You can get the coverage you need without breaking the bank.

Flexible Term Options: Choose from a variety of term lengths, ranging from 10 to 30 years. This flexibility allows you to align your coverage with specific life events, such as paying off your mortgage or sending your children to college.

No Medical Exam Options: InsLyf understands that some clients may have medical concerns. They offer no medical exam term life insurance, ensuring that even those with health issues can secure coverage.

Additional Riders: InsLyf offers a range of optional riders that can enhance your policy. These may include critical illness coverage, accidental death benefits, and more.

Fast and Easy Application Process: Applying for term life insurance with InsLyf is a straightforward process. Their online application system ensures that you can get a quote and apply from the comfort of your own home.

Why Mississauga Residents Need Term Life Insurance

Mississauga is a vibrant and diverse city in the Greater Toronto Area. With a growing population and a mix of urban and suburban lifestyles, residents face various financial challenges. Term life insurance can be particularly essential for those living in Mississauga for several reasons:

Mortgage Obligations: Many Mississauga residents own homes and have mortgages to pay off. Term life insurance can ensure that your loved ones won't lose their home in the event of your passing.

Education Costs: Mississauga is home to several educational institutions, making it a popular place for families. Term life insurance can help fund your children's education, even if you're not there to provide for them.

Cost of Living: Like any metropolitan area, Mississauga comes with a cost of living that can be high. Term life insurance provides a safety net to help cover everyday expenses.

Diversity of Needs: Mississauga's diverse population means that residents have unique financial requirements. InsLyf's customized solutions are well-suited to cater to these individual needs.

Conclusion

Term life insurance is an invaluable financial tool for anyone looking to protect their family's future. In Mississauga, InsLyf offers an array of term life insurance options that cater to the unique needs of the city's residents. By customizing coverage, offering competitive premiums, and providing flexibility in policy terms, InsLyf ensures that Mississauga families can find the perfect insurance solution to safeguard their financial well-being. Don't leave your loved ones vulnerable to the uncertainties of life; consider term life insurance from InsLyf and secure their future today. Call us now!

0 notes

Text

Explore The Key Benefits of Mortgage Life Insurance in Florida

When it comes to safeguarding your family's financial future, one important aspect to consider is mortgage life insurance, also known as mortgage protection insurance. It's a specialized insurance policy designed to repay mortgage debts and associated costs in the event of your untimely passing.

In this article, we will explore the key benefits of choosing mortgage life insurance in Florida and why it might be a smart investment for you and your loved ones.

Why Should You Opt For Mortgage Life Insurance In Florida?

1. Financial Protection for Your Family

The most significant advantage of mortgage life insurance is that it provides a safety net for your family. If you were to pass away before your mortgage is fully paid off, this insurance policy would step in to cover the remaining balance, ensuring that your loved ones won't be burdened with mortgage payments.

2. Affordability

Mortgage life insurance is more affordable than traditional life insurance policies. This affordability makes it accessible to a wider range of homeowners, allowing more families to protect their homes and financial stability without breaking the bank.

3. Coverage Tailored to Your Mortgage

Mortgage life insurance policies are specifically designed to match the outstanding balance of your mortgage. As you pay down your mortgage, the coverage amount also reduces accordingly. This ensures that you are only paying for the coverage you need and that it aligns with your financial commitments.

4. Fast Payouts

Mortgage life insurance policies typically offer fast payouts. This means that your beneficiaries can receive the funds they need to settle the mortgage quickly, reducing the stress of dealing with financial matters during a challenging time.

5. Flexibility

The beneficiaries of a mortgage life insurance policy are not obligated to use the payout solely for the mortgage. While it's a wise choice to use the funds to pay off the home loan, the beneficiaries have the flexibility to allocate the money as needed, such as covering other outstanding debts or daily living expenses.

6. Tax-Free Proceeds

In most cases, the proceeds from a mortgage life insurance policy in Florida are tax-free. This ensures that your beneficiaries receive the full benefit amount without any tax deductions, making it a more efficient financial solution.

7. Peace of Mind

Knowing that your mortgage will be paid off in the event of your passing provides invaluable peace of mind. Your family won't have to worry about losing their home or making mortgage payments while they cope with the emotional and practical aspects of your loss.

8. No Medical Exams Required

Mortgage life insurance often does not require a medical examination. This can be a relief for individuals who may have health concerns that would otherwise make obtaining traditional life insurance more difficult or expensive.

Conclusion

Mortgage life insurance in Florida offers a range of benefits that can provide significant financial protection and peace of mind for you and your loved ones. You will need to carefully consider your specific financial situation and needs before purchasing any insurance policy.

However, mortgage life insurance can be a valuable addition to your financial planning strategy, especially if you're a homeowner with a mortgage to protect.

Do you also want to safeguard your family's financial future and reduce the burden of mortgage costs in the event of your death? Contact Weldin Financial, and we can help you create strategies to protect your finances for your future.

0 notes

Text

Mortgage Life Insurance: Protecting Your Home and Family's Future

Introduction:

Owning a home is one of life's most significant achievements, representing stability and security for you and your family. However, along with the joys of homeownership come financial responsibilities, particularly in the form of a mortgage. While it is essential to plan for your family's future, unforeseen events such as illness, accidents, or untimely death can create significant financial burdens for your loved ones. Mortgage life insurance is a protective measure that ensures your family can keep the roof over their heads even if the unexpected happens. In this article, we explore the importance of mortgage life insurance, how it works, and its benefits in safeguarding your home and family's future.

Understanding Mortgage Life Insurance:

Mortgage life insurance, also known as mortgage protection insurance, is a specialized form of life insurance designed to pay off your mortgage balance in the event of your death. This type of insurance provides peace of mind, knowing that your loved ones will not face the burden of mortgage payments if you are no longer there to provide for them.

Unlike traditional life insurance, where the policyholder's beneficiaries receive a lump sum, mortgage life insurance pays off the outstanding mortgage amount directly to the lender. This ensures that your family can remain in the home without the financial strain of monthly mortgage payments.

How Mortgage Life Insurance Works:

When you purchase a mortgage life insurance policy, you are essentially agreeing to a term that matches the length of your mortgage. If you pass away during this term, the insurance company will pay the remaining mortgage balance directly to the lender, effectively clearing the debt.

It's important to note that mortgage life insurance is a decreasing term policy. This means that as you continue to make mortgage payments and reduce the outstanding loan amount, the coverage amount gradually decreases. While this may seem concerning, it ensures that your insurance coverage aligns with your mortgage balance over time.

Benefits of Mortgage Life Insurance:

a) Financial Security for Your Loved Ones: The primary benefit of mortgage life insurance is providing your family with financial security in the face of adversity. In the event of your untimely death, they can continue living in the family home without the worry of mortgage payments.

b) Peace of Mind: Having mortgage life insurance grants you peace of mind, knowing that your family's home is protected in case of the unexpected. This security can help reduce stress and anxiety about the future.

c) No Medical Exam Option: Some mortgage life insurance policies offer a no-medical-exam option, making it more accessible for individuals with certain health conditions or those who prefer a simpler application process.

d) Customizable Coverage: Mortgage life insurance policies are often customizable to fit your needs. You can choose the coverage amount that matches your mortgage balance or add additional riders for enhanced protection.

e) Mortgage-Free Home for Heirs: Mortgage life insurance ensures that your home becomes a valuable asset for your heirs rather than a financial burden. They can choose to keep the home or sell it, knowing that the mortgage is already settled.

Considerations and Limitations:

a) Decreasing Coverage: As mentioned earlier, mortgage life insurance is a decreasing term policy. While this aligns with the mortgage balance, it means that the coverage amount decreases over time, potentially leaving less financial protection for other family needs.

b) Limited Beneficiary Control: Unlike traditional life insurance, where beneficiaries receive a lump sum to use as they see fit, mortgage life insurance pays off the mortgage directly to the lender. This means that the funds are tied to the mortgage, limiting the beneficiaries' control over how the money is used.

c) Premiums and Age Considerations: Premiums for mortgage life insurance may be higher compared to traditional term life insurance for a similar coverage amount. Additionally, the cost of premiums may increase with age, making it essential to secure coverage earlier in life for more affordable rates.

Supplementing with Term Life Insurance:

While mortgage life insurance provides crucial protection for your home and family, it is important to consider supplementing it with a term life insurance policy. Term life insurance offers a lump sum payout to your beneficiaries, giving them greater financial flexibility and control over the funds.

Term life insurance can be used to cover various expenses beyond the mortgage, such as education costs, daily living expenses, and any outstanding debts. By combining both mortgage life insurance and term life insurance, you can create a comprehensive safety net for your family's future.

Evaluating Your Insurance Needs:

Before purchasing mortgage life insurance or any life insurance policy, it is essential to assess your specific insurance needs and financial goals. Consider the following factors:

a) Outstanding Mortgage Balance: Calculate the current outstanding mortgage balance and evaluate how it aligns with your mortgage life insurance coverage.

b) Other Debts and Financial Obligations: Consider any other debts or financial obligations that your family may need to cover in the event of your passing.

c) Family's Long-Term Financial Security: Assess your family's long-term financial security and determine how much additional life insurance coverage may be needed.

d) Budget and Affordability: Determine the affordability of premiums for both mortgage life insurance and term life insurance.

Conclusion:

Mortgage life insurance is a vital tool for protecting your home and ensuring your family's future financial security. By paying off the outstanding mortgage balance in the event of your death, it relieves your loved ones from the burden of mortgage payments. While mortgage life insurance offers invaluable benefits, it is essential to carefully consider your insurance needs, including other financial obligations, and supplement it with term life insurance if necessary.

Securing mortgage life insurance and other appropriate life insurance coverage provides peace of mind, knowing that your family will be financially protected during challenging times. By taking proactive steps to safeguard your home and family's future, you can focus on enjoying the present while ensuring a secure and stable future for your loved ones.

0 notes

Text

Term Life Insurance: 5 Common Mistakes to Avoid

Term life insurance is a crucial component of financial planning, offering valuable protection for your loved ones in case the unexpected happens.

However, to make the most of this coverage, it's essential to navigate the process wisely and avoid common pitfalls that can have significant long-term consequences.

In this short article, we'll delve into each aspect of term life insurance, providing in-depth information on the five common mistakes to avoid when obtaining this vital coverage.

Understanding Term Life Insurance

Lack of Understanding: Before you apply for any life insurance policy, it's crucial to comprehend the fundamentals of term life insurance. Unlike permanent life insurance, term life insurance provides coverage for a specific term, typically ranging from 10 to 30 years.

If the insured person passes away within the term, the policy pays out a lump sum death benefit to the beneficiaries. Due to the limited term, these policies are generally more affordable, making them an attractive choice for many individuals and families.

Determining the Right Coverage Amount

Insufficient Coverage: One of the most significant mistakes you can make when purchasing term life insurance is underestimating the amount of coverage needed.

When determining the appropriate coverage amount, consider your existing financial obligations, such as mortgages, outstanding debts, and future educational expenses for your children.

Additionally, think about the lifestyle you want your family to maintain if you're no longer there to provide for them. A thorough assessment of these factors will help you arrive at an appropriate death benefit that ensures your loved ones' financial security.

The Importance of Riders

Neglecting Riders: Term life insurance policies often come with riders, which are optional add-ons that provide extra protection and flexibility. For instance, a disability income rider can offer financial support if the insured becomes disabled and unable to work.

Another valuable rider is the accelerated death benefit, which allows policyholders to access a portion of the death benefit if they are diagnosed with a terminal illness. Additionally, a guaranteed insurability rider enables you to increase your coverage amount at specified intervals without undergoing medical underwriting.

Carefully assess your needs and consider incorporating relevant riders to enhance your policy's utility.

Finding the Best Rates

Failure to Compare Rates: Insurance companies offer different rates for term life insurance policies, depending on various factors, such as age, health, and lifestyle habits. It's crucial to shop around and compare prices from multiple insurers to find the most competitive and suitable policy for your needs.

Fortunately, many insurers provide online tools that can generate quick quotes based on the information you provide, making the comparison process easier.

Exploring Group Life Insurance

Missing Out on Group Rates: If you're employed, your employer may offer group life insurance plans as part of your benefits package. Group rates can be significantly lower than individual policies, and they may not require a medical exam for enrollment.

It's worth exploring this option and taking advantage of any group life insurance plans offered by your employer or union.

However, keep in mind that group policies may have limitations, such as being tied to your current job, and they might not offer the same level of customization as individual policies.

Conclusion

Term life insurance is a valuable tool for protecting your family's financial future in the event of your passing. By avoiding the five common mistakes outlined above, you can ensure that you make well-informed decisions about your coverage.

Remember to educate yourself about term life insurance, assess your coverage needs thoroughly, consider adding riders that align with your circumstances, and compare rates from multiple insurers.

Furthermore, if group life insurance plans are available through your employer, explore this option as it can potentially offer cost-effective coverage. A well-considered policy, when in place will give you peace of mind, as it safeguards your loved ones for years to come.

Regularly review your policy to ensure it continues to meet your family's evolving needs and consider consulting with a qualified insurance professional for personalized guidance.

Sources: THX News & American Family Life Assurance Company.

Read the full article

#Additionaloptions#Compareprices#Deathbenefit#Financialsecurity#Grouplifeinsurance#Insurancecoverage#Mistakestoavoid#Protectlovedones#Termlifeinsurance#Termlifepolicy

0 notes

Text

Understanding AARP New York Life Insurance: Benefits and Features

Life insurance is a critical component of financial planning, providing a safety net for loved ones in the event of the policyholder's death. Among the plethora of life insurance options available, AARP New York Life Insurance stands out for its unique features and benefits tailored to the needs of older adults. In this comprehensive exploration, we delve into the intricacies of AARP New York Life Insurance, elucidating its benefits and features to help individuals make informed decisions regarding their financial future.

Overview of AARP New York Life Insurance

AARP New York Life Insurance is a collaboration between AARP and New York Life Insurance Company, designed specifically for AARP members aged 50 to 80. It offers a range of life insurance products to meet diverse needs, providing financial security and peace of mind to policyholders and their families. These products include term life insurance, permanent life insurance, and guaranteed acceptance life insurance, each with its own set of features and benefits.

Term Life Insurance

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. AARP New York Life Insurance offers term life policies with coverage amounts up to $100,000, allowing policyholders to choose the duration and coverage amount that best align with their needs. One of the key advantages of term life insurance is its affordability, making it an attractive option for individuals seeking temporary coverage to protect against financial obligations such as mortgage payments, college tuition, or income replacement.

Permanent Life Insurance

Permanent life insurance, as the name suggests, offers coverage for the entire lifetime of the policyholder, provided premiums are paid. AARP New York Life Insurance offers permanent life insurance policies with coverage amounts up to $50,000, providing lifelong protection and cash value accumulation. Unlike term life insurance, permanent life insurance offers a savings component, allowing policyholders to build cash value over time that can be accessed through policy loans or withdrawals for various financial needs, such as supplemental retirement income, education expenses, or emergencies.

Guaranteed Acceptance Life Insurance

Guaranteed acceptance life insurance is designed for individuals who may have difficulty obtaining coverage due to health issues or other factors. With AARP New York Life Insurance's guaranteed acceptance life insurance, policyholders aged 50 to 80 can secure coverage without undergoing medical exams or answering health questions. This ensures that individuals with pre-existing conditions or adverse health conditions can still obtain life insurance protection for their loved ones, providing invaluable peace of mind.

Benefits and Features

Affordable Premiums: AARP New York Life Insurance offers competitive premiums tailored to the needs of older adults, making life insurance accessible and affordable for AARP members.

Flexibility: Whether individuals prefer term life insurance for temporary coverage, permanent life insurance for lifelong protection, or guaranteed acceptance life insurance for simplified underwriting, AARP New York Life Insurance provides flexibility to meet diverse needs and preferences.

Coverage Options: With coverage amounts ranging from $10,000 to $100,000 for term life insurance and up to $50,000 for permanent life insurance, policyholders can select the coverage amount that best suits their financial obligations and goals.

Cash Value Accumulation: Permanent life insurance policies offered by AARP New York Life Insurance accrue cash value over time, providing a valuable asset that can be accessed tax-efficiently through policy loans or withdrawals for various financial needs.

Death Benefit: In the event of the policyholder's death, AARP New York Life Insurance provides a death benefit to beneficiaries, helping to cover expenses such as funeral costs, outstanding debts, and ongoing financial obligations.

No Medical Exams Required: For guaranteed acceptance life insurance, AARP New York Life Insurance eliminates the need for medical exams or health questions, ensuring that individuals can secure coverage regardless of their health status.

Member Benefits: As a collaboration between AARP and New York Life Insurance Company, AARP New York Life Insurance offers additional benefits and resources to AARP members, further enhancing the value proposition of the insurance products.

Conclusion

AARP New York Life Insurance offers a comprehensive suite of life insurance products tailored to the unique needs of older adults, providing affordable coverage, flexibility, and peace of mind. Whether individuals are seeking temporary protection with term life insurance, lifelong coverage with permanent life insurance, or simplified underwriting with guaranteed acceptance life insurance, AARP New York Life Insurance offers solutions to meet diverse needs and preferences. With competitive premiums, cash value accumulation, and additional member benefits, AARP New York Life Insurance stands out as a reliable partner in financial planning, ensuring that policyholders and their families are adequately protected against life's uncertainties.

0 notes

Text

Many people believe that their one life insurance coverage from their place of employment takes care of everything

Make sure you choose a life insurance policy that includes mortgage protection. This aids in paying off your mortgage or other debts after your death. This is crucial since it frees your loved ones from your financial obligations after your passing. Choosing the quantity of coverage you require is the first factor to take into account when buying your first life assurance plan. Simply multiplying your existing yearly earnings by eight will accomplish this. The situations and requirements of each individual, as well as those of their dependents, make this far from ideal.

For instance, the fact that your child intends to attend college within the four years that follow may make your scenario special. You can choose a more suitable level of coverage with the aid of a number of online tools. Typically, insurance firms have people you may speak with about your needs. When purchasing a life insurance policy, you should learn about the payment alternatives that are open to you. Many businesses allow clients to make monthly, yearly, or even biannual payments. You must decide which choice is ideal for you before setting up the payment schedule. You must ascertain what exclusions or restrictions your life insurance policy contains.

A life insurance policy fails to reimburse for specific things. You must take the time to understand what is and is not covered by the life insurance you have if you are opposed to leaving your family in debt. Understanding why you require life insurance is crucial if you're planning to purchase it. After a parent or spouse passes away, it is utilised to provide families with financial support. If no one is now depending on your support, you can simply purchase a starting policy if you believe your circumstances could shift in the future. Your age, any health issues you may have, and whether or not you smoke will all affect how much you have to pay for life insurance.

Giving up smoking is one approach to reduce this expense. Life insurance will always cost significantly more for smokers. Not only would giving up smoking reduce your rates, but you'll also save money by not having to buy cigarettes. Finding out how much protection you truly require is a smart way to reduce your life insurance prices. Because insurance firms frequently overestimate the amount of insurance you need, you should calculate this figure yourself rather than leaving it to them. You are going to incur greater premiums as a result of this. As a result, you should only get an insurance policy that provides the precise coverage you require.

Instead of purchasing whole life insurance, get a term policy for the greatest amount of coverage at the most affordable price. Whole life insurance premiums are higher because of the investment component and the cash value these policies produce, but it is actually preferable to continue keeping your investments and insurance policies apart. Make sure you bring a thorough health history with you when you undergo the life insurance medical exam. You frequently have to give information regarding previous operations, mishaps, medications and dosages, pre-existing conditions, or other medical concerns. The process goes more quickly and smoothly when you have the necessary information on hand for both you and the person being examined.

As was said earlier in this essay, the majority of life insurance policies provided by employers are straightforward $10,000 coverage. If you're lucky, that will be sufficient to cover the cost of your funeral. That will place your loved ones, who are already suffering from great emotional distress, in a financial bind. By following the suggestions in this article, you may take action to ensure your family has a bright future.

0 notes

Text

What Is Life Insurance?

A life insurance policy is a contract between a policy holder and an insurance company. It promises to pay a specified beneficiary upon death. Some policies are also designed to pay out in the case of critical illness or terminal illness. It may be worth considering a InsuranceSales101 life insurance policy to ensure that your loved ones are cared for in the event of your untimely death.

Depending on your individual situation, your life insurance policy may not be as expensive as you think. For instance, if you are younger, your risk is lower. And if you have young children or a low income, you might not need life insurance. However, if you have dependents or a mortgage, you may need life insurance to protect your spouse and children from financial hardship.

You can also opt for a permanent life policy, which will pay out regardless of when you die. Some permanent policies allow you to withdraw the money early or make adjustments to the payout amount over time. If you are unsure about the right type of policy for you, it is a good idea to consult with an insurance agent or financial planner. If you are not sure what type of policy to choose, you may want to consider checking out the National Association of Insurance Commissioners' Life Insurance Policy Locator Service.

A life insurance policy is a legal contract between a policy holder and an insurance company. If the policyholder dies, the insurance company will pay the death benefit to a designated beneficiary. The beneficiary can use the money to cover expenses such as bills, a mortgage, or a child's college tuition. The benefits of having a life insurance policy can make it easier for your family to live their lives without worrying about money. Find out more from this page: https://insurancesales101.com/life-insurance-101/.

Life insurance policies can be expensive, but they are not impossible for anyone to afford. The price of a policy depends on the risk level of the insured and the health history of the person applying for the policy. You will usually need to provide medical records and undergo a health examination in order to qualify for coverage. You may also want to look into guaranteed life insurance, which doesn't require a medical exam. However, this type of policy usually has higher premiums and a waiting period.

When a beneficiary decides to make a claim against a life insurance policy, the insurance company may require acceptable proof of death. This could be due to a suicide clause in the policy. In some states, an insurer can also deny a life insurance claim if the beneficiary has changed beneficiaries or misrepresented their intentions.

Many insurance companies provide customization options. The most common way to change a plan is by adding riders. Riders are a separate premium paid by the policyholder. Other insurers include certain riders in the base premium. Some even have a waiver of premium rider, which relieves the policyholder of paying the premium. View site here: https://en.wikipedia.org/wiki/Whole_life_insurance for more details on this topic.

0 notes

Text

Time To Purchase Life Insurance? Check Out These Tips!

Taking out a life insurance policy is a way of protecting your loved ones should you pass. No one wants to think about their passing, but when it comes to life insurance, waiting is not an option. A family without life insurance could become financially devastated at an already difficult time. Choosing the right policy is important. Here are some tips to help you sort through all of your options.

When buying life insurance, it is important that you know how your broker will be paid. If they are working strictly on commission, for example, your needs may be secondary to selling you a policy that gives the best commission. Any commission at all for your broker can lead to a conflict of interest, so always ask to see all of the alternative products before buying.

When you buy life insurance, you should be sure that your coverage is sufficient. Your beneficiary can pay the mortgage, loans, or college tuition with the money.

Purchase life insurance when you are young rather than when you are old. Putting off purchasing life insurance until later life to avoid paying premiums can end up costing you more. The earlier in life you purchase a life insurance policy, the lower your premiums will be and the less likely you are to be refused a policy.

Life insurance is an important item to have in place, especially if you have a family that will need to be provided for after you have died. Do not leave this important issue until it is too late. Investigate a life insurance policy as soon as you are able and ensure that it is backed up with a current will.

Having a life insurance policy can be a nice way to leave money for the family that you are leaving behind. This extra money can help out greatly to assist your family's needs. The right life insurance policy can give an individual a wonderful peace of mind, knowing that his or her family is going to be okay, financially.

By making sure you are healthy, you have the opportunity to reduce your life insurance premium. Very often, healthier people are offered better deals by insurers because their life expectancy is higher.

When purchasing term life insurance, consider how long it will be until your children are financially independent and your debts are paid off. The point of life insurance is to protect family members such as children who are totally dependent on your income. Take a policy that will outlast the period of your children's dependence and any long-term loans such as a mortgage.

Pay your premiums promptly. If the holder fails to pay the monthly premium on their insurance term, or if they decide to stop making payments before the whole life plan gains any value, they will lose the policy. They will also be forced to get a new policy and the new policy could be more expensive. This can especially be true if they have aged or fallen into poor health since their policy payments stopped.

Do your research on the prices of life insurance. Compare the policies and the prices from many different companies. Every company will have their own price, so you want to make sure you are getting what you need in a policy, for the lowest posible price. krankenkassen vergleich can compare most companies at home on the internet.

Entering a medical exam for your life insurance policy properly hydrated is the smart move. Proper hydration will not only make it a lot simpler to provide a urine sample, but the water in your system will help regulate your blood pressure and your heart rate. This will certainly help your chances.

Consider your current health when purchasing a life insurance policy. It is less expensive to purchase life insurance at a younger age and when in good health than later in life. Often, even if you experience health problems later, your life insurance is not impacted if it has already been in place. Trying to buy a policy after a health problem can be much more expensive, if not impossible.

Life insurance is a necessity to protect your family's financial future, should you pass. There are many different options available and, as we have discussed here, sorting through them all can become confusing. The tips we have provided should help to make the decision easier. Discuss these tips, and your insurance options, with your agent today to protect your family's tomorrow.

1 note

·

View note

Text

There are dozens of stories about families who lost one of their primary earners and found themselves in a horrible financial situation. Many people are scared to even think about life insurance, but you can insure that your family will not be lost without you if you just follow these tips.

Buy the correct amount of life insurance for you. If you buy too much insurance, it can be costly, and if you buy too little insurance, it could leave you in dire straights if something happens. You are going to feel better secured if you choose your life insurance wisely.

There is no need to purchase life insurance in extravagant amounts. The huge premiums that go along with these policies will simply drain your funds while you are living. It is best to get a policy that gives your beneficiaries just enough money when you pass.

Try to determine for yourself how much life insurance you actually need. Many life insurance providers offer several ways in which they can make their own estimations. They usually over estimate in order to turn a larger profit. Do your own estimating so that you can be sure you aren't getting ripped off.

When purchasing term life insurance, consider how long it will be until your children are financially independent and your debts are paid off. The point of life insurance is to protect family members such as children who are totally dependent on your income. Take a policy that will outlast the period of your children's dependence and any long-term loans such as a mortgage.

Seek out multiple quotes when you're considering purchasing life insurance. Different companies rate customers differently depending on certain factors, and each factor will carry a different weight with each company. If you smoke, you should take special note of the variation in quoted premiums, and do what you can to find the best deal by consulting with several agents.

Some life insurance policies expire. It is important for you to keep up with the expiration date of your life insurance policy and talk to the carrier if the date draws near. You may be able to extend your policy or switch to one with different coverage options. krankenkassen vergleich will be able to let you know what options you have.

You need to find out what exclusions or limitations are included in your life insurance policy. There are certain things that a life insurance policy will not cover. If you do not want to leave your family in debt, you need to take the time to find out what is and what is not covered under your life insurance policy.

You need to find out exactly what is covered in a life insurance policy before you decide on a policy. Different policies provide different coverage options and have different terms. You need to find one that fits your specific needs. You can find out about your coverage options by talking to a life insurance agent.

If you have an old whole-life policy that you've had for several years, you should not attempt to replace it. The reason is because you could lose the premiums you have paid, and you could have to pay new administration fees. If you need more insurance on a whole-life policy, then you should just purchase more instead of discarding your current policy.

The last thing your life insurance has to be is complicated. Make sure that you're always keeping things as simple as possible. If and when you pass on, your family should be able to get the money quickly without anything there to hold the payments back. The simpler things are, the easier the money comes in.

Before going into a medical exam for your life insurance policy, you should attempt to fast for at least 8 hours. This will give the doctors an accurate reading of your blood chemistry so that there aren't any mix-ups. A wrong reading could end up costing you big on your premium payments.

If you are able to find the right life insurance, it can give you an incredible peace of mind for your loved ones. By adhering to these tips, you can stop worrying about the possible future and start focusing on the time you do have with your loved ones.

1 note

·

View note

Text

Why Invest in Term Life Insurance?

Life insurance provides your loved one’s crucial financial safety if you suddenly pass away. While buying a life insurance policy, ensure that your coverage offers sufficient financial assistance and is also within your budget. One of the most common life insurance policies Canadians apply for is Brampton’s term life insurance. If you want to buy a term life insurance policy, then you can connect with SJ Financial. Our experts are well trained and can help you understand everything about term life insurance.

Basics About Term Life Insurance

Term life insurance offers coverage for a specific term of years and pays out the death benefits if you suddenly pass away during your insurance term. It differs from permanent life insurance because it does not come with extra benefits like working as an investment tool. The best part about term life insurance is that it is cost-effective regarding premiums. Hence it is the only reason why Canadians apply for term life insurance.

The term life insurance broker suggests that term life insurance is generally available for 35 years or is even set to last for a specific age, including 65 or 80. It offers protection all the years. It offers protection when you need it. Most are in their 40s, 30s, or even 50s. Like these are the years when you need to pay off your mortgage and have young kids to provide for. Your beneficiaries will receive a guaranteed benefit if you are likely to pass away in the insurance term. If you outlive this insurance, you will not be able to get any money.

The Working of Term Life Insurance

Our term life insurance quotes in Ontario simply include everything. You just need to pay the premium for a given number of terms, and in exchange, we will promise you to pay a fixed amount of money to your loved ones if you die before your policy term.

Based on the coverage amount, we will determine your premiums, and the more coverage you want, the higher will be your policy premium. Additionally, the longer your policy term, the more you will have to pay. Being a leading insurer, we will also consider your age, medical history, gender, and family medical history.

We will consider your smoking habits, current medication, occupation, driving record other hobbies. You must submit a medical exam with us to qualify for the best premium significance to prove your eligibility.

We mainly sell term policies as level term policies. It means that your premiums will remain the same throughout the contract. Your loved ones will get tax-free death benefits if you are likely to die within the policy term.

You can connect with the Financial Advisor in Brampton and get your hands on the best term life insurance. Your beneficiaries can choose to receive the death benefit as a single instalment or instalment.

You have the opinion to convert or even renew the life insurance policy if you outlive the term or allow it to expire. Your family will not get any benefits if you are likely to die after the policy term. Most term life insurance is renewable but to a specific limit.

But if you go for renewal, you will likely pay more because life insurance costs increase as you age. You will pay high returns if you convert your term life insurance to a permanent one. You can renew or convert the term policy without any additional underwriting or without providing medical evidence.

— Know more about: A Simple Guide on Term Life Insurance

Reasons To Get Term Life Insurance From SJ Financial

Cost-Effective:

Our term life insurance rates are cheaper than the whole life insurance available as it would cover only a specific number of years and does not include the savings element.

Perfect For Young Families:

Term life insurance is more affordable than permanent life insurance and offers a better value in Canada, especially for young families. Several young families are stressed by money and ever-increasing mortgage expenses, raising kids, and other expenses.

Our term life insurance is entirely flexible, and you can choose the term and coverage per your needs.

You can lock in a low rate for the next 20 to 25 years if you want to cover the long-term debt. On the flip side, ten-year life insurance would be your best bet if you want to cover your tuition expenses.

Conclusion:

Hence, term life insurance is the need of the hour and each and every individual should have it. Hence, with the presence of experts from SJ Financial one can get the right term insurance as per their needs. The professionals here leave no stone unturned in helping people safeguard their future financially.

The team here will always be there to help you have a solid financial back up in the future by guiding you in the best way possible.

0 notes