#LLP

Text

Everyone’s like Eris will be High Lord, Eris will be High Lord … 🥰🥵🤩

Tbh? I don’t think we’re remotely ready. Because I’m highly concerned and I apologise for the kind of simp I’ll turn into, the second he is in fact HIGH LORD. The power he already holds??! And I’m not talking power power but- just—HIM. His arrogance alone is so hot, I’m not even sorry anymore to admit all feminism leaves my body, when it comes to HIM.

#but I am sorry#I’m apologising now and forever for the person I will be#eris vanserra#autumn males#keeping up with the vanserras#thoughts on eris#llp

231 notes

·

View notes

Text

8 notes

·

View notes

Text

Travis gets possessed in Love~Love Paradise.

4 notes

·

View notes

Text

Language Learning Protocol

08/31/2023

Latin:

watched one Youtube lesson

worked through one chapter of my textbook

Also I downloaded a 56 gb folder with language learning book pdfs, so... yeah.

1 note

·

View note

Text

Importer Exporter Code (IEC) is a key business identification number which is mandatory for Imports or Exports. No person shall import or export except under the IEC number allotted by the Directorate General of Foreign Trade (DGFT). An importer or exporter needs the IE Code and GST Registration to clear the Goods from the customs. Therefore it is mandatory to obtain Importer Exporter Code to start import or export business.

#importexportcode#importexportwholesale#startup#iec#export#import#india#importexportentrepreneur#llp#gstindia#taxes#importexporttraining#accountant#exportimport#exportimporttraining#company#goglobal#exporter

2 notes

·

View notes

Text

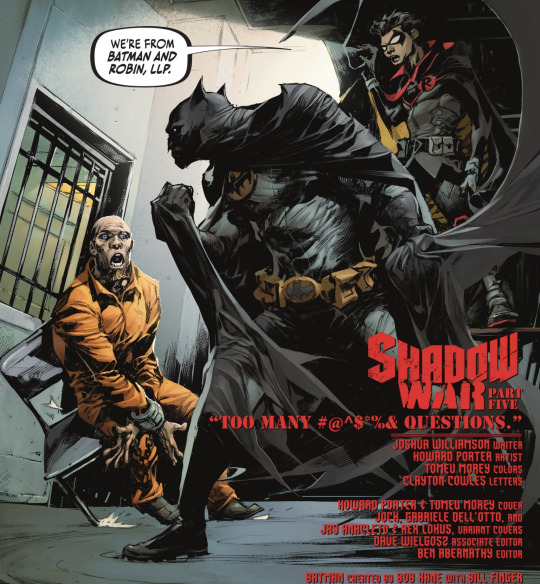

We’re from Batman and Robin LLP.

#Batman#Bruce Wayne#robin#damian wayne#llp#funny#shadow war#crossover#joshua williamson#howard porter#dc comics#comics#2020s comics

6 notes

·

View notes

Text

Is Liability of Designated Partners in LLP Unlimited?

In a Limited Liability Partnership (LLP), the liability of designated partners is not unlimited. The LLP structure combines elements of a partnership and a corporation, offering limited liability protection to its partners. Here's how liability works for designated partners in an LLP:

Limited Liability: Similar to shareholders in a corporation, designated partners in an LLP enjoy limited liability, which means their personal assets are generally protected from the debts, liabilities, and obligations of the LLP. This limited liability extends to their capital contribution and does not expose their personal assets beyond that amount.

Liability Shield: The liability of designated partners is limited to the extent of their capital contribution to the LLP and any personal guarantees they may have provided. Their personal assets, such as homes, cars, and savings, are not typically at risk to satisfy the debts or liabilities of the LLP.

Exceptions to Limited Liability: While designated partners generally have limited liability, there are certain exceptions where their liability may become unlimited:

If a designated partner engages in fraud or wrongful acts that cause harm to the LLP or third parties, they may be held personally liable for their actions.

If the LLP agreement specifies that designated partners will have unlimited liability for certain obligations or liabilities, they would be personally liable to the extent outlined in the agreement.

Joint and Several Liability: Designated partners may have joint and several liability in certain situations, meaning they can be collectively and individually liable for the LLP's debts or obligations. However, this liability is still limited to the extent of their capital contribution and any personal guarantees provided.

Overall, while designated partners in an LLP enjoy limited liability protection, it's essential for them to fulfill their duties and obligations in accordance with the LLP agreement and applicable laws to avoid personal liability exposure. Consulting with legal advisors or professionals knowledgeable about LLP regulations can provide further clarity on liability matters specific to an LLP's jurisdiction and circumstances. For more details efiletax.

0 notes

Text

P-Mo x Perspective | snippet/teaser 3 | #blamesociety | #LLP

FULL VIDEO DROPS AT NOON!! TAP IN ON THE #YOUTUBE channel(link)▶️

When editing/creating these visuals, I end up playing the track over and over. In doing so, I get very acquainted with the song. Paris' rhyme scheme on "Perspective" is damn near immaculate. His descriptions of life are dark, but he always attempted to find and show light. 💙🕊👑

💙💙💙

B.L.A.M.E.❤️🩹SOCIETY WEBSITE

(Click👆🏾 it)

#LLP#mobb deep#prodigy#nyc#new york#saint louis#stl#blamesociety#hiphop#love#youtube#capcut#depression#mental health#mental illness#brain scan#ct scan#cat scan#x-ray#light#dark clouds#bad weathers#storm#stormy#thunder#lyrics#golden#focus#hoping#silence

0 notes

Text

He’s like don’t even try change the topic YOU LEFT ME.

😭

#a court of feycien#ugggh#can you hear his little heart breaking#he’s everything#any further questions why he’s my comfort character?#lucien vanserra#feyre archeron#elucien#acotar quotes#llp#lucien quotes

196 notes

·

View notes

Text

Annual Compliance for Private Limited Company in India

#annualcompliance#soleproprietorship#partnership#LLP#privatelimited#BUSSINESSREGISTRATION#soleproprietors#Propritorship

0 notes

Text

COMPANY REGISTRATION PROCESS ONLINE WITH LEGALCY PRIVATE LIMITED.

#Legalcy#legalcyPvtLtd#legalcyPrivateLimited#companyregistration#gst#company#business#registration#startup#tax#trademark#businessregistration#companyformation#fssai#gstregistration#incometax#msme#gstupdates#startupbusiness#india#gstfiling#smallbusiness#cacregistration#privatelimitedcompany#llp#license#incometaxreturn#itr#accounting#entrepreneur

0 notes

Text

Language Learning Protocol

08/26/2023

Russian:

studied some grammar; plural of nouns in the nominative case

English:

learned some random new words

Norwegian:

started reading the wikipedia page on Supernatural and looked up and wrote down the new words I learned from it

#ill try and do one of these every day now to hold myself accountable for studying#ill use the tag#llp

1 note

·

View note

Text

SIDBI Term loan Assistance for Rooftop solar PV Plant

As the global community increasingly shifts towards sustainable energy sources, initiatives like the SIDBI Term Loan Assistance for Rooftop Solar PV Plant (STAR Scheme) have emerged to promote clean energy adoption in India. Launched by the Small Industries Development Bank of India (SIDBI), the STAR Scheme is designed to support businesses and industries in installing rooftop solar photovoltaic (PV) plants. This article explores the key features, benefits, and objectives of the STAR Scheme, shedding light on its significance in fostering a green energy ecosystem.

Key Objectives of the STAR Scheme:

Promoting Clean Energy Adoption:

The primary goal of the STAR Scheme is to encourage the widespread adoption of rooftop solar PV plants. By providing financial assistance to businesses, industries, and commercial entities, the scheme aims to contribute to the reduction of greenhouse gas emissions and mitigate the environmental impact of conventional energy sources.

Facilitating Green Financing:

STAR Scheme acts as a catalyst for green financing by offering term loan assistance for the installation of rooftop solar PV plants. This enables businesses to invest in renewable energy solutions without incurring a significant financial burden.

Enhancing Energy Efficiency:

Rooftop solar PV plants not only generate clean energy but also contribute to enhanced energy efficiency. The scheme focuses on supporting projects that align with the government's vision of building a sustainable and energy-efficient infrastructure.

Features of the STAR Scheme:

Financial Assistance:

The STAR Scheme provides term loan assistance to eligible entities for setting up rooftop solar PV plants. The financial support covers a significant portion of the project cost, making it an attractive option for businesses looking to invest in solar energy.

Eligibility Criteria:

Eligibility for the scheme extends to small and medium enterprises (SMEs), industries, commercial establishments, and other entities interested in installing rooftop solar PV plants. Meeting the predefined eligibility criteria is crucial for availing the financial benefits of the STAR Scheme.

Loan Tenure and Moratorium:

The scheme offers flexible loan tenure to borrowers, allowing them to choose a repayment period that suits their financial capabilities. Additionally, a moratorium period is provided, easing the initial financial burden on borrowers during the project implementation phase.

Interest Rates:

The interest rates for loans under the STAR Scheme are competitive, promoting affordability for borrowers. This incentivizes businesses to invest in sustainable energy solutions while minimizing their dependence on traditional power sources.

Technical Assistance:

Recognizing the technical complexities associated with solar PV projects, the STAR Scheme provides technical assistance to borrowers. This includes guidance on project feasibility, design, and implementation, ensuring the successful execution of rooftop solar initiatives.

Benefits and Impact:

The STAR Scheme has yielded positive outcomes by facilitating the deployment of rooftop solar PV plants across various sectors. Businesses and industries that have embraced the scheme have not only reduced their carbon footprint but have also benefited from long-term cost savings through reduced energy bills.

Conclusion:

The SIDBI Term Loan Assistance for Rooftop Solar PV Plant (STAR Scheme) stands as a beacon in India's journey towards a sustainable and green energy future. By providing financial assistance, technical support, and promoting clean energy adoption, the scheme plays a pivotal role in advancing the country's renewable energy goals. As businesses increasingly recognize the economic and environmental benefits of solar energy, initiatives like STAR Scheme contribute significantly to India's transition to a cleaner and more sustainable energy landscape.

#business#duns#ad code#barcode registration#singapore company registration#gst registration#finance#iso certification#llp#gst

0 notes

Text

New Section 43B Clause अपने Creditors को नहीं किया Timely Payment तो देना होगा Purchase पर Tax

New Section 43 B CLAUSE H of the Income Tax Act introduced by the Government in Budget 2023 and it is applicable for the FY 2023-2024 and AY 2024-2025. According to this Section, if you have purchased goods from enterprises registered under MSMED Act, 2006, then, you have to make timely payment to its creditors otherwise delayed payment shall be disallowed and you have to paid tax on such delayed payment.

If you want to share any query, then,

Contact Us:LEGALVISTAARCONSULTANTS Mob. No. 8267801110

Email id: [email protected]

#gst#incometax#company#msme#accounting#legalvistaar#legal#taxupdates#gstupdates#trademark#TDS#TCS#Tallyprime#LLP#Vyapari

0 notes