#Industrial sector

Text

Transformer Trade

Transformer: A device that steps up or steps down the voltage as it transmits electrical energy from one alternating-current circuit to one or more other circuits. Transformers are used for a wide range of functions, including raising the voltage from electric generators to enable long-distance transmission of electricity and lowering the voltage of conventional power circuits to run low-voltage devices like doorbells and toy electric trains.

Transformers work by inducing current in a second coil known as the secondary as the magnetic lines of force (flux lines) build up and contract in response to variations in current flowing through the primary coil. The number of turns in the secondary coil divided by the number of turns in the primary coil, known as the turns ratio, is multiplied by the primary voltage to determine the secondary voltage.

The currents used for radio transmission are transferred by air-core transformers, which are made of two or more coils coiled around a solid insulating material or on an insulating coil shape. Similar duties are performed by iron-core transformers in the audio frequency range.

Transformer On Rent

Perennial Technologies provide a transformer for hire in monthly basis.

2 notes

·

View notes

Text

Match your skills to the most in-demand job roles in Industrial Safety Sector. Join our Industrial Safety course, a tailor-made course to meet these requirements by enhancing the core competencies of students.

Learn HSE requirements that are covered from a wide spectrum of international and national legislation.

Skills you will learn:

Outstanding Organizational Skills

Excellent Communication Skills

Attention to detail

Working of Safety Management Information System

Knowledge of potentially hazardous materials or practices

Become A:

HSE Engineer

Pollution Control (Air, Water, and Soil) Officers

Environmental Protection Engineer

Consultant in HSE

HSE Audit Officer/Engineer

Industrial Safety Auditor

#industrial sector#industrial safety#workers safety#health and safety#safety training#safety first#industrial training#industrial equipment

1 note

·

View note

Text

Support both the member states and private sector to effectively participate in the new trading environment.

The operationalisation of the AfCFTA Adjustment Fund aims to support both the member states and private sector to effectively participate in the new trading environment established under the AfCFTA. As with any major trade liberalisation regime, the AfCFTA Agreement will introduce near-term disruptions, as tariff revenues by State Parties are reduced, industrial sectors are disordered, businesses and supply chains are reorganised, and employment is dislocated – often in ways that cannot be anticipated. The estimated requirement for uninterrupted implementation of the AfCFTA Agreement and to eliminate the adjustment cost is at $10 billion over the next six to ten years. The Adjustment fund will for instance, be meaningful for a country experiencing challenges with its textiles and clothing sector to access the fund for retraining of workers or for recapitalization, procuring machinery for goods, or to increase competitiveness The Adjustment Fund consists of a Base Fund, a General Fund and a Credit Fund. The Base Fund will consist of voluntary contributions from State Parties, grants and technical assistance funds to address tariff revenue losses as tariffs are progressively eliminated. It will also support countries to implement various provisions of the AfCFTA Agreement, its Protocols and Annexes. The General Fund will mobilise concessional funding, while the Credit Fund will mobilise commercial funding to support both the public and private sectors, enabling them to adjust and take advantage of the opportunities created by the AfCFTA.

#Adjustment Fund#creatingoneafrica#afcfta#intra africa trade#intraregional trade.#voluntary contributions#commercial funding#concessional funding#public sector#private sector#industrial sector#textiles sector#clothing sector#trading environment

0 notes

Text

#Japan#hydrogen#decarbonization#fuel#carbon emissions#renewable energy#clean coal#nuclear energy#fossil fuels#supply chains#strategic areas#water electrolysis#storage batteries#tankers#industrial sector#economic growth#hydrogen society#ammonia#infrastructure#legislation#energy security#liquefied natural gas#LNG#green transformation#solar batteries#offshore wind power#energy report#tokyo

0 notes

Text

New green industrial age can be the breakthrough for Sustainable Development Goals.

Amid growing food and energy crises, an uncertain global economic outlook, and the escalating impacts of climate change, the UN today said that a sustainable industrial transformation is needed to close the widening development gap between countries, meet climate targets and achieve the Sustainable Development Goals.

The 2023 Financing for Sustainable Development Report: Financing Sustainable Transformations says urgent, massive investments are needed to accelerate transformations including in electricity supply, industry, farming, transportation, and buildings.

“Without the means to invest in sustainable development and transform their energy and food systems, developing countries are falling even further behind,” United Nations Secretary-General António Guterres said in the foreword to the report. “A two-track world of haves and have-nots holds clear and obvious dangers for every country. We urgently need to rebuild global cooperation and find the solutions to our current crises in multilateral action.”

According to the report some of the necessary changes are already taking place. The energy crisis caused by the war in Ukraine has spurred investment in global energy transition, which skyrocketed in 2022 to a record $1.1 trillion. Energy transition investments surpassed fossil fuel system investments for the first time in 2022, but these are almost all in China and developed countries.

The 2023 Financing for Sustainable Development Report finds that most developing countries do not have the resources for investment, unlike their developed counterparts. Climate change, Russia’s invasion of Ukraine, the COVID-19 pandemic, and debt payments up to two times higher than in 2019 have combined to put massive fiscal pressures on most developing countries. This limits their ability to invest in sustainable transformation.

In developed countries in 2020 and 2021, for example, post-pandemic recovery spending was $12,200 per capita. This was 30 times higher than for developing countries ($410), and 610 times higher than for least developed countries ($20).

“Without delivering a reformed international financial system while scaling up investments in the SDGs, we will not deliver on our shared commitment to the 2030 Agenda for Sustainable Development,” said United Nations Deputy Secretary-General Amina Mohammed. “The good news is that we know what to do and how to do it. From launching critical transformations in energy, food and education to ushering in a new green industrial and digital age—we all must quicken the pace and leave no one behind.”

The 2023 Financing for Sustainable Development Report notes that industrialization has historically been a vehicle of progress, leading to economic growth, job creation, technological advancement, and poverty reduction. The report calls for a new generation of sustainable industrial policies, underpinned by integrated national planning, to scale up investments and lay the foundation for the needed transformations. Many opportunities for inclusive growth exist in agroindustry, green energy, and manufacturing.

The recent rapid uptake in technology points to the possibilities for an equally rapid transition to sustainable industrialization and growth. Between 2021 and 2022, 338 million more people used the Internet regularly, an increase of approximately 38,600 additional people every hour. Furthermore, in regions with high-quality connected services, 44 per cent of all the companies are exporters, in contrast to only 19 per cent of firms where Internet services are weaker.

However, manufacturing capacity remains uneven. In least developed countries in Africa, manufacturing value added, instead of doubling as per the SDG target 9.2, fell from around 10 per cent of GDP in 2000 to 9 per cent in 2021. It will take targeted policies to build the domestic productive capabilities to achieve low-carbon transitions, create decent jobs, and boost economic growth, while ensuring gender equality.

To deliver the necessary resources for this transformation, the 2023 Financing for Sustainable Development Report calls for a combination of strengthening tax systems, enabling and catalyzing private investment, and scaling up of international public investment and development cooperation. Changes to the international financial architecture are also needed to raise sufficient resources.

The report notes that the international system is currently undergoing the biggest rethink across international finance, monetary, trade, and tax systems since the Bretton Woods Conference in 1944. As international institutions work to adapt to the rapidly evolving needs of countries, the report warns that if reforms are piecemeal, incomplete, or fail to take the SDGs into account, sustainable development will be unachievable.

A reformed, effective international financial architecture to deliver for sustainable transformation must include revised frameworks for:

International tax norms, including rules for taxing digitalized and globalized business that meet the needs of developing countries;

Policy and regulatory frameworks to better link private sector profitability with sustainability;

Evolving the scale and mission of the development bank system;

A loss and damage fund on climate change, which needs to be operationalized quickly;

Debt relief and major improvement to the international debt resolution architecture – given that 60 per cent of low-income countries are in or at risk of debt distress;

Multilateral trade rules to revise the approach to and resolve current tensions on green subsidies.

“We have the solutions to avoid a lasting sustainable development divide, and prevent a lost decade for development,” said UN Under Secretary-General Li Junhua, head of the Department of Economic and Social Affairs, which led the production of the inter-agency report. “We must find the political will to overcome the rising political tensions, splintering of inter-country alliances, and worrying trends towards nationalism and seize the moment now to urgently invest in our common future.”

– ENDS –

Notes to Editors:

The 2023 Financing for Sustainable Development Report: Financing Sustainable Transformations is a joint product of the Inter-agency Task Force on Financing for Development, which is comprised of more than 60 United Nations Agencies and international organizations. The Financing for Sustainable Development Office of the UN Department of Economic and Social Affairs serves as the substantive editor and coordinator of the Task Force, in close cooperation the World Bank Group, the IMF, World Trade Organization, UNCTAD, UNDP and UNIDO. The Task Force was mandated by the Addis Ababa Action Agenda and is chaired by Mr. Li Junhua, United Nations Under-Secretary General for Economic and Social Affairs. The full copy of the report will be available at https://developmentfinance.un.org/fsdr2023 on 5 April 2023.

The report forms the basis for discussions at the ECOSOC Forum on Financing for Development, where Member States discuss measures necessary to mobilize sustainable financing. Negotiations based on the report are ongoing. The report also informs the SDG Investment Fair, a platform which brings together government officials and investors for sustainable investment opportunities that support the achievement of the SDGs.

The report covers, among others, areas of the global economic context; trade; debt, private business and finance; technology; and international development cooperation.

***

#2023 Financing for Sustainable Development Report#SDG9#Industrial sector#Green Industrial Age#industrialization#agroindustry#green energy#manufacturing#Sustainable Development Goals

0 notes

Link

Remember the claims that Russia’s economy was more or less irrelevant, merely the equivalent of a small, not very impressive European country? “Putin, who has an economy the size of Italy,” Sen. Lindsey Graham, R-S.C., said in 2014 after the invasion of Crimea, “[is] playing a poker game with a pair of twos and winning.” Of increasing Russian diplomatic and geopolitical influence in Europe, the Middle East, and East Asia, The Economist asked in 2019, “How did a country with an economy the size of Spain … achieve all this?”

Seldom has the West so grossly misjudged an economy’s global significance. French economist Jacques Sapir, a renowned specialist of the Russian economy who teaches at the Moscow and Paris schools of economics, explained recently that the war in Ukraine has “made us realize that the Russian economy is considerably more important than what we thought.” For Sapir, one big reason for this miscalculation is exchange rates. If you compare Russia’s gross domestic product (GDP) by simply converting it from rubles into U.S. dollars, you indeed get an economy the size of Spain’s. But such a comparison makes no sense without adjusting for purchasing power parity (PPP), which accounts for productivity and standards of living, and thus per capita welfare and resource use. Indeed, PPP is the measure favored by most international institutions, from the IMF to the OECD. And when you measure Russia’s GDP based on PPP, it’s clear that Russia’s economy is actually more like the size of Germany’s, about $4.4 trillion for Russia versus $4.6 trillion for Germany. From the size of a small and somewhat ailing European economy to the biggest economy in Europe and one of the largest in the world—not a negligible difference.

Sapir also encourages us to ask, “What is the share of the service sector versus the share of the commodities and industrial sector?” To him, the service sector today is grossly overvalued compared with the industrial sector and commodities like oil, gas, copper, and agricultural products. If we reduce the proportional importance of services in the global economy, Sapir says that “Russia’s economy is vastly larger than that of Germany and represents probably 5% or 6% of the world economy,” more like Japan than Spain.

This makes intuitive sense. When push comes to shove, we know there is more value in providing people with the things they really need to survive like food and energy than there is in intangible things like entertainment or financial services. When a company like Netflix has a price-earnings ratio three times higher than that of Nestlé, the world’s largest food company, it’s more likely than not a reflection of market froth than of physical reality. Netflix is a great service, but as long as an estimated 800 million people in the world remain undernourished, Nestlé is still going to provide more value.

All of which is to say that the current crisis in Ukraine has helpfully clarified how much we’ve taken for granted the “antiquated” side of modern economies like industry and commodities—prices for which have surged this year—and perhaps overvalued services and “tech,” whose value has recently crashed.

The size and importance of Russia’s economy is further distorted by ignoring global trade flows, in which Sapir estimates that Russia “may account for maybe as much as 15%.” While Russia is not the largest producer of oil in the world, for example, it has been the largest exporter of it, ahead even of Saudi Arabia. The same is true for many other essential products such as wheat—the world’s most important food crop, with Russia controlling about 19.5% of global exports—nickel (20.4%), semi-finished iron (18.8%), platinum (16.6%), and frozen fishes (11.2%).

Such commanding importance in the production of so many essential commodities means that Russia, like few other countries on the planet, is in many respects a linchpin of the globalized production chain. Unlike “maximum sanctions” on a country like Iran or Venezuela, attempting to cut the Russian link has meant and will likely continue to mean a dramatic reorganization of the global economy.

…

But if we adjust for PPP, we see that the Chinese economy reached almost $27.21 trillion in 2021, compared with $20.5 trillion for the EU and $23 trillion for the United States. In terms of PPP, in fact, China’s economy overtook America’s back as much as six years ago.

And what if we reduce the proportional importance of the service sector relative to industry and commodities? Services account for approximately 53.3% of China’s GDP, even less than in Russia (56.7%). If we roughly apply Sapir’s ratio of doubling the valuation of the nonservice sector to China, we may have to consider that in a very real and relevant way, the Chinese economy accounts for something like 25%-30% of the global economy on a PPP basis, rather than the current estimates of 18%-19%. That would put the combined Chinese and Russian economies at about 30%-35% of the global economy (again, adjusting for PPP and the overvaluation of the service sector)—a behemoth and likely unsustainable challenge for a trans-Atlantic community that looks increasingly focused on using maximalist economic sanctions to punish bad actors and achieve desired policy outcomes. That challenge becomes even more daunting when we consider that the service sector accounts for roughly 77% of the U.S. economy and 70% of the EU’s—suggesting a potentially significant degree of overvaluation in Western economic heft, and far more parity in relative economic power with China and Russia.

…

Before we enthusiastically embrace a new Iron Curtain, therefore, it’s worth pausing to consider how many countries in the world will voluntarily place themselves on our side. The countries of what we consider “the West” will—for ideological and historical reasons, in addition to economic and military enmeshment—undoubtedly remain relatively united. But the West only accounts for about 13% of the world’s population, with China and Russia together making up about 20%. That leaves about two-thirds of humanity “nonaligned,” a position that most of them would like to maintain. If we force them to choose a side, we may be surprised by many of the results.

A tally of the countries participating in current sanctions on Russia, in fact, makes it hard to say whether a new Iron Curtain is being drawn around our adversaries or around the West itself. Countries and nominal U.S. allies as significant as India and Saudi Arabia have been particularly vocal in their refusal to take sides in the conflict in Ukraine.

…

None of this is to say that the brutal invasion of Ukraine has been anything less than an atrocity, and that extraordinary measures may indeed be called for in order to counter Russian expansionism and its implications for global peace and stability. But it’s possible that the West, in a fit of self-righteousness and a need to satisfy various domestic demands, may be diving headlong into a future in which the global South and many others besides feel increasingly pressured to make a choice they don’t want to have to make, and which may leave the West more isolated than ever before in modern times.

#arnaud bertrand#tablet magazine#russia#sanctions#purchasing power parity#service sector#industrial sector#commodities#economics#china

0 notes

Text

among other things, the wga strike is a shatterpoint moment in deciding how much of a critical profession within an industry can be reduced to a poverty wage gig economy while ai takes over

if you think this doesn't affect your job somewhere down the line, reconsider that thought

#wga strike#and I'm not just talking about creative industries#my obgyn friend was telling me about some really disturbing parallels she's seeing in the medical field#I've seen people in the nonprofit sector discussing this on twitter#anyway felt like this deserved its own post

2K notes

·

View notes

Link

An ID card that appears to belong to a Chinese prisoner was found inside the lining of a coat from the British brand Regatta, raising concerns that the clothing was manufactured using prison labour.

The waterproof women’s coat was bought online by a woman in Derbyshire in the Black Friday sale. When it arrived on 22 November, she could feel a hard rectangular item in the right sleeve, which restricted the movement of her elbow.

After cutting into the coat to remove the item, she discovered what looked like a prison identification card, with a mugshot of a man apparently in a prisoner’s uniform in front of a height chart, and the name of the prison in China.

“You don’t expect it from [Regatta]. It’s a UK brand that’s up there with Next, with M&S, that you put your children in their clothes … and this happens, and it just makes you feel really uneasy and uncomfortable,” said the woman, who does not wish to be named.

The card was found inside a plastic holder embossed with the words: “Produced by the Ministry of Justice prisons bureau.”

...

According to Regatta’s 2023 modern slavery statement, “forced or imprisoned labour is prohibited” in its supply chain and it is a member of the Ethical Trading Initiative, a membership organisation that requires adherence with certain guidelines, including a ban on “forced, bonded or involuntary prison labour”. The statement also says 70 factories were audited in 2022-2023, although it is unclear how many were in China.

45 notes

·

View notes

Text

Crowdsourcing a question

Okay totally personal post here because, now that search engines suck, my research is failing me. So I'm crowdsourcing my question about the residential care work industry!

Hoping at least some of my followers have experience in/with the industry and some intel on this:

Actual question: How common is it for jobs in residential care work (residential centers, btw, not home care) to actually have two people on the night shift? vs. just saying they always have two people on the night shift in interviews and their official policies, and actually it's not true?

Because my current job was, it turns out, apparently totally lying about "you'll never be on shift alone with clients" at orientation (when it comes to the night shift, anyway). Which, holy fucking safety issues, Batman!

Suffice to say this was a very fun thing to find out like three days before my first regular shift

So, I'm thinking realllll hard about switching companies, and I'm trying to figure out if I could expect to actually have a coworker at a different company, or if it's like an open secret in the field that actually, basically all the night shifts end up being solo shifts, because the industry is so chronically understaffed or w/e

#not news#ask#me#ideally only answer if you actually have specific knowledge of or experience with the industry#technically I'm working with disabled clients but also open to other sectors of residential care work if I do get another job#so if it's something that differs by sector please do let me know!#thanks so much#safety issues are for both me and the clients btw#this is not like “I'm afraid of the clients” in any way#it's about the fact that if something happened and I got hurt#I am the only staff in that whole house until morning#and there is MAYYYYYYYBE one client who is actually physically capable of calling for help#if I can't for whatever reason#also!!! this is an incredibly vulnerable client population with horrifyingly high abuse statistics!!#they should not be leaving someone they literally just hired completely alone with the clients every night for eight hours???#not gonna give more details for many obvious reasons#but like. just. no. don't do that. no.#in any residential care work facility imho but ESPECIALLY in this type of facility#also like if a client has a medical emergency#you're really gonna want both someone who can render aid AND someone who can call 911 and the on-calls and such#and yes the chaos and “surprises” around this job and scheduling is why I haven't been doing original posts lately#so answering also helps me get back to doing that sooner!

28 notes

·

View notes

Text

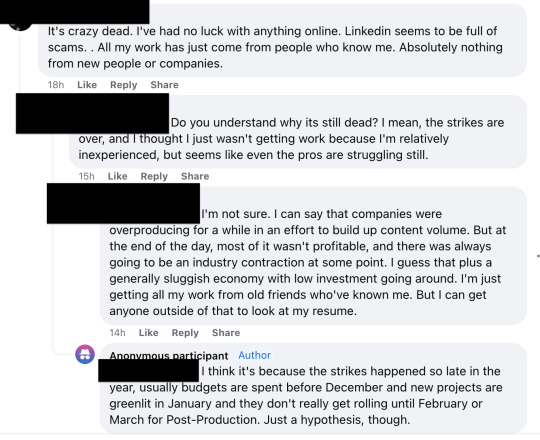

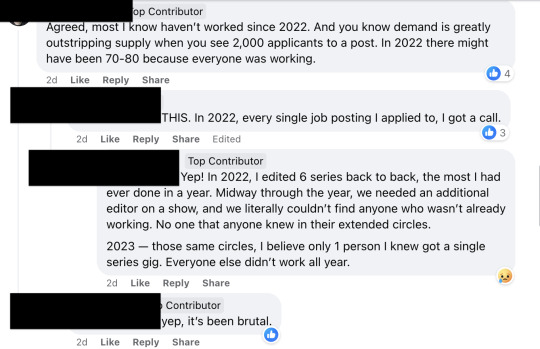

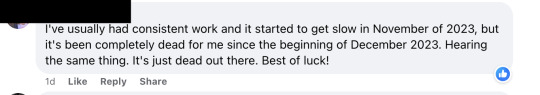

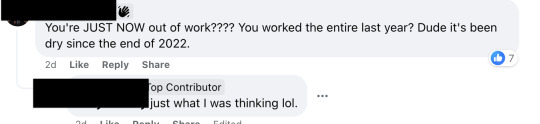

In case you were wondering where things are at in the film and television industry here's how post-production folks (editors, VFX, Colorists, etc) are doing. These screenshots are from The Blue Collar Post Collective's FB page (they are an International professional network for folks working in post).

This one is from a few months ago...

These are all from the past few days (from 2 separate Anon posts re "where to find jobs")...

My former post-supervisor really fucked me over and I've been unemployed for months. At this point I'm applying to jobs in grocery stores cause it's just dead dead dead out there. Winter is always the time of year you don't want to be without a film or series to work on but this just abysmal.

#Post-production#Film and Television#Unions and the strikes#documentary film and series#Movies#An assistant editor speaks#I work in the documentary sector which you would think wouldn't be affected by the strikes (for good and for worse)#but when the reality tv sector of the industry is doing bad then that means *everyone* is completely boned.#Also It's a reputation based industry#so 90% of the jobs I have had came from people cold emailing me ''Hey you came highly recommended from so&so. Are you available?"#And most years I'd get about a dozen of those emails a year with one of 'em usually resulting in a gig#not so this year😩

36 notes

·

View notes

Text

anyone working or knows people working in the corporate or IT sector, please contact (begging)

#corporate#corporate majdoor#IT#IT sector#IT industry#BTech#information technology#desi tag#desiblr#desi tumblr#desi dark academia#desi dukh#desi dads#desi daughter#desi drama#dissertation#psychology#project#research#desi#send help#help#meanslackofart#i'm beggin you

15 notes

·

View notes

Text

Finance and math-minded, anti-authoritarian, upper class and upper middle class (capable of more hastily breaking the classist glass ceiling), USAmerican women must pursue entry into U.S. Federal Reserve roles. The capability of USAmerican women and family units including girls to financially organize to leave the United States is likely to soon be materially, via indirect policy and "many decisions on individual case basis" of the Reserve, challenged. It is already, currently, fully legal for the Reserve to do so with complete confidentiality.

Gen Z and A USAmerican women from upper middle class to upper class backgrounds entering university, study finance and related subjects. Compete to and join your most prestigious financial student organizations, available internships and co-ops. Participate in data-oriented and finance-oriented hackathons.

Control of the U.S. dollar is already weaponized against you by the Reserve and by creditors. With alt-right (across wealth classes) flooding pollwork up to public offices, the public sector will be weaponized more strongly against you than it has been in decades.

Seizing of the Reserve by women must occur as rapidly as possible.

youtube

#radical feminists please touch#radical feminists please interact#radical feminist safe#radical feminist community#radical feminism#radical feminists do interact#radical feminists do touch#finance studyblr#finance studyspo#direct action#imperial core#reproductive control#sex industry#reproductive industry#special interest: global Northwestern finance sector dirt and impacts thereof

13 notes

·

View notes

Text

It can fly!

88 notes

·

View notes

Text

#fall#fujixpro2#photographersontumblr#lumberyard#industrial#business and industry sectors#pacific northwest#lumber

69 notes

·

View notes

Link

#brand safety-nsf oil negative#brand safety-nsf sensitive#business and industry sectors#business#economy and trade

48 notes

·

View notes

Link

Friendly reminder, we’re 9 bombs away from 90% of every USian dying

76 notes

·

View notes