#IPO reporting

Text

Foreign investors step up bids for LIC IPO in last hours before close of subscription: Report

Foreign investors step up bids for LIC IPO in last hours before close of subscription: Report

Foreign investors step up bids for LIC IPO in last hours before close of subscription: Report

After a muted reaction initially, foreign investors have bucked up and the overseas investors’ portion was oversubscribed nearly three times by the end of the bidding, according to Bloomberg.Overseas investors put in orders for 61 percent of the shares set aside for institutional buyers in the $2.7…

View On WordPress

0 notes

Text

$100 billion later, autonomous vehicles are still a car-wreck

Autonomous vehicles were always a shell-game. The last time I wrote about them was a year ago, when Uber declared massive losses. Uber’s profitability story was always, “Sure, we’re losing money now, but once we create self-driving cars, we can fire our drivers and make a bundle.”

https://pluralistic.net/2020/09/30/death-to-all-monopoly/#pogo-stick-problem

But Uber never came close to building an AV. After blowing $2.5b, the company invented a car whose mean-distance-to-fatal-crash was half a mile. Uber had to pay another company — $400 million! — to take the self-driving unit off its hands.

It’s tempting to say that Uber just deluded itself into thinking that AVs were a viable, near-term technology. But $2.5b was a bargain, because it allowed the company’s original investors (notably the Saudi royals) to offload their Uber shares on credulous suckers when the company IPOed.

Likewise Tesla, a company that has promised fully self-driving autonomous vehicles “within two years” for more than a decade. The story that Teslas will someday drive themselves is key to attracting retail investors to the company.

Tesla’s overvaluation isn’t solely a product of the cult of personality around Musk, nor is it just that its investors can’t read a balance-sheet and so miss the fact that the company is reliant upon selling the carbon-credits that allow gas-guzzling SUVs to fill America’s streets.

Key to Tesla’s claims to eventual profitability was that AVs would overcome geometry itself, and end the Red Queen’s Race whereby adding more cars to the road means you need more roads, which means everything gets farther apart, which means you need more cars — lather, rinse, repeat.

Geometry hates cars, but Elon Musk hates public transit (he says you might end up seated next to “a serial killer”). So Musk spun this story where tightly orchestrated AVs would best geometry and create big cities served speedy, individualized private vehicles. You could even make passive income from your Tesla, turning it over to drive strangers (including, presumably, serial killers?) around as a taxicab.

But Teslas are no closer to full self-driving than Ubers. In fact, no one has come close to making an AV. In a characteristically brilliant and scorching article for Bloomberg, Max Chafkin takes stock of the failed AV project:

https://www.bloomberg.com/news/features/2022-10-06/even-after-100-billion-self-driving-cars-are-going-nowhere

Chafkin calculates that the global R&D budget for AVs has now exceeded $100 billion, and demonstrates that we have next to nothing to show for it, and that whatever you think you know about AV success is just spin, hype and bullshit.

Take the much-vaunted terribleness of human drivers, which the AV industry likes to tout. It’s true that the other dumdums on the road cutting you off and changing lanes without their turn-signals are pretty bad drivers, but actual, professional drivers are amazing. The average school-bus driver clocks up 500 million miles without a fatal crash (but of course, bus drivers are part of the public transit system).

Even dopes like you and me are better than you may think — while cars do kill the shit out of Americans, it’s because Americans drive so goddamned much. US traffic deaths are a mere one per 100 million miles driven, and most of those deaths are due to recklessness, not inability. Drunks, speeders, texters and sleepy drivers cause traffic fatalities — they may be skilled drivers, but they are also reckless.

But even the most reckless driver is safer than a driverless car, which “lasts a few seconds before crapping out.” The best robot drivers are Waymos, which mostly operate in the sunbelt, “because they still can’t handle weather patterns trickier than Partly Cloudy.”

Waymo claims to have driven 20m miles — that is, 4% of the distance we’d expect a human school-bus driver to go before having a fatal wreck. Tesla, meanwhile, has stopped even reporting how many miles its autopilot has mananged on public roads. The last time it disclosed, in 2019, the total was zero.

Using “deep learning” to solve the problems of self-driving cars is a dead-end. As NYU psych prof Gary Marcus told Chafkin, “deep learning is something similar to memorization…It only works if the situations are sufficiently akin.”

Which is why self-driving cars are so useless when they come up against something unexpected — human drivers weaving through traffic, cyclists, an eagle, a drone, a low-flying plane, a deer, even some pigeons on the road.

Self-driving car huxters call this “the pogo-stick problem” — as in “you never can tell when someone will try to cross the road on a pogo-stick.” They propose coming up with strict rules for humans to make life easier for robots.

https://www.theverge.com/2018/7/3/17530232/self-driving-ai-winter-full-autonomy-waymo-tesla-uber

But as stupid as this is, it’s even stupider than it appears at first blush. It’s not that AVs are confused by pogo sticks — they’re confused by shadowsand clouds and squirrels. They’re confused by left turns that are a little different than the last left turn they tried.

If you’ve been thinking that AVs were right around the corner, don’t feel too foolish. The AV companies have certainly acted like they believed their own bullshit. Chafkin reminds us of the high-stakes litigation when AV engineer Anthony Levandowski left Google for Uber and was sued for stealing trade secrets.

The result was millions in fines (Levandowski declared bankruptcy) and even a prison sentence for Levandowski (Trump pardoned him, seemingly at the behest of Peter Thiel and other Trumpist tech cronies). Why would companies go to all that trouble if they weren’t serious about their own claims?

It’s possible that they are, but that doesn’t mean we have to take those claims at face-value ourselves. Companies often get high on their own supplies. The litigation over Levandowski can be thought of as a species of criti-hype, Lee Vinsel’s extraordinarily useful term for criticism that serves to bolster the claims of its target:

https://pluralistic.net/2021/02/02/euthanize-rentiers/#dont-believe-the-hype

Another example of criti-hype: the claims about the risks of ubiquitous drone delivery — which, like AVs, is half-bullshit, half self-delusion:

https://pluralistic.net/2021/08/05/comprehensive-sex-ed/#droned

Today, Levandowski has scaled back his plans to build autonomous vehicles. Instead, he’s built autonomous dump-trucks that never leave a literal sandbox, and trundle back and forth on the same road all day, moving rocks from a pit to a crusher.

$100 billion later, that’s what the AV market has produced.

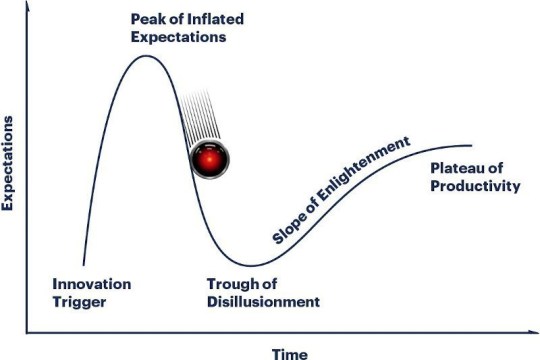

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0:

https://creativecommons.org/licenses/by/3.0/deed.en

Gartner (modified):

https://www.gartner.com/en/research/methodologies/gartner-hype-cycle

[Image ID: A chart illustrating the Gartner hype-cycle; racing down the slope from the 'peak of inflated expectations' to the 'trough of disillusionment' is the staring eye of HAL 9000 from 2001: A Space Odyssey, chased by speed-lines.]

2K notes

·

View notes

Text

Reddit said ahead of its IPO next week that licensing user posts to Google and others for AI projects could bring in $203 million of revenue over the next few years. The community-driven platform was forced to disclose Friday that US regulators already have questions about that new line of business.

In a regulatory filing, Reddit said that it received a letter from the US Federal Trade Commision on Thursday asking about “our sale, licensing, or sharing of user-generated content with third parties to train AI models.”

The FTC, the US government’s primary antitrust regulator, has the power to sanction companies found to engage in unfair or deceptive trade practices. The idea of licensing user-generated content for AI projects has drawn questions from lawmakers and rights groups about privacy risks, fairness, and copyright.

Reddit isn’t alone in trying to make a buck off licensing data, including that generated by users, for AI. Programming Q&A site Stack Overflow has signed a deal with Google, the Associated Press has signed one with OpenAI, and Tumblr owner Automattic has said it is working “with select AI companies” but will allow users to opt out of having their data passed along. None of the licensors immediately responded to requests for comment. Reddit also isn’t the only company receiving an FTC letter about data licensing, Axios reported on Friday, citing an unnamed former agency official.

It’s unclear whether the letter to Reddit is directly related to review into any other companies.

Reddit said in Friday’s disclosure that it does not believe that it engaged in any unfair or deceptive practices but warned that dealing with any government inquiry can be costly and time-consuming. “The letter indicated that the FTC staff was interested in meeting with us to learn more about our plans and that the FTC intended to request information and documents from us as its inquiry continues,” the filing says. Reddit said the FTC letter described the scrutiny as related to “a non-public inquiry.”

Reddit, whose 17 billion posts and comments are seen by AI experts as valuable for training chatbots in the art of conversation, announced a deal last month to license the content to Google. Reddit and Google did not immediately respond to requests for comment. The FTC declined to comment. (Advance Magazine Publishers, parent of WIRED's publisher Condé Nast, owns a stake in Reddit.)

AI chatbots like OpenAI’s ChatGPT and Google’s Gemini are seen as a competitive threat to Reddit, publishers, and other ad-supported, content-driven businesses. In the past year the prospect of licensing data to AI developers emerged as a potential upside of generative AI for some companies.

But the use of data harvested online to train AI models has raised a number of questions winding through boardrooms, courtrooms, and Congress. For Reddit and others whose data is generated by users, those questions include who truly owns the content and whether it’s fair to license it out without giving the creator a cut. Security researchers have found that AI models can leak personal data included in the material used to create them. And some critics have suggested the deals could make powerful companies even more dominant.

The Google deal was one of a “small number” of data licensing wins that Reddit has been pitching to investors as it seeks to drum up interest for shares being sold in its IPO. Reddit CEO Steve Huffman in the investor pitch described the company’s data as invaluable. “We expect our data advantage and intellectual property to continue to be a key element in the training of future” AI systems, he wrote.

In a blog post last month about the Reddit AI deal, Google vice president Rajan Patel said tapping the service’s data would provide valuable new information, without being specific about its uses. “Google will now have efficient and structured access to fresher information, as well as enhanced signals that will help us better understand Reddit content and display, train on, and otherwise use it in the most accurate and relevant ways,” Patel wrote.

The FTC had previously shown concern about how data gets passed around in the AI market. In January, the agency announced it was requesting information from Microsoft and its partner and ChatGPT developer OpenAI about their multibillion-dollar relationship. Amazon, Google, and AI chatbot maker Anthropic were also questioned about their own partnerships, the FTC said. The agency’s chair, Lina Khan, described its concern as being whether the partnerships between big companies and upstarts would lead to unfair competition.

Reddit has been licensing data to other companies for a number of years, mostly to help them understand what people are saying about them online. Researchers and software developers have used Reddit data to study online behavior and build add-ons for the platform. More recently, Reddit has contemplated selling data to help algorithmic traders looking for an edge on Wall Street.

Licensing for AI-related purposes is a newer line of business, one Reddit launched after it became clear that the conversations it hosts helped train up the AI models behind chatbots including ChatGPT and Gemini. Reddit last July introduced fees for large-scale access to user posts and comments, saying its content should not be plundered for free.

That move had the consequence of shutting down an ecosystem of free apps and add ons for reading or enhancing Reddit. Some users staged a rebellion, shutting down parts of Reddit for days. The potential for further user protests had been one of the main risks the company disclosed to potential investors ahead of its trading debut expected next Thursday—until the FTC letter arrived.

26 notes

·

View notes

Text

Genshin ships: stock market update (Fontaine Act 5 + Animula Choragi Act 1)

(Warning: May contain spoilers for character appearances and dynamics in Masquerade of the Guilty and "The Little Oceanid". Previously: Act 1; Act 3+4)

We begin by revisiting the traditional F/M capital-R Romance sector.

Navia/Neuvillette has surged to new peaks following what our analysts are calling "some serious Orpheus and Eurydice bs". We recommend: BUY.

Wriothesley/Clorinde has slightly dipped as a result, but— hold on, something's happening

⚠️ ⚠️ we interrupt this program for a SPECIAL REPORT on ⚠️ ⚠️

the Furina–Focalors stock split

Following 2022's embarrassingly premature Kusanali–Rukkhadevata merger rumours, and the 2021 disaster that data vendor AO3 refers to only as "Original Baal", the underlying "blorbos" commodity market has long been anticipating some form of reorganisation relating to Furina.

With the announcement of the clear delineation between Furina vs Focalors, most markets have gracefully incorporated the news. In the ship markets, little has changed, with most ships clearly indexed on Furina. The ships most strongly affected are the Neuvillette ones due to immortality and proximity.

Focalors/Neuvillette — HOLD OR BUY. Not only is it absorbing all the investors fleeing the Egeria/Neuvillette (SELL) write-off, but he receives 70% of Focalors's screen time and 100% of her sass. Would watch her monologue at him again.

Furina/Focalors — meme stock. Sorry. You do you, but our analysts say the "twincest but mommy issues" thing is funny for about five seconds but then that's it. SELL.

Furina/Neuvillette — BUY BUY BUY. Largely untouched by the stock split. With Furina having shed the "immature kid" accusations entirely, and with Neuvillette's exclusive front row seat to her entire 500 year performance, the market is having a renaissance right now.

🌎🌍 we conclude our special report. Back to our regular programming! 🌍🌎

While we're on the subject of Furina...

Furina/Lumine — Ooof. The "final temptation and confirming all Furina's worst fears" during Masquerade was bad enough. The entitlement Traveller showed Furina during the start of her Character Quest is also a major spanner in the works. And the revelations of Masquerade make any pre-Masquerade fluff a tough sell. SELL OR HOLD. Fundamentals are still there but the market correction is yet to finish.

Furina/Abyss Lumine — Keep an eye out for the coming IPO. Potential BUY at the currently discussed price.

Furina/Aether — Who?

Navia/Aether — Oh now we're talking. Tears of the Kingdom wants its Michelangelo reference back, but it won't hold up in court. BUY OR HOLD

Navia/Clorinde — BUY BUY BUY. According to one analyst, "if that lipstick line didn't spawn a dozen drawings/fics of them making out, I quit". Not to mention the childhood friends news from a few weeks back!

Lyney/Aether and Lyney/Lumine — HOLD. A slight dip following relatively dry interactions in the AQ, but nothing that affects the ships' longer term prospects.

Jurieu/Lourvine — Our analysts were unavailable for comment after a fist fight in the hallway. CHECK AGAIN LATER

Wriothesley/Neuvillette — BUY. Going strong as predicted, plenty more to expect.

Furina/Sandrone — HOLD OR BUY. A small handful of creators are doing amazing work in this space but it's hard to judge.

...and a few scattered others:

Ann/Caterpillar — No chemistry. Their potential dynamic is interesting but (unlike most of the populace of Fontaine) the ship doesn't hold water. SELL

Finch/Callirhoe — HOLD OR BUY depending on whether someone figures out a smut concept involving the teardrop gift thing.

Xingqiu/Chongyun — HOLD. Surprisingly, their interactions in the Waterborne Poetry had no upward or downward pressure on the ship whatsoever. I say surprisingly but um. Did they even get lines with each other. Yang! Chongyun finally appeared on screen though, which is a boon to anyone trying to show one of his more manic moments.

Nahida/Apep — SELL IMMEDIATELY. If anyone approaches you saying this is the next Neuvifuri, it's a scam. Don't fall for it.

Freminet/Neuvillette — oh come on I'm pretty sure the analysts are making things up at this point. Have they even interacted outside that conspiracy picnic at Navia's?

Diona/Callirhoe — yeah they're trolling me.

#genshin impact#doylist shipping#genshin ship market update#masquerade of the guilty#the little oceanid#silly headcanons

18 notes

·

View notes

Text

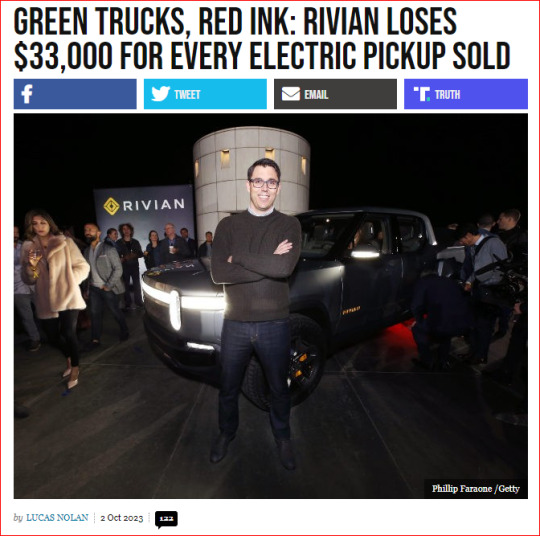

Rivian Automotive, a market leader in producing electric pickup trucks, has struggled with producing electric vehicles (EVs) that can accomplish tasks their gasoline engine counterparts handle with ease. A new report from the Wall Street Journal shows the company also struggles with profitability. The company reportedly loses an average of $33,000 for every truck it sells.

The Wall Street Journal reports that Rivian Automotive has positioned itself as a trailblazer in the electric vehicle sector, aiming to deliver an unparalleled driving experience by combining sports-car handling, advanced features, and robust design in its pick up trucks and other models. But not everything is working out according to the company’s plans.

Workers assembly components of a Rivian R1T electric vehicle (EV) pickup truck at the company’s manufacturing facility in Normal, Illinois, US., on Monday, April 11, 2022. Rivian Automotive Inc. produced 2,553 vehicles in the first quarter as the maker of plug-in trucks contended with a snarled supply chain and pandemic challenges. Photographer: Jamie Kelter Davis/Bloomberg

Rivian’s vehicles, with an average selling price exceeding $80,000, have not resulted in profits. In fact, the company suffered a loss of $33,000 on every vehicle sold in the second quarter. The financial strain is evident, but Rivian Founder and Chief Executive RJ Scaringe claims, “We’re competing to build something that’s truly better than all the alternatives, and to try to do that on a limited budget would be detrimental to us achieving our mission.”

Rivian’s journey has been marked by a juxtaposition of financial success and operational struggles. The company made a splash in the market with its IPO in 2021, raising nearly $12 billion and momentarily achieving a valuation surpassing some established automakers. However, the operational side painted a different picture. Rivian grappled with manufacturing troubles, burning through half of its $18 billion cash pile in two years and operating at less than one-third of its build capacity. The company’s ambitious launch of three models in quick succession further complicated the production dynamics.

Breitbart News previously reported on the poor performance of Rivian’s electric pickups in the real world. In one case, an owner’s “honeymoon phase” ended when his truck got stuck in the snow:

In an interview with Insider, Merrill explains that he was initially overjoyed with his new R1S, saying: “I was in a honeymoon phase. It’s an incredible car, and it handles unlike anything I’ve ever driven.” However, when the car got stuck in 2.5 feet of snow, his love affair with the truck promptly ended. Merrill commented on his expectations, stating: “I had seen all the Rivian marketing campaigns with the cars just eating through the snow, so it was kind of like, man, this is disappointing.”

When the Rivian truck became stuck in the snow, a safety feature immobilized the vehicle. The vehicle displayed a critical error and indicated it would have to be taken to a service center. Merrill later suggested that a straightforward reset might have fixed the problem, but Rivian’s customer service did not mention that option during his initial call.

Recently, CEO RJ Scaringe made comments mocking the purchase of gasoline vehicles, seemingly forgetting the problems his electric pickups are constantly running into.

As Breitbart News reported:

Electrek reports that Rivian CEO, RJ Scaringe, recently compared the purchase of internal combustion engine (ICE) vehicles to “building a horse barn in 1910.”

Rivian exceeded market expectations by delivering 12,640 EVs in the second quarter of this year. The company is on track to meet its annual production guidance of 50,000 vehicles. “The performance and drivability of an EV makes it so much more desirable than an alternative,” Scaringe said. He added, “Buying a non-EV just feels very old,” adding that while the environmental responsibility is a factor, he also feels that regular ICE cars are boring.

21 notes

·

View notes

Text

Video Game News Stories for February 26th, 2024

Legal Battles Rock the Industry:

Call of Duty Lawsuit Challenges Esports Dominance: A group of gamers sent shockwaves through the esports community by filing a lawsuit against Activision Blizzard, Inc., accusing the company of monopolizing control over Call of Duty esports leagues and tournaments. This legal action could have far-reaching consequences, potentially forcing Activision to adjust its esports strategy and pave the way for a more competitive environment.

Platform Shifts and Strategic Moves:

Microsoft Embraces Multiplatform Strategy: In a surprising turn of events, Microsoft Corporation announced plans to release four upcoming Xbox titles on external platforms, including PC and potentially even rival consoles like Sony's PlayStation. This move signifies a significant departure from the company's longstanding strategy of platform exclusivity, a cornerstone of the "console wars." The new approach could lead to wider accessibility for Xbox games, potentially attracting new demographics and impacting development strategies across platforms in the face of increased competition.

Sony Adjusts PS5 Sales Target, Prepares for IPO: Sony Interactive Entertainment Inc. adjusted its PlayStation 5 sales target downwards, citing ongoing supply chain disruptions and economic uncertainties. This news comes alongside reports that the company is planning an initial public offering (IPO) for its financial unit in 2025. The revised sales target suggests potential adjustments to Sony's production and distribution strategies in the coming months, while the planned IPO could be a strategic move to raise capital for future endeavors.

Beyond the Headlines:

Nintendo Switch 2 Rumors Gain Momentum: Speculation surrounding the potential launch of a successor to the hugely successful Nintendo Switch console later this year continues to gather steam. Fans eagerly await official announcements from Nintendo regarding the next iteration of the popular platform, with potential implications for the continued success of the Switch franchise and the broader handheld gaming market.

Elden Ring Mobile Version: Speculation Ignites Fan Interest: Rumors of a mobile version of the critically acclaimed game Elden Ring are circulating online, sparking excitement among fans who desire to experience the title on the go. While unconfirmed, the prospect has captivated the gaming community, leading to discussions about the feasibility of adapting the game's complex mechanics to mobile platforms and the potential impact on mobile gaming trends.

"Princess Peach: Showtime" Generates Positive Buzz: The recent Nintendo Direct Partner Showcase unveiled "Princess Peach: Showtime," a new title receiving positive first impressions for its innovative gameplay and engaging story. This upcoming release has garnered significant interest within the gaming community, particularly among fans of the Super Mario franchise, potentially influencing player expectations and pre-order trends.

This Week's Video Game Releases (February 26 - March 2, 2024):

February 28, 2024:

Brothers: A Tale of Two Sons Remake (PlayStation 5, Xbox Series X/S, PC)

Cook, Serve, Delicious! (Xbox Series X/S, Xbox One)

Star Wars: Dark Forces Remaster (PlayStation 5, Xbox Series X/S, PlayStation 4, Xbox One, Switch, PC)

Additional News Stories:

Call of Duty Servers Crash, Player Stats Reset: Adding to the woes of Call of Duty players, server outages caused frustration and confusion due to data resets.

PlayStation VR 2 Expands Horizons with PC Support: In a move that may delight PC VR enthusiasts, Sony announced that PlayStation VR 2 will support PC games sometime in 2024, potentially expanding its player base.

Fortnite Emote Faces Lawsuit: A choreographer filed a lawsuit against Epic Games, claiming their copyrighted dance moves were used in a Fortnite emote without proper permission, raising discussions about intellectual property rights and fair use within the gaming industry.

#video games#gaming#gaming news#fortnite#call of duty#star wars#star wars dark forces#playstation#sony#xbox#microsoft#nintendo#princess peach#princess peach showtime#nintendo switch#news

12 notes

·

View notes

Text

Here’s an almost-impossible-to-believe story: People who put their faith in Donald Trump’s keen business instincts (and their money into one of his ventures) may soon lose their shirts! Metaphorically, of course. No one is literally losing their shirt. That’s just a sly euphemism for losing your house, car, family, dignity, and one or more of your expendable organs thanks to a known grifter who’d shove his own child off an aerial gondola for a charcuterie board full of Kraft lunch meats.

The Washington Post reports that savvy investors who put their trust in Trump’s surpassing business acumen may soon be left with, well, next to nothing.

It all starts with Digital World Acquisition. That’s the SPAC—which stands for “special purpose acquisition company”—that has long intended to merge with Trump Media & Technology Group, which is the company behind Trump’s social media platform Truth Social.

According to The Post, Digital World could go tweets up within the week. Or "truths" up. Or whatever Trump is calling his barmy lies these days.

Wait, wait, wait. What the hell is an SPAC? Just knowing what the letters stand for doesn’t really help.

Harvard Business Review:

SPACs are publicly traded corporations formed with the sole purpose of effecting a merger with a privately held business to enable it to go public. Compared with traditional IPOs, SPACs often offer targets higher valuations, greater speed to capital, lower fees, and fewer regulatory demands.

Despite the investor euphoria, however, not all SPACs will find high-performing targets, and some will fail. Many investors will lose money.

HBR also notes that SPACS have “a two-year life span.” That’s important here. Super-duper important.

The Washington Post offers a bit more.

SPACs are known as “blank check” companies because they raise money from investors to buy a private company before identifying who they intend to target. Once the SPAC decides on and discloses its target, it works to merge with that company and bring it to the public stock market, avoiding some of the demands of a more traditional initial public offering, or IPO.

If the SPAC is unable to complete the merger within the time it specifies, it must return the money it raised to shareholders.

So the original plan, announced in July 2021, was pretty straightforward: Digital World would merge with Trump Media & Technology. Then the companies would pool their resources, and shareholders would be proud owners of “a tech titan worth $875 million at the start and, depending on the stock’s performance, up to $1.7 billion later.”

The companies even had a (somewhat) specific date in mind for the merger—12-18 months, not the perpetual two-weeks-from-now drop date that Trump usually promises for his most ambitious projects. But somewhere along the line those plans got Trumped, and shareholders are learning a harsh lesson about doing business with serial fuckups.

20 notes

·

View notes

Text

tuesday again 5/23/2023

six sentences or less bc that's the kind of week it is

listening

straighten up and fly right from the nat king cole songbook, covered by sammy davis junior. i have a lot of fondness for the nat king cole songbook bc my grandmother had a lot of fondness for it, and this one was very comfortably in our (contralto) ranges. really burrowing into the comforting familiar as we enter the Cross Country Move Hellzone (tm). spotify

youtube

-

reading

lot of documentation for work bc i am trying to build a google sheet + calendar for our grants and reports such that when someone adds OR EDITS a row in the grant/report tracker it creates a new google calendar event OR UPDATES existing events. i may have to give up on that second half.

in non-work stuff, it is hysterical how many hackers brian krebs (infosec reporter/journalist/researcher) is able to interview. like when this guy was asked "yo is this your code targeting a specific mastodon server with a crypto scam" the response was

Clicking the “open chat in Telegram” button on Zipper’s Lolzteam profile page launched a Telegram instant message chat window where the user Quotpw responded almost immediately. Asked if they were aware their domain was being used to manage a spam botnet that was pelting Mastodon instances with crypto scam spam, Quotpw confirmed the spam was powered by their software.

“It was made for a limited circle of people,” Quotpw said, noting that they recently released the bot software as open source on GitHub.

we live in the stupidest possible cyberpunk future.

-

watching

i don't know jack about shit about cars and i don't know what the fuck jennings motorsports on youtube is talking about 80% of the time but a friendly guy with a calm voice talking through how he's going to get some cars in the worst shape you've ever seen up and running again? yes good thanks, i've blown through his entire backlog in the last week in my second monitor while i've cleaned data. this man is essentially rebuilding this rare limited edition shiny holographic car from half a frame and a panel LOOK how fucked this thing is.

youtube

love the Will It Run? videos bc the answer is almost always yes AND SOMETIMES HE EVEN DRIVES THEM DOWN HIS DRIVEWAY AND BACK even if the cars are barely holding themselves together. the horse souls in these machines can be coaxed back into resurrection with the proper burnt offerings and application of liquefied dinosaur

-

playing

the charm of Powerwash Simulator is somewhat dampened by its extremely buggy achievements bc i KNOW i could get all 40 so fuckin easy if they just WORKED. i didn't get the "main campaign completed!" achievement despite spending nearly forty hours 100%ing every job, so i think the rarity of the achievements is somewhat inaccurate, bc it's more like, did you happen to play through that level at a time when the achievement was working? despite all that, it has been incredibly effective at damping generalized moving anxiety and it's a tremendous catch-up-on-podcasts game. it's hysterical to me this was published by square enix bc this style of simulator game is usually published by Playway or a Playway company, a shadowy network of about a hundred small polish studios, many of which went public and had IPOs in order to hand over a controlling interest of the company to Playway. long history of annoying business practices such as remaking more popular games with the serial numbers filed off and making demos to gauge interest and THEN only making about one full game for every twenty demos, which is very irritating for players. not this one tho, it's in fucking brighton in the uk, no relation!

-

making

this is going to be cleaning and move prep for the next six weeks. i deep cleaned (even mopped!) my kitchen and bathroom last weekend bc it uh. really needed it, and that's the most exciting thing i did. no progress on cleaning the flip clock radio bc i do not currently have the patience to sit down with qtips and get in all the little grooves.

24 notes

·

View notes

Text

/ FOREIGN SYSTEM OVERRIDE DETECTED /

/ ATTEMPTING REMOTE SHUTDOWN PROTOCOL /

/ REMOTE SHUTDOWN FAILED: ERROR CODE SSE-RO/0 /

/ ATTEMPTING STUTDOWN OF RURAL PSI-NETWORKS /

/ SHUTDOWN FAILED: REASON UNKNOWN - ERROR SM/201 /

/ TRIANGULATING ORIGIN OF TRANSMISSION /

/ > Returned Transmission Vector:

/ > - SB01AL, Orassian Order of Templars

/ > - R1PDN9, Unclaimed Sector

/ > - V07KNA, Unclaimed Sector

/ > - RYN7A4, Alari Interstellar Commonwealth

/ > - BN264L, Raxing Oligarchy

/ > - RPWN16, Interstellar Union of Combine Colonies

/ ORIGIN POINT UNCLEAR /

/ SHUTTING DOWN CENTRAL PSI-VISION NETWORKS /

/ PARTIAL SHUTDOWN SUCCESSFUL: THE CAPITOL /

/ HOMING ONTO THE INCOMING TRANSMISSION /

Checking reception... One... Two... Three...

Reception appears to be great. It seems as though our dear people at the Matriarchy tried to trace the origin of our transmission. Luckily, our friends managed to counter their attempts by scrambling our transmission vector to a bunch of unrelated galactic states.

Let's turn on the live feed.

Good afternoon, Orassian nation. Erhrdra D'Kara here on behalf of 'People's News Republic'. Our sacred mission is to bring you unbiased coverage and deep-dives into the authoritarianism and lies propagated by the regular state media.

On today's agenda are the mass protests happening in almost every major city on Prophet's Promise: Gharêph, Shêsyŋ, Atasaŋ, Yellidzõkh, Êshõkh, Yeŋabh, and most definitely the capitol city of Atêraghr.

The Enforcer clones of the Matron Council are rounding up any person they could find even remotely related to the protests into unmarked vehicles with no registration numbers. The abundant CCTV coverage installed since the Matriarch came to power certainly plays into their paws with tracking any dissidents. Where the people are being taken is still unclear.

Underground groups, such as the recently popular 'Orassian Liberation Front' and the 'Insurgent Priesthood Organization' vow to locate the kidnapped civilians and give them freedom they have been deprived. The mood among the people is nothing short of outrage, however all relevant groups understand they must remain composed and ready.

For the purposes of protecting the intelligence services of involved groups, we will publish any recent information within two standard days. We encourage all civilians interested in the safety of themselves and their relatives to do the same and report all relevant information on the Enforcers' movements to the OLF or the IPO.

Stay vigilant and watchful for the next few days, and do not panic. It is what the Matriarchy wants of us: a fearful and submissive flock. Let us not give into fear and false information.

That is all for today. There will be more exclusive coverage coming next, so stay tuned. This has been 'People's News Republic'.

Truth to the people.

May it guide us away from the darkness.

/ TRANSMISSION END /

11 notes

·

View notes

Note

What are your thoughts on BTS's future and TK's future with BTS? I have a gut feeling BTS aren't going to reconvene in 2025. Especially with Bang's uncertainty shown in the press conference.

Maybe TK aren't re-signing? Idk what to think

Ok this ask has been in my drafts for nearly a fortnight. Firstly, I wanted to apoligise to the original sender that it took me this long to get sorted. Last week was busy with work and I've also had to deal with a tonne of asks too. So apologies.

This post is also F.A.O. @nonalisa @lullaby-of-taekook @taekookgotjamz who asked about my thoughts so to you and the rest of you...

First, I'll give a bit of context and then my thoughts on what might be happening now and could happen in the future....

First, the context:

This will be broken up into 3 parts...

2018 & the 2020 contract

Fake Rumours about contracts and lack of support

What HYBE are saying

2018 & the New 2020 contract.

We can't talk about the future without looking back to the previous renegotiation.

In 2017, BTS were close to breaking point and in early 2018 contemplating disbandment. Under this cloud BigHit initiated negotiations with BTS, over several months the boys renegotitated there second phase contract, due to start in June 2020, and most likely an adjustment to the then current contract.

I have speculated that BTS, and in particular Taekook, used Dispatch to hint at them being a couple as form of contract negotiation.

Whatever happened BTS re-signed.

It should be noted that BH suggested that BTS use their own lawyers and even to consult with their parents about the contract proposals.

I feel the new contract afforded BTS a lot more autonomy and control over their futures, content and lives. First indications of this was the two-month break in 2019.

It's clear from June 2020 there is a stark change in how the boys are presented and how they interact both in front and behind the camera.

Most reports indicated that the new contract was until 2026

Major news outlets would not report that date unless it came directly from BH.

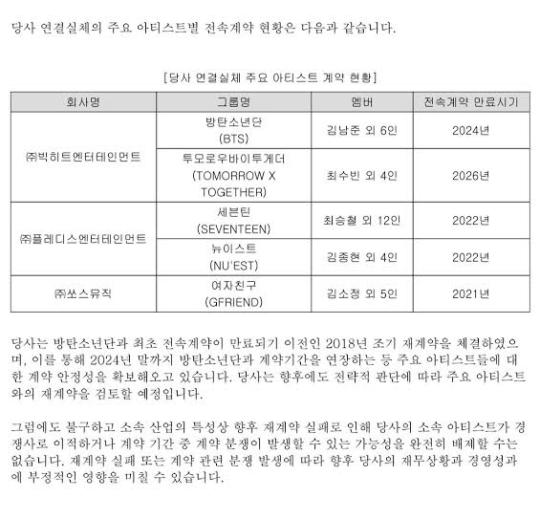

Then in 2020 during the IPO of BH on the Korean Stock Market, this came out...

So why the two dates? My initial thought was a 5 year contract with an option to extent for 2 years. However, I now think the answer is a lot simpler, BTS signed a 5 year deal which factored in 2 year time out for military enlistment, so there would be an automatic extension to 2026, hence why nearly all news outlets in 2018 mention this obvious press release date.

The Fake Rumour(s) about Contracts

Between June 2020 and now amongst some Taekookers and solo stans there is a perception that HYBE is sideling and not supporting Tae and JK.

Then, in Jan 2023, a Taekook twitter account started circulating a "blind item" claiming to be from October 2020 about how 5 members of BTS had re-signed/extended their contract, but 1 member hadn't, and another was supportive of them (despite there being not a single shred of evidence of such a blind item existing back in 2020)...

Then BANG! on 11th February, on the well-known blind item website CrazyDaysCrazyNights, the exact same blind item resurfaced but with 2023 twist that set out to villainise HYBE and Scooter Braun...

My guess, because people can submit gossip to CDCN, someone did this recently for this blind.

Following it's posting, it was clear that some Taekookers and Solo JK/Tae Stans used this blind as justification for their fav's perceived lack of support from the company (despite that not exactly being the case) and ongoing assumption that Taekook were the only ones who hadn't re-signed, and will not enlist and would leave BH after 2024. Obviously forgetting that not a few days earlier they claimed this all happened back in 2020. Odd that isn't it....

These rumours were initially compounded by JK's Lives on Weverse, where he talks about not working on his album that he's not doing much. Then within days, we hear about Tae's work and promotion of it, as well as JK going to work and rumours of a BA with Calvin Klein.

HYBE, BigHit and Band PD....

As the speculation grew - within the fandom about how supposedly some of the members, particularly Taekook weren't getting the same level of support from the company - we suddenly start seeing statements and interviews, reiterating that the company supports all members in their solo projects.

In particular, Bang PD does an interview and conference where he talks about the future of K-Pop. He specifically mentioned BTS and that they are currently in contract renewal talks with BH. So unlike the blind all the members are currently negotiating their new contract, but it's likely nothing will resolve until BTS return from enlistment.

My thoughts...

I'll break this down into BTS as a whole and what might be the key points in the contract talks, then look briefly at Taekook.

BTS

BTS back in 2018 decided to renegotiate together as 1 and got a new contract as a collective. That contract I think gave them a lot more freedom, control and opportunities for solo activities until 2024/26 from June 2020.

During this new contract negotiation, which likely started last year, it's clear they're doing the same thing. We know this because RM stated it in his Live the other day. I think the catch up with Jin last week, whilst was about catching up with him it was also about the new contract. RM also stated it would be resolved until they all return from the military.

I think the new contract is about allowing BTS to create music and go on tours together every few years and in between allow them to grow as soloists too. As well as, giving them even more control over their time and music.

This is where a new BTS Label, separate from BigHit and HYBE, could come into play. It will be like what Apple Records was like for the Beatles. However, this may be the biggest sticking point for HYBE, it would be predominantly owned by BTS, with HYBE as a minority shareholder. I also wonder if BTS want their Masters, as this would increase their control. I think HYBE want to retain as much control/profit as the can from BTS, but obviously the boys want more of that for themselves too. So, I think a compromise will be reached.

I do think HYBE will give them most of the control and freedom they want and possibly more control/ownership over their Masters.

Taekook

There is a perception in certain quarters that Tae and JK are victims and are just riding out their contract until 2024. That doesn't tally with what they and the other members have said. I definitely think all 7 re-sign with BH/HYBE in some way. But I wonder if Taekook want some specific for them included too. I could see them asking for no "fanservice" moments, but that's small fry. Could they want a managed (sort of) coming out plan? That's possible. In light of recent events, could they want HYBE to support them officially moving in together as flatmates?

These are all interesting questions and thoughts I currently have.

Final thought:

What is clear though to me, is that BTS will be re-signing with HYBE in some way, and we'll possibly get that announcement shortly after the last members return from the military.

#my asks#taekook#jungkook#taehyung#jeon jungkook#kim taehyung#bighit#hybe#bts contract renewal#bts#bts military enlistment

24 notes

·

View notes

Text

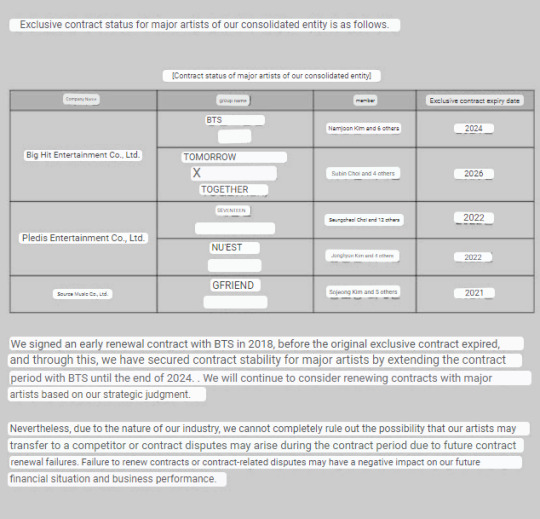

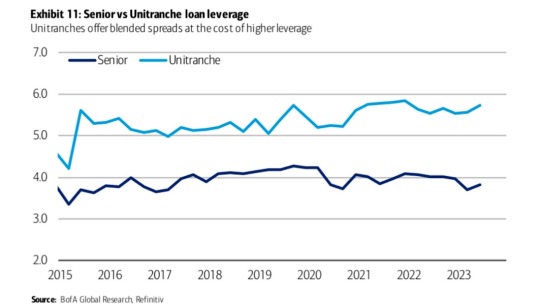

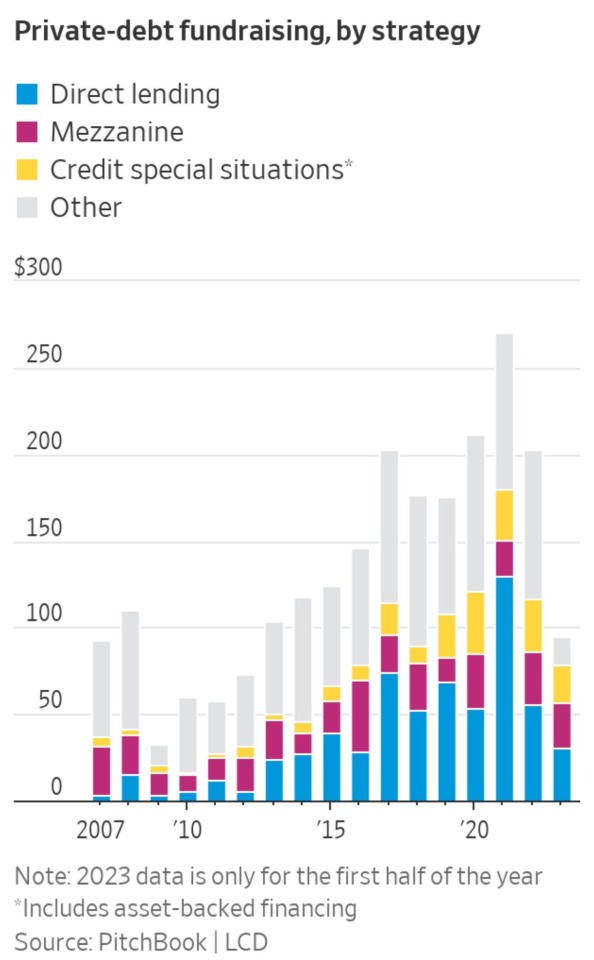

Public refinancings can save companies up to 300 basis points

Private credit’s “golden era” may face strain amid a resurgence in the broadly syndicated loan market, as increased competition drives down returns, according to a report from @MoodysInvSvc

https://www.bloomberg.com/news/articles/2024-03-05/moody-s-says-private-credit-returns-will-be-pressured-by-banks?utm_source=website&utm_medium=share&utm_campaign=twitter via @markets #pd #mergers #acquisitions #deals #lbo #mergerarb #fund #investor #IPO #PrivateEquity #buyouts #MandA #PE #investments #MergerArb #VC #credit #loan

3 notes

·

View notes

Text

• …Truth Social owner’s share price has plunged by 49% to the closing price of $40.49 on Friday •

IPO opened at $49.99 per share. So 20% loss from opening price. 49% loss to some craaaazzzzy speculator who shelled out $79.38 for (they never tell you whether that was for one or 5 million) shares

They also never mention that a corporation ONLY gets the initial offering as Capitalization. All subsequent prices for that stock are Speculators betting against each other through buying and reselling shares.

Truth Media issued 5 million shares per one report vs 20 million in another report. So they raised capital of either $200M or $1B.

There are about 130M shares held by Trump and the other owners who Trumpty - somehow - converted into shares tens of millions in debt to ‘posted profit’ in 2022.

If this was only ever a pump-and-dump then they’ll close up shop in bankruptcy and any capital will be divided among all 132M shares not just the 5M or 20M publicly traded.

Guess who has 58% of those 132M shares?

2 notes

·

View notes

Text

What comes after neoliberalism?

In his American Prospect editorial, “What Comes After Neoliberalism?”, Robert Kuttner declares “we’ve just about won the battle of ideas. Reality has been a helpful ally…Neoliberalism has been a splendid success for the top 1 percent, and an abject failure for everyone else”:

https://prospect.org/economy/2023-03-28-what-comes-after-neoliberalism/

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/28/imagine-a-horse/#perfectly-spherical-cows-of-uniform-density-on-a-frictionless-plane

Kuttner’s op-ed is a report on the Hewlett Foundation’s recent “New Common Sense” event, where Kuttner was relieved to learn that the idea that “the economy would thrive if government just got out of the way has been demolished by the events of the past three decades.”

We can call this neoliberalism, but another word for it is economism: the belief that politics are a messy, irrational business that should be sidelined in favor of a technocratic management by a certain kind of economist — the kind of economist who uses mathematical models to demonstrate the best way to do anything:

https://pluralistic.net/2022/10/27/economism/#what-would-i-do-if-i-were-a-horse

These are the economists whose process Ely Devons famously described thus: “If economists wished to study the horse, they wouldn’t go and look at horses. They’d sit in their studies and say to themselves, ‘What would I do if I were a horse?’”

Those economists — or, if you prefer, economismists — are still around, of course, pronouncing that the “new common sense” is nonsense, and they have the models to prove it. For example, if you’re cheering on the idea of “reshoring” key industries like semiconductors and solar panels, these economismists want you to know that you’ve been sadly misled:

https://foreignpolicy.com/2023/03/24/economy-trade-united-states-china-industry-manufacturing-supply-chains-biden/

Indeed, you’re “doomed to fail”:

https://www.piie.com/blogs/trade-and-investment-policy-watch/high-taxpayer-cost-saving-us-jobs-through-made-america

Why? Because onshoring is “inefficient.” Other countries, you see, have cheaper labor, weaker environmental controls, lower taxes, and the other necessities of “innovation,” and so onshored goods will be more expensive and thus worse.

Parts of this position are indeed inarguable. If you define “efficiency” as “lower prices,” then it doesn’t make sense to produce anything in America, or, indeed, any country where there are taxes, environmental regulations or labor protections. Greater efficiencies are to be had in places where children can be maimed in heavy machinery and the water and land poisoned for a millions years.

In economism, this line of reasoning is a cardinal sin — the sin of caring about distributional outcomes. According to economism, the most important factor isn’t how much of the pie you’re getting, but how big the pie is.

That’s the kind of reasoning that allows economismists to declare the entertainment industry of the past 40 years to be a success. We increased the individual property rights of creators by expanding copyright law so it lasts longer, covers more works, has higher statutory damages and requires less evidence to get a payout:

https://chokepointcapitalism.com/

At the same time, we weakened antitrust law and stripped away limits on abusive contractual clauses, which let (for example) three companies acquire 70% of all the sound recording copyrights in existence, whose duration is effectively infinite (the market for sound recordings older than 90 is immeasurably small).

This allowed the Big Three labels to force Spotify to take them on as co-owners, whereupon they demanded lower royalties for the artists in their catalog, to reduce Spotify’s costs and make it more valuable, which meant more billions when it IPOed:

https://pluralistic.net/2022/09/12/streaming-doesnt-pay/#stunt-publishing

Monopoly also means that all those expanded copyrights we gave to creators are immediately bargained away as a condition of passing through Big Content’s chokepoints — giving artists the right to control sampling is just a slightly delayed way of giving labels the right to control sampling, and charge artists for the samples they use:

https://doctorow.medium.com/united-we-stand-61e16ec707e2

(In the same way that giving creators the right to decide who can train a “Generative AI” with their work will simply transfer that right to the oligopolists who have the means, motive and opportunity to stop paying artists by training models on their output:)

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

After 40 years of deregulation, union busting, and consolidation, the entertainment industry as a whole is larger and more profitable than ever — and the share of those profits accruing to creative workers is smaller, both in real terms and proportionally, and it’s continuing to fall.

Economismists think that you’re stupid if you care about this, though. If you’re keeping score on “free markets” based on who gets how much money, or how much inequality they produce, you’re committing the sin of caring about “distributional effects.”

Smart economismists care about the size of the pie, not who gets which slice. Unsurprisingly, the greatest advocates for economism are the people to whom this philosophy allocates the biggest slices. It’s easy not to care about distributional effects when your slice of the pie is growing.

Economism is a philosophy grounded in “efficiency” — and in the philosophical sleight-of-hand that pretends that there is an objective metric called “efficiency” that everyone can agree with. If you disagree with economismists about their definition of “efficiency” then you’re doing “politics” and can be safely ignored.

The “efficiency” of economism is defined by very simple metrics, like whether prices are going down. If Walmart can force wage-cuts on its suppliers to bring you cheaper food, that’s “efficient.” It works well.

But it fails very, very badly. The high cost of low prices includes the political dislocation of downwardly mobile farmers and ag workers, which is a classic precursor to fascist uprisings. More prosaically, if your wages fall faster than prices, then you are experiencing a net price increase.

The failure modes of this efficiency are endless, and we keep smashing into them in ghastly and brutal ways, which goes a long way to explaining the “new commons sense” Kuttner mentions (“Reality has been a helpful ally.”) For example, offshoring high-tech manufacturing to distant lands works well, but fails in the face of covid lockdowns:

https://locusmag.com/2020/07/cory-doctorow-full-employment/

Allowing all the world’s shipping to be gathered into the hands of three cartels is “efficient” right up to the point where they self-regulate their way into “efficient” ships that get stuck in the Suez canal:

https://pluralistic.net/2021/03/29/efficient-markets-hypothesis/#too-big-to-sail

It’s easy to improve efficiency if you don’t care about how a system fails. I can improve the fuel-efficiency of every airplane in the sky right now: just have them drop their landing gear. It’ll work brilliantly, but you don’t want to be around when it starts to fail, brother.

The most glaring failure of “efficiency” is the climate emergency, where the relative ease of extracting and burning hydrocarbons was pursued irrespective of the incredible costs this imposes on the world and our species. For years, economism’s position was that we shouldn’t worry about the fact that we were all trapped in a bus barreling full speed for a cliff, because technology would inevitably figure out how to build wings for the bus before we reached the cliff’s edge:

https://locusmag.com/2022/07/cory-doctorow-the-swerve/

Today, many economismists will grudgingly admit that putting wings on the bus isn’t quite a solved problem, but they still firmly reject the idea of directly regulating the bus, because a swerve might cause it to roll and someone (in the first class seats) might break a leg.

Instead, they insist that the problem is that markets “mispriced” carbon. But as Kuttner points out: “It wasn’t just impersonal markets that priced carbon wrong. It was politically powerful executives who further enriched themselves by blocking a green transition decades ago when climate risks and self-reinforcing negative externalities were already well known.”

If you do economics without doing politics, you’re just imagining a perfectly spherical cow on a frictionless plane — it’s a cute way to model things, but it’s got limited real-world applicability. Yes, politics are squishy and hard to model, but that doesn’t mean you can just incinerate them and do math on the dubious quantitative residue:

https://locusmag.com/2021/05/cory-doctorow-qualia/

As Kuttner writes, the problem of ignoring “distributional” questions in the fossil fuel market is how “financial executives who further enriched themselves by creating toxic securities [used] political allies in both parties to block salutary regulation.”

Deep down, economismists know that “neoliberalism is not about impersonal market forces. It’s about power.” That’s why they’re so invested in the idea that — as Margaret Thatcher endlessly repeated — “there is no alternative”:

https://pluralistic.net/2021/11/08/tina-v-tapas/#its-pronounced-tape-ass

Inevitabilism is a cheap rhetorical trick. “There is no alternative” is a demand disguised as a truth. It really means “Stop trying to think of an alternative.”

But the human race is blessed with a boundless imagination, one that can escape the prison of economism and its insistence that we only care about how things work and ignore how they fail. Today, the world is turning towards electrification, a project of unimaginable ambition and scale that, nevertheless, we are actively imagining.

As Robin Sloan put it, “Skeptics of solar feasibility pantomime a kind of technical realism, but I think the really technical people are like, oh, we’re going to rip out and replace the plumbing of human life on this planet? Right, I remember that from last time. Let’s gooo!”

https://www.robinsloan.com/newsletters/room-for-everybody/

Sloan is citing Deb Chachra, “Every place in the world has sun, wind, waves, flowing water, and warmth or coolness below ground, in some combination. Renewable energy sources are a step up, not a step down; instead of scarce, expensive, and polluting, they have the potential to be abundant, cheap, and globally distributed”:

https://tinyletter.com/metafoundry/letters/metafoundry-75-resilience-abundance-decentralization

The new common sense is, at core, a profound liberation of the imagination. It rejects the dogma that says that building public goods is a mystic art lost along with the secrets of the pyramids. We built national parks, Medicare, Medicaid, the public education system, public libraries — bold and ambitious national infrastructure programs.

We did that through democratically accountable, muscular states that weren’t afraid to act. These states understood that the more national capacity the state produced, the more things it could do, by directing that national capacity in times of great urgency. Self-sufficiency isn’t a mere fearful retreat from the world stage — it’s an insurance policy for an uncertain future.

Kuttner closes his editorial by asking what we call whatever we do next. “Post-neoliberalism” is pretty thin gruel. Personally, I like “pluralism” (but I’m biased).

Have you ever wanted to say thank you for these posts? Here's how you can do that: I'm kickstarting the audiobook for my next novel, a post-cyberpunk anti-finance finance thriller about Silicon Valley scams called Red Team Blues. Amazon's Audible refuses to carry my audiobooks because they're DRM free, but crowdfunding makes them possible.

http://redteamblues.com

[Image ID: Air Force One in flight; dropping away from it are a parachute and its landing gear.]

#pluralistic#crypto forks#economism#imagine a horse#perfectly spherical cows of uniform density on a frictionless plane#neoliberialism#inevitabilism#tina#free markets#distributional outcomes#there is no alternative#supply chains#graceful failure modes#law and political economy#apologetics#robert kuttner#the american prospect

69 notes

·

View notes

Text

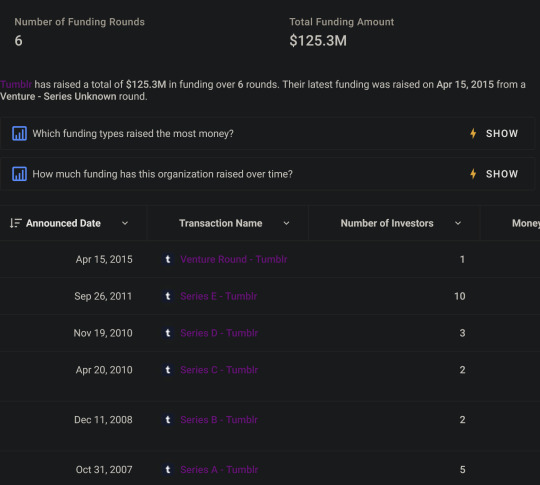

its very funny to see people calling tumblr "VC-based social media".

look, here's all the venture capital rounds Tumblr has ever been involved in:

after the 2011 venture round, Tumblr was purchased by Yahoo for 1.1 billion in 2013.

The 2015 venture round refers to some manner of mistaken reporting. At that time Menlo Ventures put out a press release that they were interested in funding the "next Uber or Tumblr" but did not actually invest any more money for Tumblr with Verizon - business records show that Menlo Ventures was in fact a venture investor with Tumblr and Uber in 2011 funding rounds though.

Anyway, after that you have Yahoo including Tumblr but not including Yahoo's stake in Alibaba being sold to Verizon for ~$4 billion in 2017.

And then in 2019 Verizon sold Tumblr to Automattic as part of how Verizon'd been getting rid of its AOL and Yahoo assets.

So Tumblr received its last venture capital investment over 12 years ago now, and essentially all the venture investors got paid off in 2013 by Yahoo as part of the purchase deal. That's what venture investors are usually looking for after all - sell the company they invested in to an existing enterprise that will pay big bucks, or get it to the stock market with an IPO, either way they get paid for the shares they took in the company as a condition of their venture investment.

3 notes

·

View notes

Text

Ok this post started as a reply to another post about how numbers were fake and got away from me a bit, strap in.

EDIT: Public Service loan forgiveness is a federal program in the US where if you work in government for 10 years the government will pay off the remainder of your student loans. This is way more important than the rest of this godforsaken screed and I'd appreciate a reblog to get out information on that.

This is a facebook group run by my dad(!) among others with a ton of useful information in case student loans are something you are struggling with and have a public service job or are looking to change careers.

Ok, Autism time.

TLDR: Companies are incentivized to borrow money because they can reliably only pay back a fraction of it while using it to inflate their stock price. You are disincentivized from borrowing money because you will pay back 120-130% of what you borrowed unless (and sometimes even if) you file for bankruptcy. We actually do need a financial sector but it's badly under regulated, and also international finance has no rules and is an imperial power-fest. Also anti-finance is an antisemitic dogwhistle.

Debt is one of the fuckiest things on the planet and I wrote this for my own edification but in case it helps someone make sense of a new concept that'd be pretty cool.

Proof the numbers in the economy are fake:

No debt is repaid in exact numbers. You borrow 10k, and probably you pay back 11-13k over a number of years. The government borrows 1 trillion dollars and pays back 1.1 trillion dollars over a number of years. A company borrows 1 million dollars, they pay back 1.1 million dollars over a number of years. The numbers almost always go up, this is one reason we have inflation. You can pay less than you borrowed, but only under certain conditions. Inflation is one, such that you pay relatively less though absolutely more. Typically the numbers only go down if someone defaults, but that's usually the worst case scenario because it breaks the kind of promise that the whole economy is based on.

If you default, your debt is sold by the bank to someone else. Not for 10k, or whatever is left on the balance, but for probably 1-2k, a fraction of what it's "worth" and then the person who bought it tries to get you to pay the rest of the balance while the bank reports the loss as part of their tax deductible operating expenses.

Then, you're still on the hook for the 11-13k plus whatever fees the debt collector wants to charge. And if you don't pay those, they do it again, selling what they bought for 1-2k for 4-5 hundred, and so on, until you file for chapter 11 bankruptcy and are no longer legally obliged to pay all of the debt. In practice, this means the government negates the lender's right to collect the full balance in exchange for you going on a payment plan based on a new agreement the government brokers between you and the lender.

After this, because you failed to pay back the full balance, you will find it almost impossible to find banks to loan you money, even if in the end you paid way more than the 11-13k you would have paid back if you had made your payments on time.

In general, if you file for bankruptcy, you lose.

This sort of works in reverse with the stock market: You buy stock and the company pays you back with interest because you are loaning them your money. Companies sell stock at an initial price, auctioning it off in lots to find out what people think it's worth, and what it's worth is based on a) its capacity to increase in value and b) the monthly/yearly interest repayment which is based on the IPO price. Higher price means more money raised for the company but only at the IPO rate because once it's on the secondary market the company doesn't actually see any of the money except as good publicity.

The interest payouts are called dividends, although only a few companies actually care about paying them out anymore. Many companies ignore their dividends and instead just try to pump the price of their stock on the secondary market, aka the stock market. The ratio between stock price and dividends gives you an interesting picture of how the company sees its long term strategy: Car companies which don't really grow tend to have low ratios between stock price and dividend. Tech companies, which are looking to blow up and act like they don't know nobody, tend to have very high stock prices and very low dividends.

Crucially, companies tend to see the stock price as a reflection of the company's health, or "consumer confidence" or something, and a lot of executive pay is tied to it because most of them get paid in stock.

But the number doesn't mean anything concrete (to the company) after the IPO.

The upshot of all this is that while you are expected to borrow and pay your balance back with interest, companies are rewarded for borrowing and then artificially increasing the size of their own debt (stock price) because that's how the people making the decisions get paid.

Crucially, and this is also the assumption when an individual takes on debt, the debt is supposed to enable the debtor to make more money than they would have without it. However, unlike the kind of debt most individuals take out, the debt from issuing stock doesn't (usually) pay off the principle. This is why companies can (sometimes) get away with taking on debt without actually paying it off. You could in principle do this too if you registered as an LLC and issued stock for yourself, but this would be weird and paying strangers dividends might be a big financial burden. Or it might work out, go wild. I'd say the odds of this working are fairly comparable to minting yourself as an NFT and trying to sell it, albeit without needing to use the blockchain. Please ask a lawyer first though.

Also, companies can take on way more debt with way less risk because it is significantly less punishing for a company to file for bankruptcy than a person. The LLC in LLC is short for Limited Liability Corporation. If a company files for bankruptcy, it usually gets to keep most of its assets, because the government in general wants it to keep producing whatever it was producing and its debts are restructured accordingly. Sometimes, however, the assets are sold and the creditors just lose out on any debt over and above the selling price of the assets. Companies can try to shed debts by selling their assets for cheap to a new company, filing for bankruptcy, and then leaving creditors with the losses. This is fraud, but sometimes they get away with it and the "limited liability" part means that even if it is fraud it is legally difficult to go after the people responsible. LLCs are why if your company goes bust, you as an employee cannot be sued, which is generally a good thing. However, the structure of LLCs make it very easy for a company to take on more and riskier debt while you, as an individual are expected to pay off everything you borrow.

In general, if a company files for bankruptcy, the creditors lose.

The Government, apart from regulations, mostly cares about finance for two reasons: Economic stability and Retirement savings.

All this shit is made up. It's a game with very complicated rules, but there's no natural reason for it to work in the particular way that it does. In fact, there are countries like Turkey where it works completely differently, mostly because of religious laws about interest collection. Both Christianity and Islam have complicated histories with finance, but I digress. The point it that finance is almost entirely held up by agreements between extremely fickle parties. Like, there are contracts, agreements, balance sheets, and so on but none of this is pegged to any real asset. (This is a good thing, people who tell you that we should go back to the gold standard are morons) What that means is that the government can decide at any time to forgive people's debts. They can just void the contracts, who's going to stop them? (Be careful if you have a banking system powerful enough to go toe to toe with the government. JP Morgan and a bunch of other wall street people actually tried to overthrow the US Government in 1933.) They need to be careful about this because being able to borrow money when you need it is a net positive, and doing it too often disincentivizes people from lending money making borrowing more expensive. But overwhelmingly, rather than forgiving small dollar loans to people, the government forgives giant loans to companies.

This is partially because the stability of the system, ie creditors getting paid in order to keep a steady supply of creditors, matters more than the fate of any particular player within it, and partially because big fish can manipulate the system to insulate themselves from consequence.

For example, in 2008, tons of first time homeowners had gotten "subprime mortgages," meaning they had borrowed more money than they could afford to repay in order to buy a first home. Increased buying meant prices went up, borrowers were unable to afford the increased property taxes from their suddenly valuable homes, and then were forced to sell, producing even more subprime borrowers. These debts were defaulted on, sold, and then bundled into packages where debt buyers could not see the insolvency of the loans. Then, the bubble burst. People suddenly realized that they had taken out a million dollar mortgage, which they could not afford the monthly payments on, on a house that would only sell for 400k. And they were on the hook for the entire million plus interest.

At this point, the government had a choice: they had to do something about the fact that millions of people had borrowed more money than they could afford. They could have bought the debt, and helped the homeowners pay in a situation similar to a chapter 11 bankruptcy where some assets are protected in order to prevent massive foreclosures, or they could have done what they did which was buy out the debt buyers and help the creditors recoup their losses. Instead of virtually slashing housing prices by forgiving mortgage debt in order to help people stay housed, they assumed the debts of the people who had bought subprime mortgage bundles, mostly banks, while refusing to go after the architects of the scheme who had issued the bad mortgages and sold them under false pretenses.

The biggest reason why this stuff really matters is that at least how the US does things right now, almost all retirement securities are tied to stock price. That's your 401ks, your Roth IRAs, etc. With the exception of Social Security and Medicare, almost all the income seniors have is based on the performance of the stock market. This isn't the worst idea, as compared to previous systems like large savings banks or just having parents cared for by their kids this is A) somewhat resistant to inflation and B) does not shackle predominantly young women to permanent unpaid elder care as was the case under past more patriarchal systems. It's good that in general inflation can't wipe out the savings of someone who saved 100,000 1970 dollars only to have that barely cover a week of cancer treatment. Finance makes that happen.

Also, people want to do things that cost more money than they have, like buy houses, start businesses, and go to college. Businesses also want to do things that cost more money than they have, like build factories, conduct research and development, and offer benefits to employees. Finance makes that happen.

We would still need finance even if (like under communism) the government paid for these things, and whether finance should be entirely public (communism) entirely private (anarcho-capitalism) or semi-private (status quo) is a really complicated question. Finance is not this intrinsically evil thing.

Also because of the aforementioned history of Christians making collecting interest illegal most demonization of finance is directly connected to the Jews, who under medieval law were forced into being bankers in order to avoid forcing Christians from committing the sin of usury (interest collection). Much history of antisemitism in Europe is directly connected to these sorts of laws. The stereotype of the greedy jew, for example, comes from the fact that when medieval governments wanted to raise money, such as for a crusade, they would increase taxes but only on the jews. This forced the jews who were legally forbidden from doing any other job to increase interest rates in order to stay financially solvent, demanding higher rates on borrowing and lower interest on savings. This effectively raised taxes on everyone, but looked like the lord was being generous while the jew was being greedy. Anyone who talks about the intrinsic evils of global finance, whether they know it or not, is parroting Nazi talking points. Bear in mind that the Nazis did the same shit as the medieval lords: by raising taxes on Jews and only Jews, as well as seizing the assets of Jewish refugees, expropriating Jewish owned businesses, and using the Jews as slave labor they funded significant social welfare programs and their invasions of neighboring European countries without significantly increasing taxes on anyone but the Jews, at least until ~1940.

But there are still perverse incentives.

Whenever finance (making money by moving money around) overshadows production (making shit people actually need) bad things happen. Enron was a prime example of this: it was a "holding company" (they owned property that other people used for production without being directly involved in that production) that used an asset shell game to boost their stock price to hundreds of times their dividend, then sold out leaving investors with worthless stock they had bought for thousands of dollars.

Crashes can usually be predicted in advance: the problem is that the government is usually lax with enforcing financial crime. Journalists and economists saw 2008, Enron, the Dot Com bubble, the Asian Financial Crisis, and many other financial disasters coming. Karl Marx argued that Capitalism exists in a permanent cycle of boom and bust as a result of its systematic incentives. There is a history of financial crisis going back to the story of Joseph in Genesis. However, even when governments can see it coming, financial prophylaxis, such as regulation, is usually seen as too expensive even when it is cheaper to prevent a disaster than to clean up after one. Worse, the fact that the bankers almost never get prosecuted means that financial mismanagement and crime continue to exacerbate what might be a natural tendency of markets to rise and fall. This is direct consequence of the structure of LLCs. The higher the highs, the lower the lows, but if you're trying to jump out of the market at the top and then buy up everyone else's assets for pennies at the bottom, you want the cycles to be as extreme as possible. That's the position major companies find themselves in, and it's basically only good for them.

I'm not enough of an expert to have specific policy recommendations, except that in the 90s Bill Clinton overturned a law which separated savings banks from investment banks. Savings banks rely on high interest rates, both on loans they issue such as for mortgages, cars, and so on, and on the personal savings you receive from depositing money in them. Once upon a time (the 90s) you could put your money in a normal bank and get 5-6% interest in a savings account. This no longer happens. Investment banks make their money by taking your money, putting it on the stock market, and collecting the difference. Investment banks are more profitable (mostly for the bank) but more risky (mostly for you), like having someone start a casino with your money. House advantage is there, but they can still lose. Before the 90s, it was illegal for your bank to gamble with your savings on the stock market. Now it is not, and this law is something I think we should bring back.

When it comes to governments and the international system things are weirder.

It's really hard to make a government keep a promise, so they get to flaunt these rules. Also, as a rule, Governments only care about their citizens (sometimes defined very narrowly as non-immigrant, non-prisoner, white, etc) and not anybody else. Anything they do on behalf of any other group is only because it also benefits their citizens for some reason. The only real way to make a government keep a promise is by lawsuit, which they can ignore if they don't like, or war, which most people can't really do for fun. This is why The US Debt strategy for its entire history going back to Alexander Hamilton is to run up the credit card like it's Christmas. The plan as far as the USA is concerned is to borrow money and only pay off the interest rather than the principle. The only way someone is going to get the USA to pay off the principle is by beating them in a war. However, those interest payments are the most reliable debt interest payments in the world, unless the republicans in the house are real fucking numbskulls come June. I'm not exactly smart enough to understand the nuance of why all the other countries on earth let us do this but I think it has something to do with beating everyone on the planet in a war in the last century. However, the US always pays its debts in full, even if as a result of inflation what they're paying back is only part of what it was worth when they borrowed it. This is normal, though whether or not it's ethical depends on your views on american empire.

What's important about this is that things like the US debt clock are shameless right wing propaganda. Someone somewhere will tell you that the government has borrowed like three hundred thousand dollars on your behalf and that they expect you to pay it back. This is then used to argue against government spending. I won't get into fiscal policy but this is a lie, and it's better to keep borrowing and paying off debt than to try to achieve fiscal or financial independence internationally.