#Government taxation and revenue

Text

Trying to choose Pretax vs. Roth 401(k)? Why it's trickier than you think, experts say

Prostock-Studio | Istock | Getty Images

If you have a 401(k), one of the big questions is whether to make pretax or Roth contributions — and the answer may be complicated, experts say.

While pretax 401(k) contributions reduce your adjusted gross income, you’ll owe levies on growth upon withdrawal. By comparison, Roth 401(k) deposits won’t provide an upfront tax break, but the money can grow…

View On WordPress

#401(k) plans#business news#Financial Advisors#Financial planners#Financial planning#Government taxation and revenue#Individual retirement accounts#Labor economy#National taxes#Personal finance#Personal saving#Retirement planning#Roth 401(k) plans#Social issues#Tax planning#Taxes#Wealth

0 notes

Video

youtube

Episode 002a - When Government Toxicity Runs Amok - A CRA Story

#youtube#government taxation and revenue#tax collection#covid payment#covid lockdown#tax cheat#government cheat

0 notes

Link

“The likely next chairman of the Ways and Means Committee will drop the panel’s long-running effort to obtain former President Donald Trump’s tax returns,” CNBC reports.

“All three Republicans vying for the chairmanship, Reps. Jason Smith, of Missouri, Vern Buchanan, of Florida, and Adrian Smith, of Nebraska, confirmed they would end the legal battle.”

1 note

·

View note

Text

UK’s self-billed 'Scrooge' promises tax rises, spending cuts

UK’s self-billed ‘Scrooge’ promises tax rises, spending cuts

Britain’s Treasury chief, Jeremy Hunt, has warned a spending crunch and tax increases are on their way as he bids to fill the “black hole” in the country’s finances

LONDON — Britain’s Treasury chief warned Sunday of a coming spending crunch and tax increases for cash-strapped Britons as he bids to fill the “black hole” in the country’s finances.

Billing himself as a Scrooge figure ahead of…

View On WordPress

#Busin#Economic policy#Fiscal policy#Government and politics#Government business and finance#Government finance#Government policy#Government spending#Government taxation and revenue#National governments#National taxes#Recessions and depressions

0 notes

Text

House passes massive climate, tax and health bill

House passes massive climate, tax and health bill

The House passed a sweeping tax, health and climate bill on Friday, delivering a major win for Democrats and President Joe Biden less than three months before the pivotal midterm elections.

The chamber approved the more than $430 billion package by a 220-207 margin, as all Democrats backed it and all Republicans opposed it. The measure, which caps a more than yearlong slog by Democrats to pass a…

View On WordPress

#bill#Breaking News: Politics#business news#climate#congress#Elections#Government taxation and revenue#health#House#Joe Biden#legislation#Massive#Nancy Pelosi#passes#Patient Protection and Affordable Care Act#Politics#tax#taxes#United States House of Representatives

0 notes

Text

Turning up heat, US targets Nicaraguan sugar imports | Business News

Turning up heat, US targets Nicaraguan sugar imports | Business News

If you know of local business openings or closings, please notify us here.

PREVIOUS OPENINGS AND CLOSINGS

· Jimmy’s Barbershop in Allentown has moved to 822 N. 19th Street

· Air Products and Chemicals Inc.’s chosen warehouse developer, Prologis Inc., will have to wait until July 13 for a final decision by Upper Macungie Township’s zoning hearing board on 2.61 million square feet of warehouses.

·…

View On WordPress

#apmediaapi#beverage and tobacco products manufacturing#business#consumer product manufacturing#consumer products and services#dcc#economy#food#food manufacturing#government and politics#government budgets#government business and finance#government finance#Government taxation and revenue#international trade#national budgets#national governments#National taxes#sugar manufacturing#us-nicaragua-sugar quotas#wire

0 notes

Text

Joe Biden asked to replace IRS chief Charles Rettig over tax document destruction

Joe Biden asked to replace IRS chief Charles Rettig over tax document destruction

Charles P. Rettig, commissioner of the Internal Revenue Service, testifies during the Senate Finance Committee hearing titled The IRS Fiscal Year 2022 Budget, in Dirksen Senate Office Building in Washington, D.C., June 8, 2021.

Tom Williams | Pool | Reuters

A leading House Democrat on Friday called on President Joe Biden to replace IRS Commissioner Charles Rettig over the agency’s controversial…

View On WordPress

#Breaking News: Politics#Business#business news#Government taxation and revenue#Joe Biden#Politics#Social issues

0 notes

Text

What Biden's proposed 1031 exchange limits mean for investors, economy

What Biden’s proposed 1031 exchange limits mean for investors, economy

manusapon kasosod | Moment | Getty Images

As part of President Biden’s 2023 budget, the administration proposed severe limitations to so-called 1031 exchanges.

A 1031 exchange is part of the IRS tax code, allowing real estate investors to defer taxes by exchanging “like-kind” properties. The term “like-kind” refers to the nature or character of the property. These properties must only be used…

View On WordPress

#Barack Obama#business news#Financial consulting#Financials#Government taxation and revenue#Joe Biden#Legislation#Personal finance#Real estate#white house

0 notes

Text

Unpacking Oklahoma's Education Funding: A Look Beyond Marijuana and Lottery Revenue

Dive into the complexities of Oklahoma's education funding, where marijuana sales and lottery tickets play pivotal roles. This post unravels the intricacies of state budgets, revealing the challenges and impacts of these unconventional revenue streams...

Introduction:

Welcome to ThinkTank Theorium, where we don’t just scratch the surface – we dig deep. Today, we’re zeroing in on Oklahoma’s education funding. It’s more than just textbooks and chalkboards; we’re talking green – and not just the kind in textbooks. Marijuana sales and lottery tickets have entered the chat, but do they really make the grade in funding our schools?

The Green Rush:…

View On WordPress

#Economic Impact#Education Funding#Educational Challenges#Fiscal Policy#Government Finance#Lottery Revenue#Marijuana Sales#Oklahoma#Policy Analysis#Public Schools#Revenue Allocation#School Funding#State Budget#State Economy#Taxation#ThinkTank Theorium#ThunkDeep#ThunkSpiracy

0 notes

Text

Massive £3.5K Tax Hike Looms for UK! Shocking IFS Report!

UK households are bracing for a substantial tax hike, with an average increase of £3,500 per year anticipated by the next election, marking the most significant fiscal burden over a parliamentary term in over seven decades, according to the Institute for Fiscal Studies (IFS), the country’s foremost economic think tank.

For more visit: financeprozone.com -

#Budget Deficit#Economic Analysis#Economic Consequences#Economic Projections#Financial news#Financial Outlook#Fiscal Policy#Government Budget#Government Spending#IFS Report#Income Tax#Personal Finance#Public Finances#Revenue Forecast#Tax Burden#Tax Impact#Taxation Changes#Taxation Trends#UK Tax Hike

0 notes

Text

These 4 Mid-Year Tax Strategies Can Cut Next Year's Bill from the IRS

These 4 Mid-Year Tax Strategies Can Cut Next Year’s Bill from the IRS

seksan Mongkhonkhamsao | moment | Getty Images

1. Review your tax withholdings

When starting a new job, fill out Form W-4which covers what your employer takes from your federal tax paycheck.

But you need to review those withheld, especially for big life changes like getting married, having children, or starting a side business.

Main reasons for changing the withholding tax:

1. Changes to tax…

View On WordPress

#Amazon.com Inc#bill#business news#cut#Financial advisors#Financial planners#Financial project#Investment strategy#IRS#MidYear#National taxes#Personal finance#Personal savings#Personal taxes#Social issues#Strategies#Tax#Tax planning#Taxation and government revenue#Taxes#Wealth#years

0 notes

Text

UK Treasury chief out as prime minister plans U-turn

UK Treasury chief out as prime minister plans U-turn

LONDON — Embattled British Prime Minister Liz Truss fired her Treasury chief ahead of a hastily arranged news conference on Friday as she struggled to calm markets and hang on to her job following the release of a controversial economic plan.

Kwasi Kwarteng’s departure comes after just over a month in the job — and three weeks after he announced a tax-cutting “mini budget” that sent the pound…

View On WordPress

#Business#Currency markets#Economy#Financial Markets#General news#Government and pol#Government business and finance#Government finance#Government taxation and revenue#National governments#National taxes#Rebellions and uprisings#War and unrest

0 notes

Text

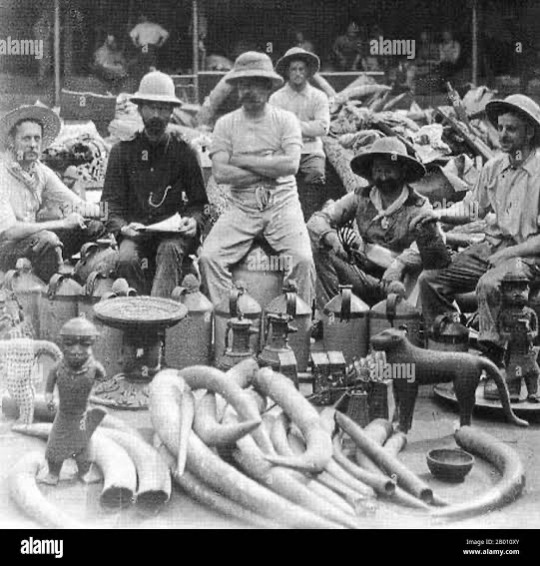

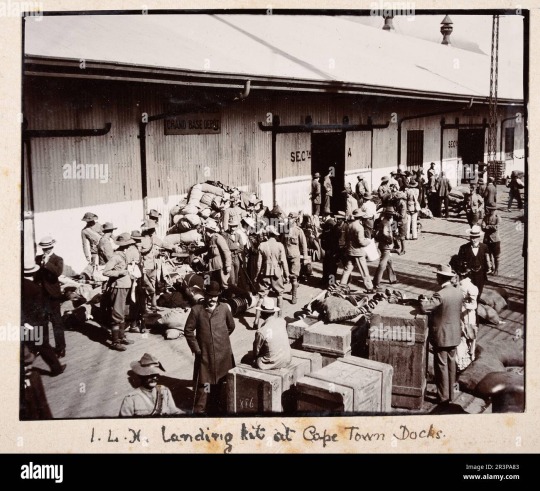

AN ARTICLE ON THE BRITISH LOOTING FROM AFRICA

AND SUFFERING OF AFRICANS

The British should return every loot of all kinds back to Africa

IF THEY CONDEMN SLAVE TRADE THEY SHOULD START BY RETURNING THE LOOTS COLLECTED FROM AFRICA ALL IN THE NAME OF TRADE AND RELIGION ,IF OUR CULTURE WAS BAD WHY DID THEY TAKE AWAY OUR HERITAGE AND STORE THEM IN A MUSEUM ?

The looting of Africa during the colonial era occurred through a combination of methods and strategies employed by European colonial powers, including Britain. Here are some of the ways in which Africa was looted during this period:

Military Conquest: European colonial powers, including the British, often used military force to conquer and control African territories. This involved armed conflicts, wars of conquest, and the suppression of local resistance movements. Through these military campaigns, colonial powers gained control over land and resources.

Resource Extraction: One of the primary motivations for colonialism in Africa was the exploitation of its abundant natural resources. European colonial powers, including Britain, extracted valuable resources such as minerals, rubber, timber, and agricultural products from African colonies. These resources were often taken for the economic benefit of the colonial powers.

Forced Labor: Colonial powers imposed forced labor systems on Africans to work in mines, plantations, and other labor-intensive industries. These labor practices were exploitative and often involved harsh working conditions and little compensation.

Taxation and Economic Exploitation: Africans were subjected to unfair taxation systems that drained wealth from their communities. Colonial administrations imposed taxes on land, crops, and other economic activities, forcing Africans to generate revenue for the colonial authorities.

Land Dispossession: Africans frequently lost access to their ancestral lands as colonial governments allocated land to European settlers and corporations. This land dispossession disrupted traditional agricultural practices and led to social and economic dislocation.

Confiscation of Cultural Artifacts: Colonial powers often confiscated cultural artifacts, sculptures, art, and religious items from Africa. These items were frequently transported to Europe and ended up in museums, private collections, or auction houses.

Unequal Trade Agreements: Colonial powers imposed trade agreements that favored their own economies. Africans often received minimal compensation for their raw materials and agricultural products, while European countries reaped significant profits from these trade relationships.

Suppression of Indigenous Cultures: The suppression of indigenous African cultures and languages was another aspect of colonialism. European powers sought to impose their own cultural norms and values, often devaluing or erasing African traditions.

Missionaries played a complex role in the context of colonialism and the looting of Africa. While their primary mission was to spread Christianity and convert indigenous populations to Christianity, their activities and interactions with colonial authorities had various effects on the looting of Africa:

1. Cultural Influence: Missionaries often sought to replace indigenous African religions with Christianity. In doing so, they promoted European cultural norms, values, and practices, which contributed to cultural change and, in some cases, the erosion of traditional African cultures.

2. Collaboration with Colonial Powers: In some instances, missionaries worked closely with colonial authorities. They provided moral and religious justification for colonialism and sometimes acted as intermediaries between the colonial administration and local communities. This collaboration could indirectly support the colonial exploitation of resources.

3. Access to Resources: Missionary activities occasionally granted them access to valuable resources and artifacts. They may have collected religious objects, manuscripts, and other items from indigenous communities, which were sometimes sent back to Europe as part of ethnographic or religious collections.

4. Education and Healthcare: Missionaries established schools, hospitals, and other institutions in African communities. While these services were aimed at spreading Christianity, they also provided education and healthcare to local populations, which could have positive impacts on individuals and communities.

5. Advocacy for Indigenous Rights: Some missionaries, particularly in later years, became advocates for the rights of indigenous populations. They witnessed the injustices of colonialism and spoke out against the mistreatment of Africans, including forced labor and land dispossession.

6. Conversion and Social Change: The conversion of Africans to Christianity brought about significant social changes in some communities. It could lead to shifts in social hierarchies, family structures, and gender roles, sometimes contributing to social upheaval.

1. Cultural Bias: The British, like many Europeans of their time, often viewed their own culture, including Christianity, as superior to the indigenous cultures and religions they encountered in Africa. This cultural bias led to the condemnation of indigenous African religions and gods as "pagan" or "heathen."

2. Religious Conversion: Part of the colonial mission was to spread Christianity among the indigenous populations. Missionaries were sent to Africa with the aim of converting people to Christianity, which often involved suppressing or condemning traditional African religions and deities seen as incompatible with Christianity.

3. Economic Interests: The British Empire, like other colonial powers, was driven by economic interests. They often saw the resources and wealth of African societies as valuable commodities to be exploited. This economic agenda could involve looting or confiscating sacred artifacts, including religious objects, for financial gain.

4. Ethnographic Research: Some British colonial officials and scholars engaged in ethnographic research to study African cultures, including their religious practices. While this research aimed to document indigenous cultures, it could sometimes involve the collection of religious artifacts and objects, which were then sent to museums or private collections in Europe.

5. Cultural Imperialism: Colonialism was not just about economic and political domination; it also involved cultural imperialism. This included an attempt to impose European cultural norms, values, and religious beliefs on African societies, often at the expense of indigenous traditions.

The issue of repatriating cultural artifacts looted from Africa during the colonial era has gained significant attention in recent years. Countries and communities in Africa have long called for the return of these treasures, which hold deep cultural and historical significance. Among the former colonial powers, Britain stands at the forefront of this debate. This article explores the ongoing discussion surrounding Britain's role in returning looted artifacts to Africa.

A Legacy of Colonialism:

Britain's colonial history left a profound impact on many African nations, including the removal of countless cultural treasures. During the height of the British Empire, valuable artifacts, sculptures, manuscripts, and sacred items were taken from their places of origin. These items found their way into the collections of museums, private collectors, and institutions in Britain.

The Case for Repatriation:

Advocates for repatriation argue that these artifacts rightfully belong to the countries and communities from which they were taken. They emphasize the importance of returning stolen cultural heritage as a step towards justice and reconciliation. Many African nations view these artifacts as integral to their cultural identity and heritage.

International Momentum:

In recent years, there has been a growing international momentum to address this issue. Museums and institutions worldwide are engaging in discussions about repatriation. Some institutions have initiated efforts to return specific items to their countries of origin, acknowledging their historical and moral responsibility.

Britain's Response:

Britain, home to several renowned museums housing African artifacts, has faced increasing pressure to address this issue. The British Museum, for instance, has faced calls to repatriate numerous artifacts, including the Benin Bronzes and the Elgin Marbles, which have origins in Africa and Greece, respectively.

In response to these demands, some British institutions have started to collaborate with African countries to explore the possibility of returning certain artifacts. These discussions aim to find mutually agreeable solutions that respect both the historical context and the cultural significance of these items.

Challenges and Complexities:

Repatriation is a complex process involving legal, ethical, and logistical challenges. Determining rightful ownership and ensuring proper care and preservation upon return are critical considerations. Additionally, questions arise about how to address the legacy of colonialism and rectify historical injustices.

The Way Forward:

The debate over repatriation is ongoing and highlights the need for respectful dialogue and cooperation between nations. While the return of looted artifacts is an essential step, it should also be part of broader efforts to promote cultural understanding, collaboration, and acknowledgment of historical wrongs.

The issue of Britain returning looted artifacts to Africa is part of a global conversation about justice, cultural heritage, and historical responsibility. While there are complexities to navigate, the growing recognition of the importance of repatriation signifies a potential path forward towards reconciliation and healing between nations and their shared history. The ongoing discussions reflect a commitment to addressing past injustices and fostering a more inclusive and culturally rich future.

They condemn slave trades yet they’re still with our treasures and cultural artifacts and heritage

#life#animals#culture#aesthetic#black history#blm blacklivesmatter#anime and manga#architecture#black community#history#blacklivesmatter#black heritage#heritage

207 notes

·

View notes

Text

Murphy signs $50.6 billion budget with property tax relief | Business News

Murphy signs $50.6 billion budget with property tax relief | Business News

If you know of local business openings or closings, please notify us here.

PREVIOUS OPENINGS AND CLOSINGS

· Hunter Pocono Peterbilt plans to move Pocono Township operations to Stroudsburg

· Coal Winery and Kitchen at 81 Broad St., Bethlehem, has closed as its owner searches for a new location for the business, according to its Facebook page.

· Lowhill Township supervisors approved a…

View On WordPress

#apmediaapi#business#dcc#general news#government and politics#government budgets#government business and finance#government finance#Government taxation and revenue#new jersey budget#Personal finance#Personal spending#personal taxes#property taxes#social affairs#state budgets#state governments#suburbs#wire

0 notes

Text

Changes to the Tax Collection System in Revolutionary and Napoleonic France

My (loose) translation from Le prix de la gloire: Napoléon et l’argent by Pierre Branda, about money and finance. This part is specifically about the reforms made to the tax collection system. Problems with taxation had been the source of many woes, so it went through major changes.

“The [tax] work of the Consulate mainly concerned the reorganization of tax collection. Until now, this essential element was not administered directly by the Ministry of Finance. The Constituent Assembly had wanted the tax rolls for direct contributions, that is to say the ‘tax slips’, to be established by municipal administrations. Their work was complex, because each year it was necessary to draw up a list of taxpayers, determine each person’s share of tax and send them the amount of the contribution to pay. Poorly motivated (or even corrupt), the municipalities had put little care in the execution of their mission since a large part of the taxpayers had not yet received anything for their taxes of year VIII, or even of year VII or year VI. Also, with two or three years of delay in preparing the rolls, it was not surprising that tax revenues were low (nearly 400 million francs were thus left outstanding). If the sending of tax matrices left something to be desired, the collection of direct contributions was hardly better. The tax collector was also not an agent of the administration: this function was assigned to any person who agreed to collect taxes with the lowest possible commission (otherwise called ‘collecte à la moins-dite’). With such a system, there were numerous inadequacies, often due to incompetence, but also due to the prevailing spirit of fraud. However, in their defense, the profits of the collectors were most of the time too low to provide such a service; also, to compensate for their losses, they were ‘forced’ to multiply small and big cheats. In any case, in such a troubled period, letting simple individuals carry out such a delicate mission could only be dangerous for the regularity of public accounts. In short, the mode of operation of taxation that Bonaparte and Gaudin inherited was failing on all sides and threatened to sink the State.”

“One month after Gaudin’s appointment, on December 13, 1799, the Directorate of Direct Contributions was created with the mission of establishing and sending tax matrices. This administration, dependent on the Ministry of Finance, was made up of a general director, 99 departmental directors and 840 inspectors and controllers. The organization of direct contributions became both centralized and pyramidal, the opposite of the previous system, decentralized and with a confused hierarchy. The work of preparing the rolls, for so long entrusted to local authorities, passed entirely ‘in the hands of the Minister of Finance’ and in this way the taxpayer found himself in direct contact with the administration. The tax system no longer having any obstacles, the beneficial effects of such a measure did not take long to be felt. With ardor, the agents of this new administration carried out considerable work: three series of rolls, that is to say more than one hundred thousand tax slips, were established in a single year. It must be said that the ministry had not skimped on their pay (6,000 francs per year for a director, 4,000 for an inspector and 1,800 for a controller), which was undoubtedly not unrelated to such success.”

“Tax reform was slower. It was not until 1804 that all tax collectors were civil servants. The consular system gradually replaced the collectors of the departments, then of the main cities and finally of all the municipalities whose tax rolls exceeded 15,000 francs. At the end of the Consulate, the entire tax administration was thus entirely dependent on the central government. Subsequently, the one in charge of indirect contributions (taxes on tobacco, alcohol or salt) created on February 25, 1804 and called the Régie des droits réunis was built on the same pyramidal and centralized model. It was the same later for customs.”

“According to Michel Bruguière, historian of public finances, ‘Napoleon and Gaudin can be considered the builders of the French tax administration. [...] They had also developed and codified the essential principles of our tax law, so profoundly derogatory from the rules of French law, since the taxpayer has nothing to do with it, while the administration has all the powers’. Basically, after having clearly understood the true cause of the ‘financial wound’, Bonaparte wanted an effective, almost ‘despotic’ instrument to avoid experiencing the unfortunate fate of his predecessors. As a good soldier, he created a fiscal ‘army’ responsible for providing the regime with the sinews of war. It was also necessary to definitively break the link between private interests and state service in everything that concerned public revenue. The time of the farmer generals of the Ancien Régime or the ‘second-hand’ collectors of the Directory was well and truly over. Napoleon Bonaparte, with his fierce desire to centralize power in this area as in many others, undoubtedly gave his regime the means to last.”

#Le prix de la gloire: Napoléon et l’argent#Le prix de la gloire#Napoléon et l’argent#napoleon#napoleonic era#napoleonic#napoleon bonaparte#19th century#first french empire#1800s#french empire#france#history#reforms#finance#economics#french revolution#frev#la révolution française#révolution française#Gaudin#tax#tax collection#tax collection system#taxation#law#napoleonic code#source#book source#french history

36 notes

·

View notes

Text

More voices are joining the increasing calls to search the Prairie Green Landfill for the bodies of two Indigenous women believed to be buried there.

Members of the Union of Taxation Employees marched in solidarity with the families, friends, and allies of missing and murdered Indigenous women and girls.

The union, representing more than 35,000 Canada Revenue Agency employees across the country, is holding a national convention in Winnipeg this week. On Thursday afternoon, members joined dozens of others from the community in a march from the Fairmont Hotel to the Canadian Museum for Human Rights.

More voices are joining the increasing calls to search the Prairie Green Landfill for the bodies of two Indigenous women believed to be buried there.

Members of the Union of Taxation Employees marched in solidarity with the families, friends, and allies of missing and murdered Indigenous women and girls.

The union, representing more than 35,000 Canada Revenue Agency employees across the country, is holding a national convention in Winnipeg this week. On Thursday afternoon, members joined dozens of others from the community in a march from the Fairmont Hotel to the Canadian Museum for Human Rights.

"We decided to come here to strongly condemn the inaction of the City of Winnipeg, the police department, the Province of Manitoba, and the federal government," said Marc Brière, president of the Union of Taxation Employees.

"Their refusal to search the Prairie Green Landfill is totally unacceptable."

Brière spoke in front of a large crowd at the museum, with more people joining the chorus of voices asking for the landfill to be searched.

"I'm asking you, if it would be three white women, if it were three white privileged males like myself, would they be searching the landfill?" he asked the crowd. "I think the chances would be greater."

The remains of Morgan Harris and Marcedes Myran are believed to be in the landfill. Myran's sister Jordan was among the family members who spoke at the rally.

"I'd like to thank everyone who showed up today," she said. "And everyone that has showed up time and time again, for every protest and rally that we've put on."

Brière said the entire Union of Taxation Employees supports the search.

"We are here with you. We ask the municipality of Winnipeg, the police department, especially the premier of Manitoba…to get going and search the landfill," he said. "And the federal government to put the money on the table, to help out and get this done."

#search the landfill#missing and murdered Indigenous women#mmiwawareness#mmiwcanada#Indigenous#First nations#violence against women#women

49 notes

·

View notes