#FINANCES

Text

We ask your questions so you don’t have to! Submit your questions to have them posted anonymously as polls.

#polls#incognito polls#anonymous#tumblr polls#tumblr users#questions#miscellaneous polls#submitted nov 28#finances#personal finance#money

4K notes

·

View notes

Text

This summer will be a financially satisfying time for you. You won't have to worry about not having enough money. You will have more than enough money to enjoy your desired experiences. You will be able to see new and beautiful places without the burden of stressing over money. You will eat the foods you want to eat and go on all the adventures that call out to you. You will enjoy all the luxuries this summer has to offer you, and money will never be a factor. Claim it.

736 notes

·

View notes

Text

396 notes

·

View notes

Text

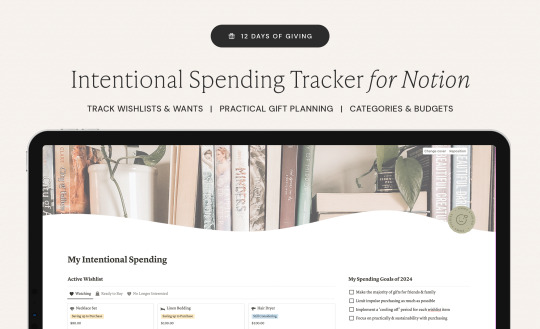

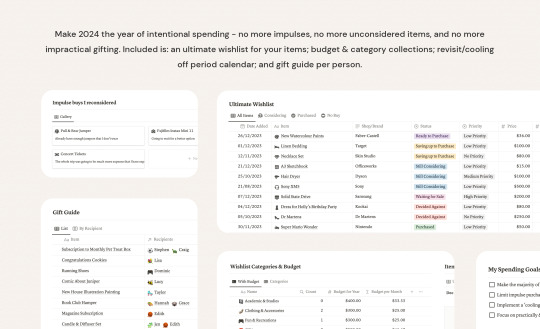

Free Intentional Spending Tracker for Notion

It's Day 8 of the 12 Days of Giving!

Track your wishlist and fill in details to help make more informed decisions regarding your purchases. Comes with an comprehensive way to categorise your wants & seeing the impact on your budgets. Whilst this has budgeting features, it's more about how you're spending and making sure those purchases are considered.

Features include:

spending goals for 2024

active wishlist & watching space

detailed digital wishlist and budget impact

wishlist categorises & year budgeting

pre-populated dates with calendar view for revisiting items after "cool off period"

gift gifting ideas (by idea, rather than recipient for more intentional gifting!)

recipient database

Download Free Here

Check back in each day for a new free item! Hopefully they're all useful and a fun way to end the year 🥰🎁

#download#free#wallpaper#studyspo#studyblr#emmastudies#studying#freebie#notion#notion template#spending#money#finances#old money#intentional spending#intentional living#gift guide

431 notes

·

View notes

Text

Now that student loans are starting back up-

(The following is absolutely not art related at all)

Hey guys! Posting this here because I find it important-

Money is super scary shit and can cause a lot of anxiety, but please please for the love of god-

Do not avoid looking at your finances.

I cannot stress this enough. I'm in no real position to give any meaningful advice other than that. Keeping an eye on your finances and looking at them at least once a week will help break the cycle of money avoidance.

I spent most of my life being super money avoidant due to how I was raised and it caused me to get into a really rough patch because I straight up missed nearly a year of student loan payments. It very nearly fucked over my whole financial life. Thankfully it has a happy ending- I paid off my loans in 2019 and have effectively repaired my credit score (after a lot of work.)

I am currently helping some family members budget for student debt repayments because I had both fucked around and found out, so I'm trying to use that recovery and lessons learned to help the people in my life.

Please please please keep up to date with your own finances. Budget (it's honestly really easy even though it sounds intimidating.) Gamify it if you gotta. Just be sure you are looking at your account and are aware of your money situation at all times.

701 notes

·

View notes

Photo

#nintendo#animal crossing#funny#finances#money#gaming#video games#home#house#mortgage#dog#new horizons#acnh#villagers#tom nook#switch#nintendo switch#lol#humor#meme#relatable#economy#animal crossing new horizons#ac

881 notes

·

View notes

Text

PICK A CARD - 10 things you should do to become the person you want to be in 2023.

PILE 1 //

You can explore your sensual energy.

Remimance on your pain in order to understand how much you have grown.

Enjoy your own star power (writing, singing etc.)

Moses Sumney has a song that says "Think about who gave them their definitions and rewrite those definitions for themselves". Sometimes what you think of yourself comes from someone else's wrong opinion of you - do the work to define you.

Learn more languages, interact with people from different cultures etc. (Make sure you're engaging with people outside of your bubble.

Be more direct, especially with your romantic interests and partners. I see more of "do you want this to be something more?", "how do you feel about me?"

FLIRT (check my flirting PAC on my master list).

Budget in such a way that you have some extra savings that will go toward life's pleasures; get that bag you want, go on a trip etc.

Say NO more - stand your ground and speak up for yourself. Your inner child deserves it. You deserve it.

Attend more live shows and concerts.

PILE 2 //

Take care of building your finances, school or work career - a major focus of the year.

Trust in your own feelings and instincts about other people instead of going with whatever people have to say.

Identify the bad habits you may have, compassionately release them and practice a new helpful habit.

You might struggle with your emotions, and to help you stabilize them, you need some tools. Whether that's having emergency affirmations, meditation, eft tapping, sleeping etc.

A lot of you are transitioning from youth into adulthood and I'm seeing that you need to focus on pushing yourself into the adult role. It'll help you with your responsibilities and socially.

Remain hopeful in love but take care of your feelings.

Instead of asking people for advice and validation, try to tap into your own inner power for the answers.

Prompt more conversations with other people. Get to know other people more. Be more curious - it's good for your own social growth.

Very specific but you may carry spiritual/religious trauma, release the resentment - PLEASE. It gets in the way of how you perceive yourself.

Give yourself credit often. Celebrate your wins. Don't just let life pass you by.

PILE 3 //

You're doing so well. Make some room for some fun - blast music, dance more etc.

You've been alone for too long - you need a kiss or two. Make the effort to date or manifest more romantic opportunities. You deserve it.

Shake off regrets and move forward owning your life and your power. This is your life.

Put more effort into your body and health. Walk more, yoga, weights etc,

Your doubts and fears are just a shadow of your old self. Do everything to maintain the new you. The ideal version of yourself. Stop falling for that trap.

Avoid your ex relationships (family or friendships) and if you can't, take care of yourself as you interact with them. It might set you back a lot. If you're with someone new (romantically or not), do not compare them to those ex relationships.

Doors are opening. Walk through them all.

This needs to be emphasized, you keep replaying bad memories with people from your past, please do the work to overcome this. Let it go. Cut those cords. It keeps you stagnant.

Latto says "Money talks and I speak fluent". Heal your relationship with money. Make space for more money.

Increase your productivity and do the projects, goals etc. you've always had in mind.

#pick a card reading#pick a pile#pick a picture#pick a card#free tarot reading#tarot reading#tarot readers#hello 2023#empowerment#desire#affirmations#meditation#finances#fs reading#free intuitive readings

2K notes

·

View notes

Text

Financial strain can impact far more than just a person's mental health.

A nationally representative study from the United Kingdom has found evidence that stress over money is tied to long-term changes in key health markers, including those associated with the immune system, the nervous system, and the hormonal system.

Continue Reading.

190 notes

·

View notes

Note

Testament to pet insurance because I feel you guys would appreciate it: I adopted my new kitten, Gargoyle, today. I had arranged for him to go to the vet 3 days ago for his first vaccines and wellness exam so I could set up his insurance asap, even though he was still going to be with his foster for a few more days. LAST NIGHT he hurt his leg and his foster mom had to take him to emerg (not broken, thank god, but it was still 800$ for xrays and pain meds). Because I had that insurance set up already (and the company waived my 30 day waiting period when I set it up), I only had to pay 200$ out of pocket! SO GLAD I got it set up the day I decided to adopt him. Moral of the story for everyone on the fence about pet insurance: get it while they're young and don't have problems yet!!!!

Anyway, here's my stinker:

He's getting around just fine, despite the cast he has to have on for the next 5 days.

vet-and-wild here.

Shameless boost to encourage more people to get pet insurance. I have it, most of my coworkers have it, and I encourage every new client to get it. It's such a game changer.

Please keep in mind though that most insurances won't cover pre-existing conditions! It always sucks when I have to tell a client that no, they can't go out and get insurance for the cancer we just diagnosed. Pet insurance also reimburses you, they do not pay up front; it is NOT like human insurance. Consider something like Care Credit if you need help paying for services up front. I have both, and so do a lot of my coworkers.

176 notes

·

View notes

Text

Black parents >

372 notes

·

View notes

Text

Solar Return : Finances (2nd House)

Solar Return 2nd House in Aries: You may find yourself eager to invest in entrepreneurial ventures or take on new financial risks that could yield immediate returns, but it's important to ensure these ventures are well-thought-out and align with your long-term financial goals.

Solar Return 2nd House in Taurus: Focus on building a steady savings plan or exploring stable investment opportunities that provide a reliable and predictable income source, allowing you to feel financially secure and prepared for any unexpected expenses that may arise.

Solar Return 2nd House in Gemini: Explore various freelance opportunities or part-time jobs that leverage your diverse skill set and offer flexible earning potential, ensuring that you maintain clear and organized records of your income and expenses to manage your finances effectively.

Solar Return 2nd House in Cancer: Consider investing in real estate or other stable long-term assets that provide both financial security and emotional comfort, ensuring that you create a well-structured budget that allows for both practical saving and occasional indulgences that bring you joy.

Solar Return 2nd House in Leo: Channel your creativity into monetizing your passions, such as starting a side business or pursuing artistic endeavors that have the potential to generate additional income, while also being mindful of creating a sustainable financial plan that supports your creative ambitions.

Solar Return 2nd House in Virgo: Focus on organizing your financial records and exploring investment opportunities that are based on thorough research and careful analysis, ensuring that you prioritize practical and cost-effective solutions that align with your long-term financial stability and personal values.

Solar Return 2nd House in Libra: Collaborate with trusted partners or consider investment opportunities that emphasize fairness and mutual benefits, ensuring that you maintain transparent communication and legal clarity in any financial agreements to maintain a harmonious and balanced financial portfolio.

Solar Return 2nd House in Scorpio: Evaluate high-potential investment options that involve calculated risk-taking and in-depth research, ensuring that you remain aware of the potential for financial fluctuations and have contingency plans in place to manage any unexpected changes in your financial situation.

Solar Return 2nd House in Sagittarius: Embrace opportunities for professional growth and consider investing in educational pursuits or travel experiences that can expand your skill set and open up new income streams, while also maintaining a well-planned financial strategy that supports your adventurous endeavors.

Solar Return 2nd House in Capricorn: Focus on building a strong financial foundation through disciplined saving and conservative investments that prioritize long-term stability over short-term gains, ensuring that you approach financial planning with a pragmatic and realistic mindset to achieve sustainable wealth.

Solar Return 2nd House in Aquarius: Explore innovative investment options or consider contributing to socially responsible projects that align with your values and have the potential for long-term financial growth, while also maintaining a balance between your progressive financial approach and the need for practical financial security.

Solar Return 2nd House in Pisces: Trust your intuition when making financial decisions, and consider investing in charitable causes or artistic pursuits that bring you emotional fulfillment, while also maintaining a realistic and well-organized financial plan that balances your compassionate nature with the need for practical financial stability.

#astrology#astrology aspects#astrology observations#astrology finance#finances#solar return#astrology solar return#solar return 2nd house#2nd house

140 notes

·

View notes

Text

We ask your questions so you don’t have to! Submit your questions to have them posted anonymously as polls.

#polls#incognito polls#anonymous#tumblr polls#tumblr users#questions#miscellaneous polls#submitted nov 21#money#finances#financial#credit score#personal finance

254 notes

·

View notes

Text

This is your sign.

Your money situation is turning around for the better.

16K notes

·

View notes

Text

How I Built an Emergency Fund, inspiration I deeply hope is helpful

As the blog URL says, this is not financial advice. This is how I did this thing, and I am posting it here, publicly, in hopes that it helps you should you need this information.

In short: Remix this advice to what fits your life + do not sue me if this goes poorly for you. This is for Americans, if you do not live in America and/or your money is not in America, I hope this is a useful base.

None of these links are affiliate links.

I write these things as a mental shift. I like to ramble and I wish I had someone tell me this stuff 20+ years ago. I'm hoping this helps you.

This is an incredibly long post so I'm putting it under a KEEP READING.

This post goes over two stages: "short term + not life-or-death" and "long term + actual life or death"

Part 01: SHORT TERM + NOT LIFE-OR-DEATH FUND

You need to find a high yield savings account that is FDIC insured. Ally is a popular bank for this.

Functionally, the only difference between a "high yield savings account" and "savings account" from the giant conglomerate bank down the street is the interest rate.

I do not know why non-high-yield savings accounts exist. I'm guessing because legally they can, and I hate it.

Moving away from my personal socioeconomic views to return to advice.

"FDIC insured" is not something you pay for. It is nearly universal on savings accounts. If a savings account, or a checking account, does NOT have it, then you should not put your money there. Something is wrong with that bank.

FDIC means if your bank goes out of business, your account is insured up to $250,000, per account, by the government. So if your bank goes out of business, the government makes sure you still have your cash (up to $250k).

A high-yield savings account means your cash is available whenever you need it.

Other products, like CDs, exist, but this ramble is designed to be as simple and starter as possible. Begin with a high yield savings account, build up from there as you do your own research + compare this to your needs.

Do not accept an account that has minimum balances. Do not open an account with monthly fees.

Touch this account as little as possible.

For every $1 you put in, every month, a few pennies will materialize. It's not much, but the main point is at every level, your money works for you.

Rich people do this. You can too.

Touch this account as little as possible.

You can have multiple savings accounts.

I personally have a savings account in the above structure designed for "oh hell I am kinda screwed, but will be okay, just need a buffer."

"How much should I have in there?" you might ask. Common advice says "3-6 months expenses" which is a lot. I say "start with literally $1 and continue as you can until comfortable with what is possible, for you, at this time."

Will $1 make you rich? No.

Will it save your life in a bad situation? Probably not.

Does this $1 essentially become a tiny robot that is making you money for as long as it is docked into its cargo bay? ...weird metaphor but we'll go with it, sure.

Ultimately is it a start? Yes.

You can have multiple savings accounts. You can have a savings account "this is for short term emergencies" and "this is for... slightly less short term" etc.

It costs you nothing to have multiple. They all operate in the same way. It's handy to have them all at the same bank because it can make transferring cash easier.

Part 02: LONG TERM + ACTUAL LIFE-OR-DEATH FUND WITH RISK SO BE CAREFUL

Once you have your savings account set up, and it's being funded on a regular basis (every week, every paycheck, every month, every quarter -- whatever works for you), look into creating a second, bigger, more dangerous-term cash reserve.

I like my Roth IRA. This is a link to a proper finance blog that has a lot of details. I am trying to make this handy/simple to get started.

401ks and (non-Roth) IRAs are funded with pre-tax dollars, frequently in conjunction with your job.

Normally, cash goes from job -> government takes a slice -> you.

Pre-tax retirement accounts, cash goes from job -> retirement takes the percentage you decide -> government takes a slice of what is left -> you

Roth IRAs, job -> government takes a slice -> you -> Roth IRA

The benefit to pre-tax retirement accounts being, because the cash going in is pre-tax, there is more of it.

It can grow faster in the stock market or other places your particular fund allows you to put cash into.

The taxes come out when you withdraw -- usually retirement -- because if you withdraw before you retire, you are heavily penalized with extra fees.

That's why Part 02 is a ROTH IRA. Your money has already been taxed -- job -> government's slice -> you -> Roth IRA.

This means the money is yours, already taxed. If you withdraw the gains, those get taxed, but the base, that's yours.

If you invest $100 and it grows to $105, you can withdraw $100 without paying fees or taxes. If you withdraw that extra $5, that is when taxes start to come into play. If you withdraw $100, and leave the $5, the $5 continues to grow, and that extra growth is taxed if withdrawn. So try not to touch it (ideally you leave all of it until retirement).

This is why this is an emergency, life-or-death only, account. You tap it only when you need to when all other choices are wretched and ruinous.

There is an annual limit as to how much money you can put into a Roth IRA (several thousand bucks).

You can start them very small. Like $20 or maybe less.

Look for a bank or institution that does not charge fees to open and maintain one.

AT EVERY STEP YOU SHOULD BE AVOIDING FEES

Here are smart people talking about ideas on how to get started.

Okay, so, what do we do now with this fancy roth thing.

Here is where things get... uncomfortable.

A Roth IRA is an account type.

You need to do something with your money.

The reason you have this in addition to, and secondary to, your high-yield savings account is because this is an investment vehicle, the balance is going to go up and down, and may reach $0.00.

For my Roth IRA, I like "exchange traded funds" -- ETFs.

There are a lot of options -- you can invest in most anything

Because my Roth IRA is built for "help me I'm dying" emergencies, I invest in a mix of S&P 500 index funds and small-cap funds.

SO MANY WORDS.

Let's break this down what this means.

S&P 500 index funds: This is an index fund of giant, giant, giant companies.

An index fund is like a stock. But instead of a single company, it tracks (owns shares of) an index -- like the DOW or Nasdaq. Or countries. Or... the entire market for oil. Etc.

The metaphor isn't completely accurate, but I like to think of it as "an index fund is a company that owns tiny bits of other companies."

Like, okay, say you have SlimeIndexFund and a share price is $40.

In this example, SlimeIndexFund owns $10 worth of "BardCo" and $10 of "ThiefCo" and $10 of "MermaidCo" and $10 of "EvilCo".

Let's say EvilCo does a lot of evil and is now worth $15, and MermaidCo does a lot of mermaid stuff and is now worth $15, and BardCo sings out of tune so is now worth $5. ThiefCo is oddly at the same $10 but we're scared so we're leaving ThiefCo to stay at $10.

A share in SlimeIndexFund is now worth $45. ($5 BardCo + $10 ThiefCo + $15 EvilCo + $15 MermaidCo)

This is diversification

Because I bought an index fund, instead of just buying BardCo, my risk is less.

Had I bought all MermaidCo, my return would be higher -- but this is a much bigger risk.

The entire purpose of this set up of a Roth IRA is TO MINIMIZE RISK.

Your Roth IRA should allow you to buy "fractional shares" and if it doesn't fuck that bank, go somewhere that does.

In the above example, SlimeIndexFund is $40/share and at that price you are getting the full benefit of 1 share.

Let's say you have $10.

You buy a fractional share of SlimeIndexFund for $10, which is 25% of 1 share.

So when SlimeIndexFund shares raise from $40 -> $45, your fractional share goes from $10 -> $12.50.

Not all funds and stock shares (etc) have fractional shares, most do.

It's a great way to start and build.

Small-cap funds: These operate in literally the same way. The difference is the companies are (in comparison) much smaller. They tend to be more nimble.

So I am diversifying between "here is a fund, it has a lot of large companies" and "here is a fund, it has a lot of small companies."

Let's say Big Office Building real estate goes down, but the sale of Small Company Making waffles goes up. This mixes together and I'm less in danger of losing money, or losing much money.

You can pick individual stocks.

The reason it is not recommended, by nearly everyone, is because the market has incredible tools and power over individual stocks.

By using any kind of fund that bundles things together, you are thereby automatically using these tools by proxy

It is critical to understand this is the stock market. Your account will go up and down. It may go down A LOT, like 25%, and take years to recover. Maybe it goes down 100% to literally $0.00.

That's why this is the LAST RESORT EMERGENCY FUND.

So why are we doing this.

This feels... wrong?

The potential for growth is significantly higher than a savings account. Adjusted for inflation, somewhere in between 6-7%.

At this rate, if you can leave your initial deposit alone for somewhere between 10 - 13 years, it has doubled.

This equation recalculates every time you make a deposit. So if you can deposit $20 every pay check, it has the potential to grow very quickly.

As above, this is the stock market, so it can also get wiped out.

But given the stock market has historically always recovered, though it may take several years, the risk is worth it to me + a lot of other people.

The reason this is built as a last-resort cash bucket is because of this risk. Before moving into this arena, you should have other cash buckets as a buffer.

Your RISK is it goes down. Which it will frequently.

Your REWARD is if it goes up. Which historically it has far more than it went down.

The PURPOSE of using funds as described above is so you don't have try to guess who the next Amazon is and wind up picking the next Pets.com (which went out of business, like, a long... long time ago).

The people making the funds figure out who is Amazon and who is Pets.com and work, day and night, to make your money grow and/or protect it when outside influences are hurting the market.

They are incredibly equipped to do this and their literal livelihood is on the line when they do it poorly.

Which is a polite way of saying, they are continuously incentivized above all else to work for the fund you're investing in.

The reason you're doing this in a Roth IRA specifically is you're hoping to keep as much of it intact, as possible, until you retire, at which point -- if you've followed fairly simple rules -- you withdraw the base and gains tax-free.

Whereas money in a normal stock account? Those gains are taxable every year.

"I have literally $20 I can save per pay check! Can I put in $15 into a high-yield savings account and $5 into a Roth IRA to get started?!"

Yes!

Also, congrats! You're diversifying already!

Your Roth IRA broker should allow you to invest a minimum of $1 at a time, and buy fractional shares. If they don't, don't sign up with them!

Lean heavily into your high-yield savings account until that is very comfortable and thick, then push money into the Roth IRA.

Your goal is to build a system that works for you -- both literally (money working for you) and emotionally ("this is comfortable")

"Should I pay off debt before proceeding? A lot of people say to pay off excess debt first."

This is up to you.

Most financial blogs etc. do say "focus on paying off debt first" -- it's good advice, your returns are risk-free and permanent, since the lower your debt is, the less you have to pay over time.

Interest -- working for you or against you -- is continuous and eternal.

Personally, I like to diversify everything, so I not-financial-advice ramble "do all three -- pay down debt, throw a little cash into a high-yield savings, throw a little cash into a Roth IRA"

The problem with "pay off debt first" is that it misses out any occasional giant gains the stock market makes (Roth IRA) and introduces the risk of "I have paid this credit card on time for 5 years, I'm short on change for 3 months due to a situation that gets resolved quickly, and now I have a late payment fee, and a higher interest rate."

Look at your life, finances, and potential future and make decisions!

And also:

Always be on the look out for deals with banks. Sign up bonuses, referral links from friends, etc. Think of it as a money sale.

If you are not comfortable with the idea of a Roth IRA hitting $0.00 potentially, do not do step 02. These are ideas, not directives.

All financial tools can be used for different purposes. All of them. Thus -- these are ideas, not directives.

I am listing a few examples of banks, funds, etc. These are not recommendations nor are they affiliate links. They are listed because I want to maximize your start on this path, but caution, in strongest possible terms, you must do your own research and figure out what makes sense for you.

There are a lot of nuances I am paving over for the sake of simplicity, which is why I am continually saying...

...c'mon say it with me...

...you must do your own research before continuing

Smart, free sites that cover this + a lot of other stuff:

NerdWallet

Bank Rate

One final note about Roth IRAs:

Robinhood currently is offering a 1% match on an IRA. Considering the strict limits of how much an IRA can intake per year, it's not much, but it doesn't cost you anything. Money on sale!

As a final note -- always feel comfortable asking people handling your money for help. They are working for you. Your money works FOR YOU.

If you are uncomfortable, leave, immediately, without concern.

At the retail level, there are hundreds of banks and financial institutions clamoring for your business. If someone makes you uncomfortable for not knowing something, or getting a term wrong, or asking "too many" questions -- go somewhere else.

It doesn't matter if your account is literally worth $20.

They are working for you.

This is a business transaction, and if they make you feel like your time isn't worth their business, I promise you there is someone else who will gladly take care of you.

I end with -- whenever someone is giving you financial advice, always ask why. It helps ensure they aren't scamming you, it's just a good business practice.

I like to ramble, it helps me mentally

I like to be useful, I want the world to be significantly more balanced in terms of who is doing okay

I like to write, this is all good practice for me in doing Various Other Things I do

I fucking hate predatory financial practices. I was gatekept out of financial literacy for decades and so every time I help someone else figure out how to set up their own life and protect themselves it is a giant "fuck you" to the systems and directly to the people who stood in my way.

561 notes

·

View notes

Text

Whumpee starts a hobby or a collection, something that offers them a sense of control and oversight in the aftermath of what happened, but it doesn't help when they would rather channel all of the admittedly tight finances toward that than the medical supplies they need to recover in other ways

102 notes

·

View notes

Text

‘When scientists like me advocate for healthy and environmentally-friendly eating, it’s often said we’re sitting in our ivory towers promoting something financially out of reach for most people. This study shows it’s quite the opposite. These diets could be better for your bank balance as well as for your health and...the planet.’

Oxford University research has today revealed that, in countries such as the US, the UK, Australia and across Western Europe, adopting a vegan, vegetarian, or flexitarian diet could slash your food bill by up to one-third.

🌱 🌼 ✨ 🌱 🌼 ✨ 🌱 🌼 ✨

It found that in high-income countries:

Vegan diets were the most affordable and reduced food costs by up to one third.

Vegetarian diets were a close second.

Flexitarian diets with low amounts of meat and dairy reduced costs by 14%.

By contrast, pescatarian diets increased costs by up to 2%.

#txt#veganism#solarpunk#food centric herbalism#sustainability#vegan#plant based lifestyle#holistic leveling up#leveling up#environmentalism#animal liberation#animal exploitation#adulting#finances#that girl#green juice girl#glow up#mindful consumption#mindful living#mindfulness#consumerism#ethical consumption#yeahhhh I've never known anyone to find it more expensive. it really seems a huge misconception#earth stewardship#today i learned#sidewalkchemistry

221 notes

·

View notes