#Auto Loan

Text

I’m so exhausted. I did so much at storage this weekend. A total of 9.5 hours of going through stuff and moving boxes. It took so much out of me. Plus I’m worried about Chloe being sick and about it costing money and about having to buy a new car and having to take out an auto loan. I have rarely napped since starting the Provigil, but I’ve napped for a few hours every day this week, without feeling rested. I’m frustrated at how many recovery days I seem to need. Cfs/me really sucks when it flares. And I have to get up early again tomorrow because Chloe has a checkup appointment at 10:30. I think I’m going to sleep right where I am in the recliner because Chloe is comfortable in her hammock. This way I can have her near me and know she’s ok. I know I’m just babbling at this point. Thank the exhaustion and anxiety. I just want my girl to be ok, and I hate that I worry about the money as much as I worry about her getting better. Does that make me a horrible person?

#always exhausted#so tired#cfs/me#me/cfs#chronic fatigue#recovery days#Provigil#modafinil#storage#downsizing#lilmisschloe#chloe#cats#cars#money#auto loan#finances are scary and overwhelming#especially when you’re broke

4 notes

·

View notes

Text

7 things home loan, auto loan borrowers need to know about MCLR

7 things home loan, auto loan borrowers need to know about MCLR

An increase in the inflation rate, the ongoing Covid-19 pandemic and the war in Ukraine have created uncertainties for the financial market across the world. The cost of fuels has already gone up significantly, and now there are signs lending rates will also get expensive.

Are you an existing loan borrower or a new customer planning to buy a house or a new car? You cannot afford to ignore this…

View On WordPress

#auto loan#home loan#Interest rates#loan#loan borrowers need to know about MCLR#Marginal Cost of Funds Based Lending Rate#MCLR#personal loan#RBI

2 notes

·

View notes

Text

Discover how much you can save with Heritage Financial Credit Union's Auto Loan Refinance Calculator. Easily compare your current loan with our refinancing options to see your potential savings. Whether you're looking to lower your monthly payments or pay off your car loan faster, our intuitive calculator provides the insights you need. Make an informed decision about refinancing your auto loan and unlock financial benefits today. Start your journey to savings with Heritage Financial Credit Union.

#Auto Loan Refinance Calculator#Auto Loan Refinance#Auto Refinance Calculator#Auto Loan Calculator#Refinance Calculator#Auto Loan

0 notes

Text

Best Finance Company for Commercial Car Loans in India.

https://www.skfin.in/loan/car-loan

0 notes

Text

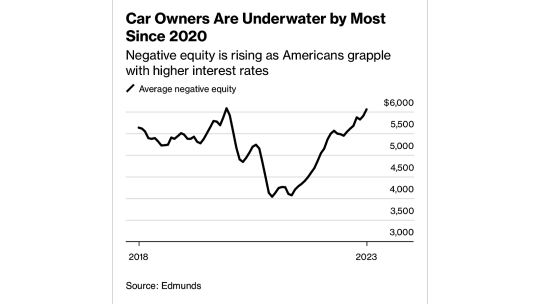

#Car #loan: Negative equity on automobiles is at the highest level in more than three years, with higher prices and borrowing costs hitting owners.

https://www.bloomberg.com/news/articles/2023-12-16/used-car-prices-drop-as-negative-equity-slams-buyers?utm_source=website&utm_medium=share&utm_campaign=twitter via @wealth #autoloan #clo #vehicle #credit #consumer #investor

0 notes

Text

https://www.psbloansin59minutes.com/knowledge-hub/driving-towards-your-dreams-unlocking-the-power-of-auto-loans

Driving towards your dreams: unlocking the power of Auto loans

Drive to success with auto loans! Unlock the door to your dreams by financing your dream car. Explore the power of auto loans today.

#onlinepsbloans#psbloansin59minutes#loans#digitalloanapproval#digital approval#auto loan#car loan#bike loan

0 notes

Text

How to Pay Down Your Car Loan Wisely

View On WordPress

1 note

·

View note

Text

Understanding Commercial Auto Loan Rates: A Comprehensive Guide

When it comes to acquiring commercial vehicles for your business, understanding the nuances of commercial auto loan rates is crucial. In this comprehensive guide, we will delve into the factors that influence these rates and provide you with valuable insights on securing the best rates for your company's needs.

Factors Affecting Commercial Auto Loan Rates

1. Creditworthiness: Your business's credit score and financial history play a significant role in determining the interest rates you'll be offered.

2. Loan Term: The length of the loan term affects the interest rate. Shorter terms usually come with lower rates, while longer terms may have higher rates.

3. Vehicle Age and Condition: The age, condition, and mileage of the commercial vehicle you wish to finance can impact the loan rates. Newer and well-maintained vehicles generally qualify for better rates.

4. Down Payment: Making a substantial down payment can help lower your interest rate as it reduces the lender's risk.

5. Industry and Business Profile: Certain industries and business profiles may be perceived as higher risk, resulting in higher interest rates.

6. Lender Competition: Interest rates can vary among different lenders. It's essential to shop around and compare offers to find the most favorable rates for your commercial auto loan.

Tips to Secure the Best Commercial Auto Loan Rates

1. Improve Your Credit: Strengthen your business's credit profile by paying bills on time, reducing outstanding debts, and resolving any inaccuracies on your credit report.

2. Save for a Larger Down Payment: Accumulating a larger down payment will not only reduce your loan amount but also increase your chances of qualifying for lower interest rates.

3. Research Lenders: Look for lenders who specialize in commercial auto loans and compare their rates, terms, and customer reviews. Consider both traditional financial institutions and online lenders.

4. Consider Refinancing: If you currently have a commercial auto loan with a high-interest rate, explore refinancing options. Refinancing can help you obtain better rates and save money over time.

FAQs

Q1: Can startups qualify for commercial auto loans?

A1: Startups can qualify for commercial auto loans, but they might face more scrutiny due to their limited operating history. Establishing a solid business plan and showcasing a strong personal credit score can improve your chances of approval.

Q2: How long does the loan approval process usually take?

A2: The loan approval process varies among lenders. It can range from a few days to a few weeks. Online lenders often provide quicker turnaround times compared to traditional banks.

Q3: Is it possible to finance multiple vehicles under a single commercial auto loan?

A3: Yes, it's possible to finance multiple vehicles under a single commercial auto loan. This can streamline the application process and potentially result in better rates.

Conclusion

Understanding commercial auto loan rates is essential for businesses looking to finance vehicles. By considering factors such as creditworthiness, loan terms, vehicle condition, down payment, industry profile, and lender competition, you can make informed decisions to secure the best rates. Remember to improve your credit, save for a larger down payment, research lenders, and consider refinancing options. With careful planning and thorough research, you can find favorable rates that suit your business's needs and contribute to its success.

0 notes

Text

Explore the convenience and benefits of getting pre-approved for an auto loan at Heritage Financial Credit Union. Get peace of mind by knowing your budget and securing a competitive interest rate before visiting the dealership. Our trusted credit union offers a streamlined application process, quick approvals, and personalized loan options.

#pre-approved for an auto loan#pre-approved an auto loan#pre-approved for auto loan#pre-approved for a auto loan#pre-approved aut#auto loan

0 notes

Text

Since 2004, we’ve been dedicated to providing hardworking people with the funds they need fast.

#personal loans usa#personal loans online usa#sandstone financial#auto loan#san antanio#auto refinance loan#solar loan#personal loan online#united states

0 notes

Text

Looking for Quick Finance in Australia? Look no further than EFT Capital!

We also provide a substantial selection of additional lending options as a leading supplier of same-day secured and unsecured loans, as well as a range of other financial services like business loans, debt consolidation, and auto loans.

We are dedicated to helping you reach your financial objectives and take pride in providing prompt, trustworthy service to each and every one of our clients.

Whether you need money to start a new business, restructure debt, or purchase a car, EFT Capital has the knowledge and tools to help you swiftly acquire the capital you need.

So why continue? Get in contact with us right away to find out more about our services of quick finance Australia and how we can help you meet your financial goals.

#quick loans#fast loan#instant cash loan#Australian loans#personal loan#fast loans#auto loan#debt consolidation

0 notes

Text

Auto Loan Calculator: How to Get an Auto Loan in the USA - Requirements and Process

Auto Loan in the USA: Requirements, Process, and Using the Auto Loan Calculator on Allcalculator.net

As per Allcalculator.net’s Auto Loan Calculator, When purchasing a new or used car in the USA, many buyers opt for auto loans to finance their vehicle. If you're considering getting an auto loan, it's important to understand the requirements and the process involved. This comprehensive guide will walk you through the steps, empowering you to make informed decisions and secure the best possible terms.

Assess Your Financial Situation:

Before applying for an auto loan, closely examine your finances. Evaluate your income, expenses, and credit history. Lenders will consider these factors to determine your eligibility and interest rates. Allcalculator.net offers a user-friendly Auto Loan Calculator that can help you estimate your monthly payments based on the loan amount, Interest rate, and loan term. Using the calculator, you can adjust the variables to see how different loan amounts and terms affect your monthly payments. This way, you can determine a loan amount that fits your budget.

Check Your Credit Score:

A good credit score greatly improves your chances of obtaining favorable auto loan terms. Request a free credit report and review it for any errors or discrepancies. If your credit score is lower than desired, improve it before applying for a loan. Paying bills on time, reducing existing debt, and correcting inaccuracies on your credit report are all effective strategies. Allcalculator.net provides valuable resources and tools to help you understand and improve your credit score. Their credit score calculator can estimate your credit score based on various factors, allowing you to track your progress over time.

Also Read: Simplifying Auto Loans: Understanding and Utilizing an Auto Loan Calculator

Allcalculator.net is your one-stop destination for all kinds of calculators. Whether it's simple arithmetic, complex math, financial planning, or health-related calculations, Allcalculator.net has you covered. With a user-friendly interface and accurate results, our site ensures efficiency and convenience for all your computation needs. Explore Allcalculator.net today and experience the power of smart calculations

0 notes

Text

Looking for a car loan? Get quick digital approval for an auto loan at psbloansin59minutes. Apply now!

Download PSB59 App.

#business loan#onlinepsbloans#loans#auto loan#car loan#digital approval for loan#digitalloanapproval#digital car loan#PSB59#quick car loan approval

0 notes