#ARK Genomic Revolution ETF

Text

Cathie Wood's Ark Invest Adds $23M Of Verve Therapeutics Shares As Stock Drops 10% In A Month - Verve Therapeutics (NASDAQ:VERV)

Cathie Wood’s Ark Invest Adds $23M Of Verve Therapeutics Shares As Stock Drops 10% In A Month – Verve Therapeutics (NASDAQ:VERV)

Cathie Wood-led Ark Investment Management on Friday raised its stake in clinical stage genetics medicine company Verve Therapeutics Inc VERV via two of its exchange-traded funds. Together, the flagship ARK Innovation ETF ARKK and the ARK Genomic Revolution ETF ARKG bought over 675,000 shares, valued at over $23 million, based on Friday’s closing price.

Verve is the 12th largest holding in the ARK…

View On WordPress

0 notes

Photo

Cathie Wood Watch: Ark Buys a Spectrometry Stock, More Biotech Ark ETFs also bought shares of a 3D printer maker and a robotics software provider. Renowned investor Cathie Wood, chief executive of Ark Investment Management, on Tuesday continued her recent patterns, buying biotechnology stocks, a spectrometry stock, a 3D printer maker and a robotics-software stock. She also sold a financial technology stock. (All the valuations below are as of Tuesday’s close.) Ark Genomic Revolution ETF (ARKG) - Get ARK Genomic Revolution ETF Report purchased 119,876 shares of biotech company Personalis (PSNL) - Get Personalis, Inc. Report, valued at $890,679. Ark Genomic Revolution snatched 100,007 shares of spectrometry company 908 Devices (MASS) , valued at $1.9 million. Spectrometry has applications in detection of chemicals, explosives and illegal drugs as well as in medicine and other fields. Ark funds snapped up 76,301 shares of biotech company Invitae (NVTA) - Get Invitae Corp. https://fancyhints.com/cathie-wood-watch-ark-buys-a-spectrometry-stock-more-biotech/?utm_source=tumblr&utm_medium=social&utm_campaign=ReviveOldPost

0 notes

Text

Cathie Wood's ARK ETFs Are in a Deep Hole—Already

Cathie Wood’s ARK ETFs Are in a Deep Hole—Already

Text size

Cathie Wood of ARK Invest

Reed Young

The new year didn’t bring a fresh start for Cathie Wood’s ARK Invest, a fund company known for its focus on innovation stocks and high price targets.

The firm’s flagship

ARK Innovation

exchange-traded fund (ticker: ARKK) plunged 7.1% in Wednesday trading, marking its worst day since Sept 3, 2020. All of ARK’s other ETFs, including the…

View On WordPress

#ARK Fintech Innovation#Ark Fintech Innovation ETF#ARK Genomic Revolution#ARK Genomic Revolution ETF#ARK Innovation#ARK Innovation ETF#ARK Next Generation Internet#ARK Next Generation Internet ETF#ARK Transparency#ARK Transparency ETF#ARKF#ARKG#ARKK#ARKW#Autos#C&E Industry News Filter#Content Types#corporate#Corporate/Industrial News#CTRU#etfs#Exchange Traded Funds#Factiva Filters#Financial Investment Services#Financial Services#financial vehicles#Fintech#funds#Growth Investing#industrial news

0 notes

Text

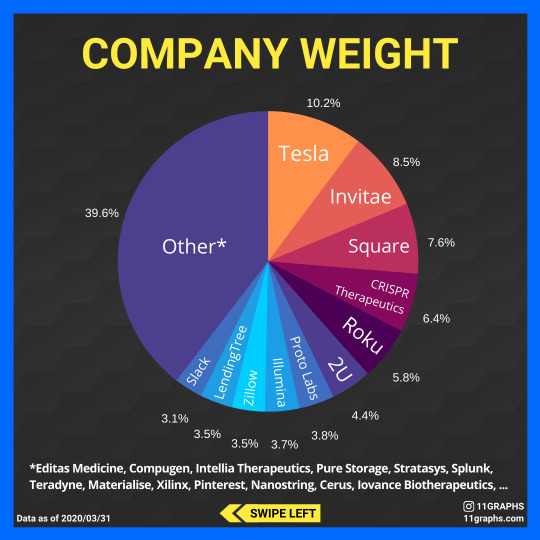

Cathie Wood Top Holdings

Here are the stocks in which Cathie Wood (CEO of ARK Invest) has invested the most through its ETF $ARKK!

ARK Invest holds a precision lens on thematic investing. They focus on disruptive innovation and identify themes that will enhance productivity and create wealth. ARK seeks to research and invest in technologically enabled innovation that cuts across economic sectors and changes the way world works. The current themes include Industrial Innovation, Next Generation Internet, FinTech, and the Genomic Revolution.

-

*Remember this isn't investment advice, just general information only. Any investing involves risks.*

-

❤️ Like | 👇 Save | 📣 Share | 💬 Comment

🏆 Many thanks for your support 🏆

-

👉Follow @11Graphs for more👈

👉Follow @11Graphs for more👈

5 notes

·

View notes

Text

Los ETFs ARK mucho mejor que Nasdaq "aún en corrección"

Los ETFs ARK mucho mejor que Nasdaq “aún en corrección”

Es hasta paradójico que los tres ETFs confeccionados por Cathy Wood para su firma ARK INVEST denominados Ark Innovation, Ark Genomic revolution y Ark Next Generation lleven corrigiendo desde febrero y aún así con un Nasdaq imperial le saca una ventaja muy considerable partiendo de marzo 2020 la comparativa.

Para nosotros los ETF de ARK realizaron una corrección en la típica abc no al 61,8% sino…

View On WordPress

0 notes

Text

Cathie Wood is Making Better Investment Decisions than Warren Buffett

If you have any interest in money and investing, then you will have heard of Warren Buffett. Chances are that you’ve heard of him even if you don’t. The CEO of Berkshire Hathaway, Buffett, is in the top 10 richest people in the world — the 6th richest in Dec 2020, according to Business Insider. He has an estimated wealth of $85 billion.

Buffett famously lives a simple, frugal life despite his vast wealth. Now 90 years old, he still lives in the house he bought in the 1950s and drives a 2014 $24k Cadillac.

His frugality makes him a fascinating individual. How can someone who gets so much enjoyment from pursuing growing his money be so uninterested in spending money?

This is his secret sauce. Investing is a psychological game as much as it is having finance and business knowledge. He is motivated by the game itself rather than the fruits of the game. He is driven not by wealth itself but by staying true to his values. He has committed to donate all his vast wealth to charity rather than bestow it to his children.

For all these reasons and more, there’s no other investor in the world with Buffett’s profile. Or is there? If you haven’t heard of Cathie Wood yet, then you will soon.

If Buffett was the type of investor that was successful in the 20th century, then Cathie Wood is the one to watch and emulate in the 21st century.

Warren Buffett doesn’t invest in anything that he doesn’t understand. He doesn’t invest in technology, making an exception for Apple. He follows the Benjamin Graham school of value-based investing, finding a stock that is low in price based on the intrinsic worth — a subjective concept with no universally agreed definition.

To build his view of intrinsic value, Buffett uses his working time to understand the underlying businesses he is interested in. He spends 5–6 hours a day reading company reports and business sections of newspapers. The companies he invests in are those he believes will generate earnings — those that will make money in the long term.

As a result, the Berkshire Hathaway portfolio is full of old-school companies such as Coca Cola, Bank of America and ExxonMobil. The reliable stockmarket stalwarts.

This strategy has served Buffett well over the years, with Berkshire Hathaway outperforming the stock marketing by growing at 20% every year since it’s inception. Until recently, that is.

Even the Oracle of Omaha wasn’t able to outperform the losses of 2020. In fact, Berkshire Hathway has not performed any better than the S&P500 for the past decade.

It’s time for the new lady in investor town.

Cathie Wood founded ARK Invest in 2004. In complete contrast with Berkshire Hathaway, she embraces new technology. Wood specifically targets artificial intelligence/deep learning, blockchain, digital payments, energy storage, robotics, and genomics for her investments.

She asserts that companies that are based on these technologies will experience exponential growth in the coming decade.

If you don’t believe her predictions, her track record speaks for itself. In 2020, the year that investors would rather forget, ARK’s five investment funds grew by at least 100%, compared with 15% for the S&P500. ARK Genomic Revolution EFT grew by a phenomenal 182%.

ARK Innovation is now the biggest actively managed exchange-traded fund (ETF) in the US. The top 10 holdings in this fund read like the great, and the good in the new technology revolution — Tesla, Spotify, Crispr Therapeutics and Shopify speak for themselves.

Her assessment of companies with exponential growth potential comes from her belief that we are going through a new golden age of disruptive innovation.

In her 2019 speech at a Singularity University Finance event, Wood explained that we have to go back to the late 1800s to find a similar point in history. Back then, the revolutionary technologies of telecommunications, electricity and the internal combustion engine were changing the world. These platforms enabled many other industries to spawn with a resultant exponential growth impact on the stock market at the time.

Wood believes that an analogous trajectory is about to happen in the next decade and beyond, driven by blockchain, genomics and deep learning.

‘ARK’s investment process recognises that true disruptive innovation causes rapid cost declines and demand growth, cuts across sectors and geographies, and spawns further innovation, stimulating growth over extended time horizons.’ — Cathie Wood.

This vision resonates with the views of Wharton Professor Mauro F. Guillen in his book ‘2030’. Guillen makes predictions about what will happen in the world over this decade we’re currently in.

The subtitle ‘How today’s biggest trends will collide and reshape the future of everything’ is aligned with Cathie Wood’s thesis — the enormous changes that our near-term future will bring based on current trends.

I raise this book not only because Guillen and Wood’s general world views are aligned but because of the insight Guillen highlights on the future role of women in finance.

Even as close in our recent past as the early 2000s, women were largely left out of decision making around money both in the home and business. The major financial institutions were all male-dominated.

I’ve heard it said many times, and Guillen repeats it in his book, that the financial crash of 2008 would not have happened if Lehman Brothers were Lehman Sisters.

Guillen writes that in this decade, the wealth between men and women will become more balanced. And this will have profound effects on the economy and the world of business.

As women around the world become more financially savvy, it’s not surprising that the role of women is also shaking up Wall Street.

Cathie Wood is the leading example of this trend. We’d all be wise to follow her lead.

This article is for entertainment purposes only. It is not intended as financial or legal advice. Consult a financial professional before making any major financial decisions.

0 notes

Text

Stock-market investors are banking on this sector in the COVID recovery, while JPMorgan steps up its ETF game

Hello again: Quickly! What is the best performing sector in the S&P 500 SPX, + 0.04% 11 this week? It’s finance (with materials right behind it). By the way, financials are also the best-performing sector to date, up over 5% in August. Morgan Stanley

MS, + 0.23%,

JPMorgan Chase

JPM, + 0.07% and Goldman Sachs Group

GS, -0.25% helps add value to exchange traded funds that offer exposure to this sector.

Investors are betting heavily on the banking sector’s rebound amid the COVID-19 economic rebound and it shows in ETF movements with the week this week Invesco KBW Bank ETF and SPDR S&P Regional Banking ETF. Check out the ETF Wraps table of this week’s top performers below. The outperformance of financial ETFs even comes from the fact that interest rates haven’t necessarily cooperated.

Rising interest rates are good for bank profitability, but currently the 10-year government bond TMUBMUSD10Y is 1.360%,

used to price everything from mortgages to car loans is around 1.35%. Banks borrow short-term debt and make longer-term loans. It is expected that the longer-term interest rates will eventually rise and that the economy will also benefit from a broader recovery if the delta variant does not derail this.

We’ll also talk a little about the playbook for new infrastructure laws, betting on small caps versus large, and JPMorgan Chase’s change of power in ETFs.

As usual, send tips or feedback and find me on Twitter @mdecambre to tell me what to jump at. Sign up for ETF Wrap here.

JPM and ETFs

A recent announcement by JPMorgan Chase that it will convert a portion of its actively managed mutual funds into ETFs, about $ 10 billion, is sweeping the fund market. Todd Rosenbluth, Head of ETF and Investment Fund Research at CFRA, says JPMorgan is currently number 9 in 2020 (currently number 7) but could be near the top of ETF providers in the next half decade.

“JPMorgan could be in the top five providers for the next five years,” Rosenbluth told ETF Wrap.

CFRA

The move comes as fund providers are increasingly restructuring mutual funds into ETFs due to increased interest in the benefits of the ETF wrapper, including tax efficiency and transparency.

However, Rosenbluth notes that JPMorgan’s tactics are different from competitors like American Century and Fidelity, which recently launched semi-transparent ETFs under the same name as popular mutual funds.

Overall, the CFRA analyst says that actively managed ETFs have generated a lot of interest, raising $ 38 billion since the start of the year as of August 10, according to CFRA data.

The good and the bad

Last week’s top 5 winners %To return

SPDR S&P Metals & Mining ETF XME, -2.25%

8.5

Amplify Transformational Data Sharing ETF BLOK, -2.77%

6.4

Invesco KBW Bank-ETF KBWB, -0.15%

5.9

SPDR S&P Regional Banking ETF KRE, -0.69%

5.2

SPDR S&P Bank-ETF KBE, -0.47%

5.1

Source: FactSet, until Wednesday, August 11, excluding ETNs and leverage products. Includes ETFs traded by NYSE, Nasdaq, and Cboe of $ 500 million or more

Top 5 relegators in the last week %To return

Aberdeen Standard Physical Silver Shares ETF SIVR, -1.43%

-6.3

iShares Silver Trust SLV, -1.48%

-6.3

ARK Genomic Revolution ETF ARKG, + 0.19%

-6.1

Invesco DWA Healthcare Momentum ETF PTH, +1.28%

-5.3

iShares MSCI Global Gold Miners ETF RING, -2.24%

-4.8

Source: fact set

Pictures of the week

via Frank Cappelleri. by Instinet

Instinet’s Frank Cappelleri, a technical analyst, notes that the Utilities Select Sector SPDR Fund XLU hit a 52-week high of -0.07% on Wednesday. However, the tech notes that while government bond yields have risen lately, they haven’t necessarily confirmed the move in utilities that historically tended to be, along with fixed income assets like the benchmark 10-year government bond TMUBMUSD10Y, 1.360% increase.,

for example.

“The XLU was of course a bond proxy in the past. But its correlation with the 10-year note largely diverged in 2021. Whether we blame the Fed or not, we shouldn’t ignore the move just because rates don’t confirm it, ”Cappelleri writes.

We’ll have to see how that plays out as returns pick up some pace.

Do you think small?

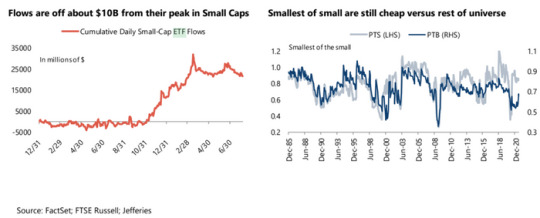

Jefferies’ equity strategist Steven DeSanctis believes that small caps continue to be value even though inflows into small cap ETFs have cooled in recent weeks. Here is his take on the matter in a research note posted on Wednesday.

“Inflows into small-cap ETFs may have peaked in mid-March and hurt performance … But we believe institutional investors are interested in size segments. For every dollar invested in small caps, 45 cents go into the passive, that creates tailwind for smaller small caps, ”he writes.

via Jefferies

“If value continues to outperform, reviews drive performance,” he writes. The most popular and largest small-cap ETFs include the iShares Core S&P Small-Cap ETF IJR, -0.72%,

the iShares Russell 2000 ETF IWM, -0.55% and the Vanguard Small-Cap ETF VB, -0.50%,

and the Vanguard Small-Cap Value ETF VBR, -0.66%.

DeSanctis and his crew expect small caps to outperform large caps by 5.50 percentage points in the next year.

Build on infrastructure

After the U.S. Senate passed an infrastructure package worth roughly $ 1 trillion on Tuesday with broad bipartisan support, the immediate question was: Do ETFs that have been used to bet on infrastructure games still have room to run?

The Global X US Infrastructure Development ETF PAVE is a popular exchange traded fund that offers exposure to stocks that would likely benefit from an infrastructure bill, data shows.

Other areas such as renewable energy and electric vehicles have not seen a boom recently. The Invesco Solar ETF TAN, -0.94%, was down 1.1% over the course of the week, while the Global X Autonomous & Electric Vehicles ETF DRIV, -0.29% was practically unchanged this week. TAN, which refers to the ticker symbol of the solar ETF, is down 17% since the start of the year, while the EV-ETF is up 21% so far in 2021.

However, it remains questionable how quickly the House will react to the bill.

Ally Invest’s Lindsey Bell says there may still be upside potential if the bill is ultimately signed by President Joe Biden.

“Sector ETFs, which have cooled in recent months due to growth uncertainty, in industries, materials, construction equipment, semiconductors and electric vehicles, could see a boost as the bill moves closer to President Biden’s desk,” she wrote.

source https://seedfinance.net/2021/08/12/stock-market-investors-are-banking-on-this-sector-in-the-covid-recovery-while-jpmorgan-steps-up-its-etf-game/

0 notes

Photo

Cathie Wood Watch: Ark Buys Biotech Stocks Ark also acquired shares of a healthcare-clinic chain and an electric air-taxi company. Ark sold shares of a lender. Investment star Cathie Wood, chief executive of Ark Investment Management, on Tuesday had focused some of her buying on biotechnology stocks. Recent purchases including Atai Life Sciences (ATAI) - Get ATAI Life Sciences N.V. Report, Codexis (CDXS) - Get Codexis, Inc. Report and Adaptive Biotechnologies (ADPT) - Get Adaptive Biotechnologies Corp. Report. Ark exchange-traded funds also purchased 1Life Healthcare (ONEM) - Get 1Life Healthcare, Inc. Report, a chain of healthcare clinics, and Joby Aviation (JOBY) - Get Joby Aviation, Inc. Report, which is developing an electric air taxi. On the selling side, Ark unloaded LendingClub (LC) - Get LendingClub Corp Report, a peer-to-peer lender. Ark Genomic Revolution ETF (ARKG) - Get ARK Genomic Revolution ETF Report bought 83,881 shares of Atai Life Sciences, valued at https://fancyhints.com/cathie-wood-watch-ark-buys-biotech-stocks/?utm_source=tumblr&utm_medium=social&utm_campaign=ReviveOldPost

0 notes

Text

Cathie Wood's ARK Invest Is Testing a Fund That Can Sell Short

Cathie Wood’s ARK Invest Is Testing a Fund That Can Sell Short

Text size

Cathie Wood.

Reed Young/ARK Invest

Cathie Wood’s investment firm, known for investing in companies that are shaking up their industries, is testing a portfolio that would let her bet against the corporate victims of that disruption.

Wood, a widely followed stock picker, founded and runs the asset-management firm ARK Invest. ARK currently offers six actively managed exchange-traded…

View On WordPress

#ARK Genomic Revolution ETF#ARK Innovation ETF#ARKG#ARKK#Financial Investment Services#Financial Services#funds#investing#Investing/Securities#investment advice#Investment Advice/Research Services#research services#S&P 500 Index#securities#SPX#synd

0 notes

Photo

Все, хватит надоело, продаю все акции Sarepta Therapeutics (SRPT). Не так ли себя чувствует каждый второй инвестор, купивший акции на хаях, и смотрящий теперь на свой красный портфель.Все, хватит надоело, продаю все акции Sarepta Therapeutics (SRPT). Это боль... Не так ли себя чувствует каждый второй инвестор, купивший акции на хаях, и смотрящий теперь на свой красный портфель. Ох уж этот фармацевтический сектор, он умеет как взлетать, так и падать, и уж если падает, так на 50 процентов. Но это неважно, если вы еще сидите и думаете, а не купить ли мне еще акций SRPT, стоит ли усредняться... Я однозначно промолчу, но сам пойду покупать и усреднять. Объясню почему. Во-первых, акция уже обвалилась по полной, и если вы считаете, что она может еще упасть, возможно вы будете правы. НО, во-вторых, это самый волатильный и спекулятивный сектор, так что, в любой момент, даже после просадки в 20-30%, может полететь ракетой вверх и разбросать всех шортистов-каратистов по разным углам. Есть еще одна причина, почему я топлю за Sarepta Therapeutics (SRPT), их акции состоят в 87 фондах на сумму в $546 000 000, если вы после таких данных хотите слить акции, закрыться в убытке, это Ваше право, но если у Вас стальные бубенцы, то вы однозначно должны сжать их покрепче и держать. Конечно, если у Вас "Колян" (Margin Call) на носу, будет тяжело, но все же, боремся до последнего. Инвесторы мы или кто? Все так любят и почитают Кэти Вуд, ее ведь даже вторым Баффетом называют. Так вот даже у нее есть акции SRPT и она их не бежит распродавать на право и налево. А у нее их не 10 штук, а 1 миллион 880 акции в фонде ARKG (ARK Genomic Revolution ETF), не убедил? Тогда взгляните на крутых инвест фондов под громким названием Vanguard, они тоже держат акции в количестве 597 тысяч, это на секундочку 41 790 миллионов долларов. Вы как хотите, а я завтра усредняю свою сарепточку, которая у меня сейчас болтается на средней в 90 зеленых и буду ждать ракету. Продам по цене в 110-120$. Всем профита и добра. #srpt #Sarepta #сбербанкинвестор #лучшиеинвесторы #инвесторгода #акцииинвестора #разумныйинвестор #деньгинеспят #инвестиции #вложитьденьги #заработать https://www.instagram.com/p/COGYWPYhwze/?igshid=enoclp7lrf8j

#srpt#sarepta#сбербанкинвестор#лучшиеинвесторы#инвесторгода#акцииинвестора#разумныйинвестор#деньгинеспят#инвестиции#вложитьденьги#заработать

0 notes