#ANYWAY that also depends on how much information is available in jp too

Note

Sorry for the bother but, like, I started the game 2 months ago and I depend on the free gifts from watching ads alot ... now after I update my game, the "watching ads" window has disappeared! Do you know what's the problem??? Or am I alone in this ??

1. Quick question here: Ad rewards option doesn't appear in my game since Monday. I don't have any of the devices that were going to be affected by the app software. Does anyone else have the same issue? What can I do to keep collecting free LP and Prisms? Will they have to be bought now? D:

2. My ads haven't refreshed for like 4 days now, at first I thought I must've done them but forgot but there was nothing in my gift box either - Has anyone else had this with the daily video ads? Have I missed a notif saying something about them lately?

3. Hi! I’ve been having a problem and was wondering if anyone else was getting the same thing. A couple days ago the ad rewards completely disappeared from my app, and they haven’t come back since. I’m not sure if it’s just a me problem or if they were actually removed from the game. Do you know anything about this? Thanks!

4. I was wondering if you could help me figure out if my game needs to be reinstalled. I know a while ago, KLab did an update that said they were going to remove video ads until further notice. Do you know if the video ads are back or if they're still being worked on? I haven't had a video ad in quite a while and I wanted to try and stockpile LP for events.

5. Hello! I got a question. After the recent updates I realized that the ads for getting prisms and LP's are gone. I wonder if that happened to everyone or just me. It's not a big dead but I mostly collected LP from ads so I can use them on events T - T

6. When will the ads come back from the war? (╥_╥)

Thank you all for asking nicely. Here are the many asks I recieved about the state of ads. As I have mentioned, ads are currently not available. This was mentioned in advance of the update in the game notice, on the official twitter, facebook, app store, and here on my blog. KLab and myself did our best to let everyone know, so I dont know how so many people are unaware. especially since even if you missed it on social media, it was in the game and app store.

As for those of you asking when ads will be back, I have literally no more access to that information than you do. All we know is that they will be back when they are fixed since they werent working correctly for a lot of users. As a result, KLab decided it was unfair for a lot of users to have much less rexources than others, so they have been disabled for all players while being fixed.

Theres also not too much cause to complain because they were never a thing on JP anyway, so they’re really just a bonus for Global. JP players seem to get by find without them, I’m sure we can too. I also miss the free LP and prisms, but I’d prefer to wait until it is fair for all players.

#this is with no bas intent but WOW i got a lot of asks about this#ads#please read the in game notices yall they always have important info#shining live#Anonymous

9 notes

·

View notes

Photo

Unboxing: StyleGenie’s Surprise Me Express Smart Casual Box

Note: This is a post that was in my queue way back November 2017 and StyleGenie has up their game. I'm thinking of availing a box again just to compare it from this first try, haha. Anyway, please keep in mind that I wrote this months ago which makes the possibility of StyleGenie having a different service (probably better) than the time I tried it!

Hello, friends! This is a blog post that is different from all my other posts, but this is just something that I’ve always wanted to venture into as a blogger. This is a Surprise Me Express Smart Casual Box from StyleGenie, which claims to be the first ever style subscription box in the country. Being someone who always dresses for comfort, I wanted to try something different and let the stylists from StyleGenie pick an outfit for me to wear.

Before I get started on the unboxing part, I’ll give a quick run down with how I managed to receive this box. My curiosity for this service has been in my mind for weeks already and then one random day, I read a Facebook post of theirs saying that from a box of 899, I can get an Express Smart Casual Box for only 500! I got it for a total of PHP 599 since the shipping fee was PHP 99.

Alright, first thing’s first: creating a profile. You can either click the “Get Styled” button from their homepage or the “Create a Profile” option from their menu. On to the Create a Profile option, you will be asked if this is your first time filling out the quiz, if you’re updating your answers, or if you just want to order again. You will then be asked of the reason why you’re opting to try StyleGenie out. I personally chose option C: “It’s time to update my look”. Because like what I said earlier, I wanted to try something different. I wanted to see how other people will style me without staying with my go-to comfort clothes, which are usually consists of a shirt, jeans, and a pair of sneakers.

The next steps include the basics and it even asks for your skin tone (which helps the stylists maximize the potential of the outfit), size (self-explanatory), height, and even the specific sizes of your bra, shirt, and pants. This will really make sure that the size/s of the outfit you get, if not perfect, is near perfect fitting. The next batch of questions include your preferences. This section includes the features you’d like to emphasize, and other body parts you’re a bit uneasy to show. They’ll also ask you with colors and patterns you love and not love wearing. To be even more specific, you can provide links of outfits you really like and even your style icon!

So that’s the whole quiz experience. It then follows the usual steps of ordering online: personal information necessary for shipping, payment details, order confirmation, payment confirmation, and the actual shipping of the box. It took a week after ordering and 4 days after payment confirmation until I finally received my order.

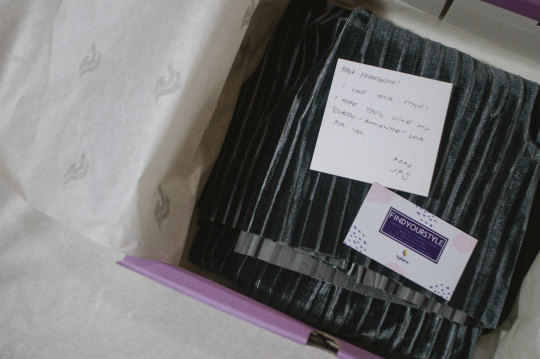

Ta-dah! I love the personal touches of the box. It gave me that special treatment kind of vibe. It’s really simple but it let me know that this service really is hands on with every order they get.

The box isn’t the sturdiest but it’s an okay quality kind of packaging. If you look closely, you’ll see a few creases on the top part. I guess it all depends on the courier’s handling. The thing about the packaging though is that it’s not sealed, and you can easily slide it and open the package. This could be an issue but I guess they trust their couriers so much so I guess that’s fine. Or maybe it’s because I’m from Metro Manila and it doesn’t take much time for the actual shipping. I don’t really know, hahaha. Anyway, opening the box reveals this wrapping paper with the pattern of their logo, just like the box.

As you open it further, you’re surprised with a handwritten note personally from the stylist plus a bonus of a discount code when subscribing to a monthly plan! The handwritten note was a lovely touch. Knowing my sentimental and old school self, I’m such a sucker for these things and this definitely made my day, besides the thrill of receiving my order.

For the Express Smart Casual box, I received two items for an outfit. A pleated velvet skirt and an off-shoulder top. This is what the stylist, JP, called in his note as a “classic-romantic” look.

Each of the item has a tag that says “Do not remove this tag. Items can only be returned if tag is still attached and garment is unworn except for trying-on.” The bottom part has a link for more information on their exchange policy. (Yes, no refunds, just exchange.) When I ordered this, they used to have a 7-day allowance for the request for exchange. But they recently updated it to a 30-day allowance. You can read more about it here.

The first item from the box is this gray pleated velvet skirt that runs from my waist to a few inches under my knees. It has slits on its side and adds a more feminine touch to the clothing. It also has a layer of thin, somewhat sheer, black cloth underneath and runs until the start of the slit. I do have a few issues about this piece, though. The garter is like an inch and a half thick and it looks distracting for me. It just looks bulky when worn. The garter also sometimes twists in a really awkward way and I had a hard time trying to fix it back. But like what I said, I’m all for trying out something new that’s why I decided to keep this in my wardrobe. I thought of wearing this for Halloween (I went as a generic witch, lol) but I can’t find a top I already own that I can pair with this skirt.

The next item is a black off-shoulder top. I’ve always wanted an off-shoulder top and it made me kind of like this piece. The details on the sleeves were a cute touch too! You can tie the ends as a ribbon and adds a bit of character to the outfit.

One thing to note is that the material is sheer so even if it’s black, you can still somewhat see through the fabric. I’m not in love with this piece but it’s something new to my wardrobe and I know that there is a big possibility that I'll use it in the near future.

If I were to wear both pieces in an outfit, I don’t really think I’ll be comfortable wearing them. To be honest, I’m quite confused if they’re really meant to be worn at the same time because I don’t see it forming a cohesive outfit. I’d insert a photo of me wearing the outfit, but I haven’t had the time to do that, hahaha. I did try it but I didn’t like it. But I’m open to trying the pieces on separate outfits.

The whole experience was really fun and I’d love to do it again. It was such a thrill to order something not knowing what you’ll receive. It’s like buying yourself something for Christmas with the actual element of surprise in it. It’s also such a lovely experience knowing that actual stylists evaluated your quiz and your style; and that they came up with an outfit that they think would look great on you.

As an overall review of the whole service and the items, I’d give it a 3 out of 5 because despite it being such a fun experience, I honestly think that the materials aren’t the best. It’s okay that I got it on sale but if I were to buy it for the regular price with this quality, I’d opt for something else. But on another note, it’s the actual experience that I really value from this service. I just hope they’ll up their game when it comes to the quality of the items. But, yes, I’ll be on the lookout for more discount codes and promos and I might try their other boxes as well.

14 notes

·

View notes

Text

Is Bitcoin Too Low? PayPal Blockchain, Tether Explodes, Bitcoin Development & Litecoin As Money

VIDEO TRANSCRIPT

Hello, everybody. Welcome back. For another. Video. Hope you’re all doing well and now you’re all having an incredible day to start things off. American Institute for Economic Research. Editorial director Jeffrey Tucker reignited the long running Bitcoin scaling debate with a tweet earlier to day. The Economist, who has been a long advocate of Bitcoin, suggested the current price is much lower than it would otherwise be if the underlying technology had properly scaled on the thirty first of March. Tucker tweeted I’m not unimpressed by a six thousand dollar bitcoin. I was blown away when the thing reached $30. Can you imagine the price today if the thing had properly scaled between expands on comments Tucker made earlier this month on Artie during a panel discussion with noted Bitcoin skeptic Peter Schiff? I think I don’t think Schiff is a skeptic as much as he’s just really bored. Like I think he has nothing more to do with his life. So he just constantly makes sure that he is. Talking about Bitcoin during the debate, he said too much time had been wasted on this ridiculous scaling problem which had ultimately prevented mainstream adoption. He said adoption hasn’t gone far enough and it hasn’t come into consumer use like it should and would have been if it had been able to scale. Now we’re seeing what happens when Bitcoin was not properly scaled, Tucker said. Bitcoin was designed to thrive in times like the current financial crisis and suggested the reason it hasn’t is due to its scaling Perot Bloom. He said Bitcoin was invented to become a safe haven during times just like this. So why are we seeing bitcoin become the safe haven that it was developed to be and was for a number of years? I have my own thoughts on all of this. I’ll get to that in the second. Don’t don’t you even don’t you even worry? The Bitcoin scaling issue has been one of the most, if not what yet the most heated debate in cryptocurrency. The base layer network isn’t able to process transactions quickly enough to enable wide scale mainstream adoption as a currency. The debate over raising the block size as a solution ultimately led to be cash, and PSV is just a money grab. BMV has nothing to do with actual. I would even argue that they were probably a number of people who actually walked into B cash who probably did believe at some point that they were doing the right thing, but that also then just became a bit of a money grab as well. Would be ASV has nothing to do with the entire scaling solution, especially when it’s not even being used while bitcoin itself adopted the Layer 2 lightning network as a scaling. So Lucian, I. First off. I think that Burt. Burt Kern. I think that Bitcoin itself is already extremely undervalued just based on what it is and what it does and what it enables other people to do. I think if we had many other currencies. So it’s it’s it’s it’s it’s a bit two sided rather. One side is is a lot heavier than other. I think when we hear tons of people talk about especially whether they are the which we’re gonna get to as well. The head of pay, pal, the head of JP Morgan, the head of this bank, the IMF. Whatever the case might be, people who have come forward to negatively talk about Bitcoin and the cryptocurrency space, I think it does have a dampening effect because people tend to keep it sometimes negative things in their mind than they do. Optimistic, positive things. I’m not exactly sure why we think this way sometimes, but this kind of just how it is. So when you get years of Bitcoin bashing, as it were, and people keep saying that Bitcoin can do this and Bitcoin can do that. And especially when they are completely mute during times when Bitcoin’s price is rising really fast or rising more than they think that it should. I think this does have a negative detrimental effect, especially if you end up having news stories, especially like we did years ago, talking about that bitcoin was criminals and bitcoins for this. Bitcoin is for that. I think a lot of bitcoin narrative itself has completely changed. I think the idea of what bitcoin is has also, I guess, morphed and evolved with the not the current financial crisis just over the last eleven years. I think Bitcoin itself as an idea has completely changed. However, I do agree and I do think as well when we and I said this in the last videos, a lot of the things that we have and had been proposed as scaling solutions or upgrades from many different cryptocurrency projects have not yet come to fruition. And or they are currently available, but they are just not being used in mass like people once thought they were. If I’m not mistaken, I believe lightning was dropped, released BTD in 2017 and it was believed by the end of 2019 that it would be the main thing that we would use to be able to send bitcoin transactions back and forth. That this was something that I also noted in 2018 as well. When we first got news that the New York Stock Exchange and the Nasdaq were looking to get into the cryptocurrency space, I said probably if they want rapid, quick, speedy transactions through BTC, they’re going to be using the lightning network. But a lot of that has kind of not fallen silent. We know that it’s still being developed, but it’s more like a I think we need like a major push if we start getting information that especially the partnerships between the major stock exchanges and Starbucks and Nordstrom and end there’s no blabla are all going to be use some use some type of lightning enabled payment system. I think Bitcoin will be completely solidified even right now. Bitcoin as the number one coin I believe is solidified, but it’s more like a where would we be if a lot of the other scaling had happened. The entire idea has been and will probably continue to be that the base layer is too valuable to upgrade. What do I mean by that? And I’m sure some people suck their teeth, roll their eyes, cross their arms when you have a network that is new. Bitcoin is only 10, 11 years old that has processed. Last year alone, 1 trillion dollars worth of value. And you upgraded and something goes wrong. You have a major problem. The entire system, the entire belief behind it completely begins to crumble. Even if it was something as simple as someone being able to manipulate the code and create one extra bitcoin. It doesn’t even have to be a one hundred million bitcoin, just one extra. On the actual BTC blockchain network would cause people to go, well, yeah. If you can create one, you can create more. So the idea is to leave the core chain as it is and simply have other side chains which at some point interact with the main chain to validate and or post the transactions that have taken place on them. But at the same exact time, the other chains around it will take care of the load of their transactions passing through it. Yes, lightning does work, but it’s not as massive as we were told in 2017, we were told that by this point Bitcoin would be able to handle 1 million transactions per second. We never get official numbers as far as and I mentioned this before in 2019 as well. And I like that people told me I was wrong in the comment section, but no one could actually tell me why I was wrong. It was more so we never get an actual number as to how many transactions per second we’re actually able to process now. Just using the lightning network i e whenever Tron gets an upgrade, it can handle 5000 transactions per second. When iOS gets it tracked, when an upgrade, it can do 3000 transactions per second. Ex Fifteen hundred transactions per second. How many? Like what’s the actual number? Is it like a website where I can see the fluctuating number depending on how many people actually have an active channel open on the lighting network like a mathematical numbers, we can see how many transactions are actually being done on the lightning network. I think this would actually cause a very huge shift in the mentality of using bitcoin, even if we saw that just based off of the current. I don’t know how many nodes are currently open on the lightning network. Even if we just saw that based on the current nodes, the transactions per second that we would get would be around eight hundred and fifty per second per minute, whatever the number you need to push forward in your head during bitcoin usage. That would be a major we we’d be able to say officially. We’re no longer at three to five transactions per second. We can now do eight hundred and fifty and get what I’m saying, but no one has ever told me the number. Like we have to mathematically be able to calculate their X amount of people on the lightning network, their X amount of channels open. These channels have zero point one 5 bitcoin. The amount of people using that you go I’m saying anyway. I think the any under valued ness of bitcoin comes from simply people not knowing enough people putting their money into coins that they should not have. We’ve had the discussion many of the times before. I think I’ve I grew quite fatigued with the idea of it. If all the people who had their money and BSB Bitcoin, gold, light coin, light, all the other coins, you know, and I don’t even mean like a sprinkle of coins, there are tens of thousands of coins, thousands of coins that should not exist if all that money had squashed into the correct coins. I think we did least be seeing a ten eleven thirteen thousand dollar bitcoin. Any devaluation? Like I say, I think it just comes from negative news and what people are not really understanding exactly what bitcoin is, but it’s neither here nor there. I assume we’ll have this conversation once again when bitcoin is at fifteen thousand. People think that bitcoin should be at one hundred and thirty thousand. But as of right now, this debate will continue. As it stands from what we hear, Bitcoin’s base layer will never be upgraded. It’s more of a if that’s not going to be upgraded. Upgrade the other. Chains quickly, rapidly do what you can. I think even something if if it had been a simple air quote as a simple something that lay on top of Bitcoin that allowed everyone to have at least 30 transactions per second, that’s still a 6 X from what we have right now anyway. That’s the Bitcoin. UNDER-valued news. And without further ado. For your can can confusing news for the day to pay, pal is hiring a blockchain strategy director based on a recent job posting, the new hire will be part of their global financial crimes group. According to the job description, PayPal’s newly hired anti-money laundering and blockchain strategist will lead market expansion efforts and focus on opportunities and partnerships related to blockchain. PayPal’s job posting explains. The successful candidate will be responsible for evaluating blockchain use cases with an eye towards financial crimes, risk management and overseeing anti-money laundering, investigative activities and emerging trends in the space. The strategist will also carry out external partner diligence meetings around blockchain opportunities. They’ll pay. Pao has not confirmed that it has hired an agent. It appears that it has completed the hiring process based on the status of its ad Ver Tai’s meant so I guess maybe I’ll even work backwards. Is this it? Pay pal, valuating, blanching new cases out there. Yeah. So you’re really working backwards. The CEO of Pay Pal. Many moons ago had released information that not only did he not like Bitcoin, but he didn’t care for other cryptocurrencies and he said that blockchain was the way to go. Even weirder is that at some point during this year, the PayPal. Even before this, I think a couple of weeks ago, the PayPal CEO, after all of his hate mongering. Fear mongering. I don’t like you Bitcoin mongering, announce that he actually owned Bitcoin. He said that Bitcoin was the only crypto he owned. How weird. Right after you tell everyone that you also hate it. And then the other speculative part it would be is the actual hiring of a blockchain and anti-money laundering professional. Whatever. Where do you want to use y? If you don’t think. I mean, so we’ve thought for a while that pay PAO would probably integrate. This is just. There’s lot of speculation. I was floating around the cryptocurrency space that PayPal, eBay, WP or whatever would also integrate bitcoin. I. Could see. In the future, this being a thing around five years from now, well, they have like a separate section. We got a click over here for pay pal payments or he’ll ever have a Bitcoin payment. I don’t think is going to happen anytime soon, especially with. I don’t know, say how well a PayPal is doing, but it’s more like a. I don’t expect them to change their current method of money making in the near future. But one can only assume if they’re looking for someone or have found someone who is a master at blockchain and AML, they’re probably figuring out trying to figure out ways to integrate cryptocurrency, if not maybe stable coin payments through their platform and being able to make sure that they know exactly where all the money is going based on the AML compliance. Of course, I mean, a large part of what I just said is speculation, but one can only assume. Why would you why would you be doing all of this? If not to at some point integrate some of the cryptocurrencies that we currently know about? If not, once again, just bitcoin. Yeah, sure. This is probably the three thousand millionth person who said that day before hated bitcoin and then announced that they actually own bitcoin. How weird, right? I’m looking at you, Jamie Diamond, and I know Warren Buffett has like half a bitcoin somewhere anyway. Let’s move on. Next up, despite the strong downturn seen in the crypto markets epitomized by Bitcoin’s 50 percent decline that transpired on the 12th of March, the amount of Teather in existence has exploded. In fact, according to the industry news aggregator on foaled did the market capitalization of the asset recently surpassed 6 billion U.S. dollars, with 1 billion added to this metric in the past two weeks alone in an industry valued at under 200 billion. Such inflows are clearly dramatic. Furthermore, alternative stable coin solutions paxos Dollar USD, COIN Finance USD USD, etc. have been printing dozens of millions of coins as well. This begs the question what is driving this demand for stable coins? How will the increase in stable coins supply affect bitcoin moving forward? Sam. Why? His name is Sam. Wow, what a last name. His name is Sam. Bank Man Fried. A former institutional investor turned CEO of both Derivatives Exchange F.T. X and Bitcoin Quant Fund, Almeda recently chalked up the phenomenon of the rapidly increasing stock of USD T to three factors over-the-counter traders, primarily in Asia. People who are selling bitcoin for tether to hedge positions. And people who are selling bitcoin for USD t. To reduce risk. The idea being is as more people get into the market and the cryptocurrency market continues to have wild swings, that of course in theory people will want something that can stabilize or hedge their bets as they don’t want lose tons of money. If you see that Bitcoin’s price is looking like it’s going to go down by. Seemingly fifteen percent and you see it’s already down by 4 percent and that line is going straight down, you swap your money into tether. But it doesn’t exactly explain exactly why a billion dollars worth of tether was printed in the last two weeks or why many other stable coins are printing dozens of millions of but jillions of coins as well. The idea in 2017 as to why there was so much Stetler, so much tether being printed, was that there was demand for it. But nearly every single time that we saw Teather and I assume other stable coins being created, there was usually or was usually followed by an immediate price rise in bitcoin. We saw this many times throughout 2017. Every time, according to the news, that there was an increase in interest in the cryptocurrency market. More Teather was printed and in Bitcoin’s price would. Shoot up. So it could simply be that there are maybe many people behind the scenes who have expressed their interest to Coinbase or by NANCE or the paxos people or even to the Teather people saying, we want to get in. We want to do so. And so therefore we’re gonna need some more to be able to do the trades that we want to do. Or it could also simply just be that a lot of people may believe that the cryptocurrency market is moving to a more stable koine world or third thing. It could just be tons of investors who are realizing that as Teather and all these other stable coins are being used, that there’s like a transaction fee and if they give enough money that they’ll also be they’ll have a piece of the pie as the transactions are kind of going through anyway. It’s all rather fascinating. I don’t think we’ll ever have an actual answer for for any of this ever. We’ve been trying for years. We’ve had multiple companies who said that they knew what was going on. They all had a completely different answer. The entire point is there’s more Teather being printed. A billion is a lot, I think in 2017. I think we maxed out at 1.2 billion, 1.3 somewhere around there. It wasn’t the 6 billion that it is today. Also funny to note that we are six times as much Teather, but still one third the price of Bitcoin. Fascinating. In deed. Next up in Super Mega Obvious everywhere, News BLOCK, Stream and Lightning Labs are the two firms currently leading the funding for open source Bitcoin and lightning development, according to data compiled by Bit Mex.. Announcing the news on Saturday, Big Mac said the two firms employ the largest number of Bitcoin developers. Peter Willie, Wiley, Andrew Chow and Gregory Sanders are some of the Bitcoin developers, which are currently being funded by block stream lighting. Labs, on the other hand, employs at least eight developers working on open source lightning software. And those names, right? There is little chart square crypto is ranked third per bit. mecs, which currently employs notable bitcoin developer Matt Carollo, as well as provides grants to other bitcoin and lightning developers. Square Crypto is followed by M.I.T. Media Lab, Digital Currency Initiative and Chain Code Labs. The latter, in fact, is the largest contributor into Bitcoin core development per the data. I don’t think that anyone should be surprised that the people from lightning are funding lightning development, or that the people from BLOCK Stream who have the most developers working on bitcoin are doing the most funding for. Yeah, we have a lot of really weird news sometimes I guess that the yay that Bitcoin is still being developed on. I didn’t assume that it was not. Yeah, I should. Should we just move on? Because, yeah. Here’s the actual bit Max blog. Who funds Bitcoin development? The people who are working on Bitcoin. Simple enough, right? Yeah. And to finish things off like COIN founder Charlie Lee says that he sees other use cases where cryptocurrencies, apart from speculation and store of value, payment settlement and confidential transactions on top of the list. In a new episode of Creds Meet Our Partners, Lee explains how the Light Gwin Foundation is shaping the world’s seventh largest cryptocurrency by market cap become a reliable means of exchange, he said with like coin. We are definitely aiming, aiming, moving towards what payments for peoples has actually spend the coins as opposed to just holding or onto it as a store value. You can see there’s more and more 80m coming out that support like COIN, where people can easily withdraw their light coin or convert cash like coin. I I don’t think that anyone. Tell me if I’m wrong. I don’t think that anyone’s gonna be selling their light coin or using or, you know, selling their light coin anytime soon. Like coin is like thirty dollars. Thirty five dollars like coins all time high was like ten times that. Estimates that we’ve had before as light coins havingthe continue to take place over the next ten generic jaybird, which are three years now. I’ve seen calls for a fifteen hundred dollar light coin. I’ve seen a four thousand dollar light coin. I think it’s pretty believable if like coin has two more havingness. By 2030, lite coin could easily be. Obviously, anywhere from nine hundred to ten thousand dollars per coin, I think a lot of people have. This is how I feel. I think a lot of people have kind of missed the ball on their crypto being used as any type of major payment method in the near future. I think the coins have to go really high in price for people to infrastructure has to also be there. But it’s also like a lot of cryptocurrencies are held speculatively. I think Bitcoin is held hyper speculatively. I think he theorem is accumulated speculatively for a Theorem 2.0 to be able to actually mined more ether, especially with it being used and locked up in DFI projects. I think exampIe, while it’s supposed to be used for banks and institutions, is also being gobbled up by investors because if other banks and institutions use it. Therefore, I also want to have a large slice of the pie as well. And it kind of goes down the line. I don’t think besides stable coins that there are many coins off the top of my head. Maybe Monaro, daschund and Cash now would actually be used more or percentage wise as an actual usage of payment. Like we know that there are companies who convert holdings or whatever into bitcoin to send back and forth as the actual transaction. But that’s also like companies. I think a lot of people who are directly investing in these cryptocurrencies like myself. I see no actual like I have some light coin, but there’s not going to be a point anytime soon where I’m going to probably sell off my light coin or use it to buy a cup of cup of soda. But what what does that can of soda or anything? No, it’s probably not going to happen in anytime soon. As you know, a lot of people this is just how I feel about certain things, though. A lot of coins that I have, I think I’m going to definitely eventually sell off, especially when prices start going up. I’m not sure if I’ll swap it into a Teather. I’m not sure if I’ll swap it directly into Bitcoin or if I’ll do something kind of just put it back into cash and start buying some vacation homes or whatever the case might be. But as it did, there are a couple others and I think like Coin is one of them. Not because I’m long term bullish on Litecoin, but is just something about light coin. It’s something about the actual project that makes me curious and makes me want to kind of way too longer to see if something will actually be done with it. If you get what I’m saying, like I don’t assume that like coin will disappear. I don’t think that like coin will ever be as big as ethereal or SRP. But I could eventually see it catching on as a as an official test net for bitcoin or even more so just as like a SMI store value, not kind of the gold and silver it kind of thing, but you get what I’m saying. Like I just say, it’s one of the oldest coins that has a big enough community behind it. I think you’re just a more part of the thing. If the people from the Light Coin Foundation chugga chugga, chugga, chugga, chugga like a little bit more, I think things would be a bit more solid for light going. He said the goal is for light coin to be money. It’s where you store your value and also where you can use it to purchase goods and services. Yeah. But even then, I think in order for like going to be considered money, if we get to a fifty thousand dollar light coin, I think that’ll be BAMN. I think that’s a good aim. A price. But even the Bitcoin would have to be a million by that if Bitcoin did ever hit a million. That means it’s absorbing a huge portion of the actual fiat currencies on the planet anyway. To bolster like coins bid as the preferred crypto currency for payments. Charlie Lee is pooling resources to make like coin transactions private. He said recently we put a big effort into a project called Confidential Transaction in Member Limbo, which is to create ways to create or make Litecoin more private. I think privacy and fungibility are very important and we’re pushing that technology, trying to get that implemented and deployed in light coin. It was supposed to happen. I think as far as I remember. I think they mentioned it at the end of last year and now they said sometime this year. I hope it actually ends up happening. I think this would be. And I hope you understand what I mean by Dasch Monaro and Z Cash being used. I think we’re gonna see a divergence in many KOIN soon. I think we’re gonna see coins that are. Like two coins, maybe three coins that are. Actively hoarded and used as a potential future store value. I think we’re going to see coins that are actually going to be used for payments and that could be anywhere along the lines of SRP and lumens if it’s actually going to be still used with IBM. Maybe Stretch, maybe Catano depending on how they develop their entire ecosystem because they said they also want to be used as a payment method stretch. Not too certain on that one. And they were definitely on to have coins, that kind of. They’re in a different portion of the Internet as more crypto transactions are going to be followed. And third party E-D i.e. if you want to spend it in a store, you’ll have to use it through an app that Apple know your name and your address kind of the same way you use your debit or credit card. There will be other methods of payments that will be for people who don’t want to be seen. So this is where I think these kind of coins come into the mix. Anyway, let’s see if this ends up happening. I know I’ve said the words. Let’s see if this ends up happening. But jillion times. But this goes back to what I was saying before. I don’t know if it was the last video or the video before that. We get a lot of news about upgrades and when this upgrade is going to take place and how that upgrade is going to be. But we ever rarely actually see the upgrade. I once again would love. I think this can be the year, the year or cryptocurrencies. But the upgrades have to roll out. You can’t say for 3, 5 years you’re going to do something and then it doesn’t happen. I’m looking at you. Lightning Ethereal SRP Lite Coin, KOIN, Catano, Tron Lumens iOS, everyone. The updates have to happen because if not, there is a huge amount of slippage that could occur. And yeah. As all ways, a very special thank you to my and supporters, hold on, I have this nis Crayola. You are l on crypto with Lino. Take her out much on NESA Bake me a cake. Artomatic 17 anytime. Fitness amongst Korner staff Bodi make boat. face. Yes de Krypto Miller Hitch Test Hebridean Caskets Leg Day minting coins. Jeremy Fox. Jim Garner. Anthony Charles. Nick Amun Yellow Body. Pyxis Crypt. Don’t Be a Ship Made. Vlad the Impaler. Richy Rich A Third. Nick Kanaya setsuna Damian Nicholas onEarth One Piece One Love Krypto. Art is called a 3D Milieus Easy Otto Oh Bankroll Network Krypto do to forward to to the world. Why is Night Owl Gerrish Night Our Brady Nields Massive Interest in Thailand. Mohammed Ronee Adam Grayslake. Todd Mullis Barebones Mining a Biblio Phobia. The Animal reader.. John Sarrazin. Mr Pickles Nostromo. Josh Gorcyca Chong. No song. Oh, no, no. Martin Steuer. Joshua Vinyard Moon Man. Hi, exampIe Yashar. Hi, Daddy. And Professor Wolley from Gun Bot’s You Ni versus Tea at the moment. The market’s in a little Christmas mood. It’s red and green. Bitcoin is currently down by 2.1 8 percent, at least at the time of me making this video, anything could change. Fifteen minutes from now, I was reading around and apparently stocks went up. And then also faltered. Over the last twelve, thirteen, fourteen something hours and it potentially had a negative effect on the price of Bitcoin. Bitcoin goes down. It uses magnetize and drags everything else. Down with it. But at the moment, it’s not too too bad. I do think. I feel like so much. Of the pricing of cryptocurrencies is completely inaccurate. I don’t think that these six million Bitcoin that are lost, six million Bitcoin are lost forever. I don’t think that that’s been priced in. I don’t think that people price in the actual network usage. I think a lot of people who buy and sell Bitcoin are probably influenced by other people around them who tell them how high or how low something could be. This is why I usually get very frustrated whenever we get tone veirs or a bunch of other people. Bitcoin goes up by 8 percent and one day they’re like, Oh, it’s too hot, too hot. Got dumped the bitcoin and is like, yeah, but we were at 14000 just a couple of months ago, so I don’t think an 8 percent increase is too hot or that bitcoin has to reconnect, especially if the network is still robust. So I think a lot of the. I think it’s a lot of noise coming from all different directions as to why Bitcoin is still very low. It’s also the whales, it’s also rich people who may be selling. It could be a literal million and one things, but I think a large amount of the cryptocurrency market is just kind of all over the place. There are so many coins passing by, a lot of them that have no use that you’re never going to use that you may have heard of once or twice that you may have put money into. And they may only have 11 million dollars worth of 24 hour volume. Imagine if the market cap of this two hundred and three million dollars flew into bitcoin. Imagine if two hundred and twenty two million dollars flew into bitcoin. Two hundred and twenty five. And the numbers kind of go on and on. I think we’d have a much healthier cryptocurrency market. I think bitcoin would be a lot more stable already as a price. And I think it wouldn’t be as easy to manipulate it. But. People like to that hedge their bets on other things. I don’t know, it’s it’s it’s it’s always something that could really move the cryptocurrency space, I think, in the long term. Be fine. But it just is kind of like randomization of everything that’s going on within the market is a bit of a laugh anyway. I do hope you all enjoyed. I do hope that you all are having have had continue to have a great day. A great morning. A great afternoon. A great evening. Wherever you are, wherever you might be. I do hope. That it’s I forgot my words. Absolutely fantastic. Thank you all once again for watching and or listening. Somebody was mentioning the other day they think they will like you do your same closing every single day. How could you forget it? You’ve never been inside my brain. It’s not all there. Thank you all once again for watching and listening. And I will most certainly be talking to you all soon. See you.

source https://www.cryptosharks.net/is-bitcoin-too-low-paypal-blockchain-tether-explodes/

source https://cryptosharks1.blogspot.com/2020/04/is-bitcoin-too-low-paypal-blockchain.html

0 notes

Text

Is Bitcoin Too Low? PayPal Blockchain, Tether Explodes, Bitcoin Development & Litecoin As Money

VIDEO TRANSCRIPT

Hello, everybody. Welcome back. For another. Video. Hope you’re all doing well and now you’re all having an incredible day to start things off. American Institute for Economic Research. Editorial director Jeffrey Tucker reignited the long running Bitcoin scaling debate with a tweet earlier to day. The Economist, who has been a long advocate of Bitcoin, suggested the current price is much lower than it would otherwise be if the underlying technology had properly scaled on the thirty first of March. Tucker tweeted I’m not unimpressed by a six thousand dollar bitcoin. I was blown away when the thing reached $30. Can you imagine the price today if the thing had properly scaled between expands on comments Tucker made earlier this month on Artie during a panel discussion with noted Bitcoin skeptic Peter Schiff? I think I don’t think Schiff is a skeptic as much as he’s just really bored. Like I think he has nothing more to do with his life. So he just constantly makes sure that he is. Talking about Bitcoin during the debate, he said too much time had been wasted on this ridiculous scaling problem which had ultimately prevented mainstream adoption. He said adoption hasn’t gone far enough and it hasn’t come into consumer use like it should and would have been if it had been able to scale. Now we’re seeing what happens when Bitcoin was not properly scaled, Tucker said. Bitcoin was designed to thrive in times like the current financial crisis and suggested the reason it hasn’t is due to its scaling Perot Bloom. He said Bitcoin was invented to become a safe haven during times just like this. So why are we seeing bitcoin become the safe haven that it was developed to be and was for a number of years? I have my own thoughts on all of this. I’ll get to that in the second. Don’t don’t you even don’t you even worry? The Bitcoin scaling issue has been one of the most, if not what yet the most heated debate in cryptocurrency. The base layer network isn’t able to process transactions quickly enough to enable wide scale mainstream adoption as a currency. The debate over raising the block size as a solution ultimately led to be cash, and PSV is just a money grab. BMV has nothing to do with actual. I would even argue that they were probably a number of people who actually walked into B cash who probably did believe at some point that they were doing the right thing, but that also then just became a bit of a money grab as well. Would be ASV has nothing to do with the entire scaling solution, especially when it’s not even being used while bitcoin itself adopted the Layer 2 lightning network as a scaling. So Lucian, I. First off. I think that Burt. Burt Kern. I think that Bitcoin itself is already extremely undervalued just based on what it is and what it does and what it enables other people to do. I think if we had many other currencies. So it’s it’s it’s it’s it’s a bit two sided rather. One side is is a lot heavier than other. I think when we hear tons of people talk about especially whether they are the which we’re gonna get to as well. The head of pay, pal, the head of JP Morgan, the head of this bank, the IMF. Whatever the case might be, people who have come forward to negatively talk about Bitcoin and the cryptocurrency space, I think it does have a dampening effect because people tend to keep it sometimes negative things in their mind than they do. Optimistic, positive things. I’m not exactly sure why we think this way sometimes, but this kind of just how it is. So when you get years of Bitcoin bashing, as it were, and people keep saying that Bitcoin can do this and Bitcoin can do that. And especially when they are completely mute during times when Bitcoin’s price is rising really fast or rising more than they think that it should. I think this does have a negative detrimental effect, especially if you end up having news stories, especially like we did years ago, talking about that bitcoin was criminals and bitcoins for this. Bitcoin is for that. I think a lot of bitcoin narrative itself has completely changed. I think the idea of what bitcoin is has also, I guess, morphed and evolved with the not the current financial crisis just over the last eleven years. I think Bitcoin itself as an idea has completely changed. However, I do agree and I do think as well when we and I said this in the last videos, a lot of the things that we have and had been proposed as scaling solutions or upgrades from many different cryptocurrency projects have not yet come to fruition. And or they are currently available, but they are just not being used in mass like people once thought they were. If I’m not mistaken, I believe lightning was dropped, released BTD in 2017 and it was believed by the end of 2019 that it would be the main thing that we would use to be able to send bitcoin transactions back and forth. That this was something that I also noted in 2018 as well. When we first got news that the New York Stock Exchange and the Nasdaq were looking to get into the cryptocurrency space, I said probably if they want rapid, quick, speedy transactions through BTC, they’re going to be using the lightning network. But a lot of that has kind of not fallen silent. We know that it’s still being developed, but it’s more like a I think we need like a major push if we start getting information that especially the partnerships between the major stock exchanges and Starbucks and Nordstrom and end there’s no blabla are all going to be use some use some type of lightning enabled payment system. I think Bitcoin will be completely solidified even right now. Bitcoin as the number one coin I believe is solidified, but it’s more like a where would we be if a lot of the other scaling had happened. The entire idea has been and will probably continue to be that the base layer is too valuable to upgrade. What do I mean by that? And I’m sure some people suck their teeth, roll their eyes, cross their arms when you have a network that is new. Bitcoin is only 10, 11 years old that has processed. Last year alone, 1 trillion dollars worth of value. And you upgraded and something goes wrong. You have a major problem. The entire system, the entire belief behind it completely begins to crumble. Even if it was something as simple as someone being able to manipulate the code and create one extra bitcoin. It doesn’t even have to be a one hundred million bitcoin, just one extra. On the actual BTC blockchain network would cause people to go, well, yeah. If you can create one, you can create more. So the idea is to leave the core chain as it is and simply have other side chains which at some point interact with the main chain to validate and or post the transactions that have taken place on them. But at the same exact time, the other chains around it will take care of the load of their transactions passing through it. Yes, lightning does work, but it’s not as massive as we were told in 2017, we were told that by this point Bitcoin would be able to handle 1 million transactions per second. We never get official numbers as far as and I mentioned this before in 2019 as well. And I like that people told me I was wrong in the comment section, but no one could actually tell me why I was wrong. It was more so we never get an actual number as to how many transactions per second we’re actually able to process now. Just using the lightning network i e whenever Tron gets an upgrade, it can handle 5000 transactions per second. When iOS gets it tracked, when an upgrade, it can do 3000 transactions per second. Ex Fifteen hundred transactions per second. How many? Like what’s the actual number? Is it like a website where I can see the fluctuating number depending on how many people actually have an active channel open on the lighting network like a mathematical numbers, we can see how many transactions are actually being done on the lightning network. I think this would actually cause a very huge shift in the mentality of using bitcoin, even if we saw that just based off of the current. I don’t know how many nodes are currently open on the lightning network. Even if we just saw that based on the current nodes, the transactions per second that we would get would be around eight hundred and fifty per second per minute, whatever the number you need to push forward in your head during bitcoin usage. That would be a major we we’d be able to say officially. We’re no longer at three to five transactions per second. We can now do eight hundred and fifty and get what I’m saying, but no one has ever told me the number. Like we have to mathematically be able to calculate their X amount of people on the lightning network, their X amount of channels open. These channels have zero point one 5 bitcoin. The amount of people using that you go I’m saying anyway. I think the any under valued ness of bitcoin comes from simply people not knowing enough people putting their money into coins that they should not have. We’ve had the discussion many of the times before. I think I’ve I grew quite fatigued with the idea of it. If all the people who had their money and BSB Bitcoin, gold, light coin, light, all the other coins, you know, and I don’t even mean like a sprinkle of coins, there are tens of thousands of coins, thousands of coins that should not exist if all that money had squashed into the correct coins. I think we did least be seeing a ten eleven thirteen thousand dollar bitcoin. Any devaluation? Like I say, I think it just comes from negative news and what people are not really understanding exactly what bitcoin is, but it’s neither here nor there. I assume we’ll have this conversation once again when bitcoin is at fifteen thousand. People think that bitcoin should be at one hundred and thirty thousand. But as of right now, this debate will continue. As it stands from what we hear, Bitcoin’s base layer will never be upgraded. It’s more of a if that’s not going to be upgraded. Upgrade the other. Chains quickly, rapidly do what you can. I think even something if if it had been a simple air quote as a simple something that lay on top of Bitcoin that allowed everyone to have at least 30 transactions per second, that’s still a 6 X from what we have right now anyway. That’s the Bitcoin. UNDER-valued news. And without further ado. For your can can confusing news for the day to pay, pal is hiring a blockchain strategy director based on a recent job posting, the new hire will be part of their global financial crimes group. According to the job description, PayPal’s newly hired anti-money laundering and blockchain strategist will lead market expansion efforts and focus on opportunities and partnerships related to blockchain. PayPal’s job posting explains. The successful candidate will be responsible for evaluating blockchain use cases with an eye towards financial crimes, risk management and overseeing anti-money laundering, investigative activities and emerging trends in the space. The strategist will also carry out external partner diligence meetings around blockchain opportunities. They’ll pay. Pao has not confirmed that it has hired an agent. It appears that it has completed the hiring process based on the status of its ad Ver Tai’s meant so I guess maybe I’ll even work backwards. Is this it? Pay pal, valuating, blanching new cases out there. Yeah. So you’re really working backwards. The CEO of Pay Pal. Many moons ago had released information that not only did he not like Bitcoin, but he didn’t care for other cryptocurrencies and he said that blockchain was the way to go. Even weirder is that at some point during this year, the PayPal. Even before this, I think a couple of weeks ago, the PayPal CEO, after all of his hate mongering. Fear mongering. I don’t like you Bitcoin mongering, announce that he actually owned Bitcoin. He said that Bitcoin was the only crypto he owned. How weird. Right after you tell everyone that you also hate it. And then the other speculative part it would be is the actual hiring of a blockchain and anti-money laundering professional. Whatever. Where do you want to use y? If you don’t think. I mean, so we’ve thought for a while that pay PAO would probably integrate. This is just. There’s lot of speculation. I was floating around the cryptocurrency space that PayPal, eBay, WP or whatever would also integrate bitcoin. I. Could see. In the future, this being a thing around five years from now, well, they have like a separate section. We got a click over here for pay pal payments or he’ll ever have a Bitcoin payment. I don’t think is going to happen anytime soon, especially with. I don’t know, say how well a PayPal is doing, but it’s more like a. I don’t expect them to change their current method of money making in the near future. But one can only assume if they’re looking for someone or have found someone who is a master at blockchain and AML, they’re probably figuring out trying to figure out ways to integrate cryptocurrency, if not maybe stable coin payments through their platform and being able to make sure that they know exactly where all the money is going based on the AML compliance. Of course, I mean, a large part of what I just said is speculation, but one can only assume. Why would you why would you be doing all of this? If not to at some point integrate some of the cryptocurrencies that we currently know about? If not, once again, just bitcoin. Yeah, sure. This is probably the three thousand millionth person who said that day before hated bitcoin and then announced that they actually own bitcoin. How weird, right? I’m looking at you, Jamie Diamond, and I know Warren Buffett has like half a bitcoin somewhere anyway. Let’s move on. Next up, despite the strong downturn seen in the crypto markets epitomized by Bitcoin’s 50 percent decline that transpired on the 12th of March, the amount of Teather in existence has exploded. In fact, according to the industry news aggregator on foaled did the market capitalization of the asset recently surpassed 6 billion U.S. dollars, with 1 billion added to this metric in the past two weeks alone in an industry valued at under 200 billion. Such inflows are clearly dramatic. Furthermore, alternative stable coin solutions paxos Dollar USD, COIN Finance USD USD, etc. have been printing dozens of millions of coins as well. This begs the question what is driving this demand for stable coins? How will the increase in stable coins supply affect bitcoin moving forward? Sam. Why? His name is Sam. Wow, what a last name. His name is Sam. Bank Man Fried. A former institutional investor turned CEO of both Derivatives Exchange F.T. X and Bitcoin Quant Fund, Almeda recently chalked up the phenomenon of the rapidly increasing stock of USD T to three factors over-the-counter traders, primarily in Asia. People who are selling bitcoin for tether to hedge positions. And people who are selling bitcoin for USD t. To reduce risk. The idea being is as more people get into the market and the cryptocurrency market continues to have wild swings, that of course in theory people will want something that can stabilize or hedge their bets as they don’t want lose tons of money. If you see that Bitcoin’s price is looking like it’s going to go down by. Seemingly fifteen percent and you see it’s already down by 4 percent and that line is going straight down, you swap your money into tether. But it doesn’t exactly explain exactly why a billion dollars worth of tether was printed in the last two weeks or why many other stable coins are printing dozens of millions of but jillions of coins as well. The idea in 2017 as to why there was so much Stetler, so much tether being printed, was that there was demand for it. But nearly every single time that we saw Teather and I assume other stable coins being created, there was usually or was usually followed by an immediate price rise in bitcoin. We saw this many times throughout 2017. Every time, according to the news, that there was an increase in interest in the cryptocurrency market. More Teather was printed and in Bitcoin’s price would. Shoot up. So it could simply be that there are maybe many people behind the scenes who have expressed their interest to Coinbase or by NANCE or the paxos people or even to the Teather people saying, we want to get in. We want to do so. And so therefore we’re gonna need some more to be able to do the trades that we want to do. Or it could also simply just be that a lot of people may believe that the cryptocurrency market is moving to a more stable koine world or third thing. It could just be tons of investors who are realizing that as Teather and all these other stable coins are being used, that there’s like a transaction fee and if they give enough money that they’ll also be they’ll have a piece of the pie as the transactions are kind of going through anyway. It’s all rather fascinating. I don’t think we’ll ever have an actual answer for for any of this ever. We’ve been trying for years. We’ve had multiple companies who said that they knew what was going on. They all had a completely different answer. The entire point is there’s more Teather being printed. A billion is a lot, I think in 2017. I think we maxed out at 1.2 billion, 1.3 somewhere around there. It wasn’t the 6 billion that it is today. Also funny to note that we are six times as much Teather, but still one third the price of Bitcoin. Fascinating. In deed. Next up in Super Mega Obvious everywhere, News BLOCK, Stream and Lightning Labs are the two firms currently leading the funding for open source Bitcoin and lightning development, according to data compiled by Bit Mex.. Announcing the news on Saturday, Big Mac said the two firms employ the largest number of Bitcoin developers. Peter Willie, Wiley, Andrew Chow and Gregory Sanders are some of the Bitcoin developers, which are currently being funded by block stream lighting. Labs, on the other hand, employs at least eight developers working on open source lightning software. And those names, right? There is little chart square crypto is ranked third per bit. mecs, which currently employs notable bitcoin developer Matt Carollo, as well as provides grants to other bitcoin and lightning developers. Square Crypto is followed by M.I.T. Media Lab, Digital Currency Initiative and Chain Code Labs. The latter, in fact, is the largest contributor into Bitcoin core development per the data. I don’t think that anyone should be surprised that the people from lightning are funding lightning development, or that the people from BLOCK Stream who have the most developers working on bitcoin are doing the most funding for. Yeah, we have a lot of really weird news sometimes I guess that the yay that Bitcoin is still being developed on. I didn’t assume that it was not. Yeah, I should. Should we just move on? Because, yeah. Here’s the actual bit Max blog. Who funds Bitcoin development? The people who are working on Bitcoin. Simple enough, right? Yeah. And to finish things off like COIN founder Charlie Lee says that he sees other use cases where cryptocurrencies, apart from speculation and store of value, payment settlement and confidential transactions on top of the list. In a new episode of Creds Meet Our Partners, Lee explains how the Light Gwin Foundation is shaping the world’s seventh largest cryptocurrency by market cap become a reliable means of exchange, he said with like coin. We are definitely aiming, aiming, moving towards what payments for peoples has actually spend the coins as opposed to just holding or onto it as a store value. You can see there’s more and more 80m coming out that support like COIN, where people can easily withdraw their light coin or convert cash like coin. I I don’t think that anyone. Tell me if I’m wrong. I don’t think that anyone’s gonna be selling their light coin or using or, you know, selling their light coin anytime soon. Like coin is like thirty dollars. Thirty five dollars like coins all time high was like ten times that. Estimates that we’ve had before as light coins havingthe continue to take place over the next ten generic jaybird, which are three years now. I’ve seen calls for a fifteen hundred dollar light coin. I’ve seen a four thousand dollar light coin. I think it’s pretty believable if like coin has two more havingness. By 2030, lite coin could easily be. Obviously, anywhere from nine hundred to ten thousand dollars per coin, I think a lot of people have. This is how I feel. I think a lot of people have kind of missed the ball on their crypto being used as any type of major payment method in the near future. I think the coins have to go really high in price for people to infrastructure has to also be there. But it’s also like a lot of cryptocurrencies are held speculatively. I think Bitcoin is held hyper speculatively. I think he theorem is accumulated speculatively for a Theorem 2.0 to be able to actually mined more ether, especially with it being used and locked up in DFI projects. I think exampIe, while it’s supposed to be used for banks and institutions, is also being gobbled up by investors because if other banks and institutions use it. Therefore, I also want to have a large slice of the pie as well. And it kind of goes down the line. I don’t think besides stable coins that there are many coins off the top of my head. Maybe Monaro, daschund and Cash now would actually be used more or percentage wise as an actual usage of payment. Like we know that there are companies who convert holdings or whatever into bitcoin to send back and forth as the actual transaction. But that’s also like companies. I think a lot of people who are directly investing in these cryptocurrencies like myself. I see no actual like I have some light coin, but there’s not going to be a point anytime soon where I’m going to probably sell off my light coin or use it to buy a cup of cup of soda. But what what does that can of soda or anything? No, it’s probably not going to happen in anytime soon. As you know, a lot of people this is just how I feel about certain things, though. A lot of coins that I have, I think I’m going to definitely eventually sell off, especially when prices start going up. I’m not sure if I’ll swap it into a Teather. I’m not sure if I’ll swap it directly into Bitcoin or if I’ll do something kind of just put it back into cash and start buying some vacation homes or whatever the case might be. But as it did, there are a couple others and I think like Coin is one of them. Not because I’m long term bullish on Litecoin, but is just something about light coin. It’s something about the actual project that makes me curious and makes me want to kind of way too longer to see if something will actually be done with it. If you get what I’m saying, like I don’t assume that like coin will disappear. I don’t think that like coin will ever be as big as ethereal or SRP. But I could eventually see it catching on as a as an official test net for bitcoin or even more so just as like a SMI store value, not kind of the gold and silver it kind of thing, but you get what I’m saying. Like I just say, it’s one of the oldest coins that has a big enough community behind it. I think you’re just a more part of the thing. If the people from the Light Coin Foundation chugga chugga, chugga, chugga, chugga like a little bit more, I think things would be a bit more solid for light going. He said the goal is for light coin to be money. It’s where you store your value and also where you can use it to purchase goods and services. Yeah. But even then, I think in order for like going to be considered money, if we get to a fifty thousand dollar light coin, I think that’ll be BAMN. I think that’s a good aim. A price. But even the Bitcoin would have to be a million by that if Bitcoin did ever hit a million. That means it’s absorbing a huge portion of the actual fiat currencies on the planet anyway. To bolster like coins bid as the preferred crypto currency for payments. Charlie Lee is pooling resources to make like coin transactions private. He said recently we put a big effort into a project called Confidential Transaction in Member Limbo, which is to create ways to create or make Litecoin more private. I think privacy and fungibility are very important and we’re pushing that technology, trying to get that implemented and deployed in light coin. It was supposed to happen. I think as far as I remember. I think they mentioned it at the end of last year and now they said sometime this year. I hope it actually ends up happening. I think this would be. And I hope you understand what I mean by Dasch Monaro and Z Cash being used. I think we’re gonna see a divergence in many KOIN soon. I think we’re gonna see coins that are. Like two coins, maybe three coins that are. Actively hoarded and used as a potential future store value. I think we’re going to see coins that are actually going to be used for payments and that could be anywhere along the lines of SRP and lumens if it’s actually going to be still used with IBM. Maybe Stretch, maybe Catano depending on how they develop their entire ecosystem because they said they also want to be used as a payment method stretch. Not too certain on that one. And they were definitely on to have coins, that kind of. They’re in a different portion of the Internet as more crypto transactions are going to be followed. And third party E-D i.e. if you want to spend it in a store, you’ll have to use it through an app that Apple know your name and your address kind of the same way you use your debit or credit card. There will be other methods of payments that will be for people who don’t want to be seen. So this is where I think these kind of coins come into the mix. Anyway, let’s see if this ends up happening. I know I’ve said the words. Let’s see if this ends up happening. But jillion times. But this goes back to what I was saying before. I don’t know if it was the last video or the video before that. We get a lot of news about upgrades and when this upgrade is going to take place and how that upgrade is going to be. But we ever rarely actually see the upgrade. I once again would love. I think this can be the year, the year or cryptocurrencies. But the upgrades have to roll out. You can’t say for 3, 5 years you’re going to do something and then it doesn’t happen. I’m looking at you. Lightning Ethereal SRP Lite Coin, KOIN, Catano, Tron Lumens iOS, everyone. The updates have to happen because if not, there is a huge amount of slippage that could occur. And yeah. As all ways, a very special thank you to my and supporters, hold on, I have this nis Crayola. You are l on crypto with Lino. Take her out much on NESA Bake me a cake. Artomatic 17 anytime. Fitness amongst Korner staff Bodi make boat. face. Yes de Krypto Miller Hitch Test Hebridean Caskets Leg Day minting coins. Jeremy Fox. Jim Garner. Anthony Charles. Nick Amun Yellow Body. Pyxis Crypt. Don’t Be a Ship Made. Vlad the Impaler. Richy Rich A Third. Nick Kanaya setsuna Damian Nicholas onEarth One Piece One Love Krypto. Art is called a 3D Milieus Easy Otto Oh Bankroll Network Krypto do to forward to to the world. Why is Night Owl Gerrish Night Our Brady Nields Massive Interest in Thailand. Mohammed Ronee Adam Grayslake. Todd Mullis Barebones Mining a Biblio Phobia. The Animal reader.. John Sarrazin. Mr Pickles Nostromo. Josh Gorcyca Chong. No song. Oh, no, no. Martin Steuer. Joshua Vinyard Moon Man. Hi, exampIe Yashar. Hi, Daddy. And Professor Wolley from Gun Bot’s You Ni versus Tea at the moment. The market’s in a little Christmas mood. It’s red and green. Bitcoin is currently down by 2.1 8 percent, at least at the time of me making this video, anything could change. Fifteen minutes from now, I was reading around and apparently stocks went up. And then also faltered. Over the last twelve, thirteen, fourteen something hours and it potentially had a negative effect on the price of Bitcoin. Bitcoin goes down. It uses magnetize and drags everything else. Down with it. But at the moment, it’s not too too bad. I do think. I feel like so much. Of the pricing of cryptocurrencies is completely inaccurate. I don’t think that these six million Bitcoin that are lost, six million Bitcoin are lost forever. I don’t think that that’s been priced in. I don’t think that people price in the actual network usage. I think a lot of people who buy and sell Bitcoin are probably influenced by other people around them who tell them how high or how low something could be. This is why I usually get very frustrated whenever we get tone veirs or a bunch of other people. Bitcoin goes up by 8 percent and one day they’re like, Oh, it’s too hot, too hot. Got dumped the bitcoin and is like, yeah, but we were at 14000 just a couple of months ago, so I don’t think an 8 percent increase is too hot or that bitcoin has to reconnect, especially if the network is still robust. So I think a lot of the. I think it’s a lot of noise coming from all different directions as to why Bitcoin is still very low. It’s also the whales, it’s also rich people who may be selling. It could be a literal million and one things, but I think a large amount of the cryptocurrency market is just kind of all over the place. There are so many coins passing by, a lot of them that have no use that you’re never going to use that you may have heard of once or twice that you may have put money into. And they may only have 11 million dollars worth of 24 hour volume. Imagine if the market cap of this two hundred and three million dollars flew into bitcoin. Imagine if two hundred and twenty two million dollars flew into bitcoin. Two hundred and twenty five. And the numbers kind of go on and on. I think we’d have a much healthier cryptocurrency market. I think bitcoin would be a lot more stable already as a price. And I think it wouldn’t be as easy to manipulate it. But. People like to that hedge their bets on other things. I don’t know, it’s it’s it’s it’s always something that could really move the cryptocurrency space, I think, in the long term. Be fine. But it just is kind of like randomization of everything that’s going on within the market is a bit of a laugh anyway. I do hope you all enjoyed. I do hope that you all are having have had continue to have a great day. A great morning. A great afternoon. A great evening. Wherever you are, wherever you might be. I do hope. That it’s I forgot my words. Absolutely fantastic. Thank you all once again for watching and or listening. Somebody was mentioning the other day they think they will like you do your same closing every single day. How could you forget it? You’ve never been inside my brain. It’s not all there. Thank you all once again for watching and listening. And I will most certainly be talking to you all soon. See you.

source https://www.cryptosharks.net/is-bitcoin-too-low-paypal-blockchain-tether-explodes/

source https://cryptosharks1.tumblr.com/post/614367059687751680

0 notes

Text

Is Bitcoin Too Low? PayPal Blockchain Tether Explodes Bitcoin Development & Litecoin As Money

VIDEO TRANSCRIPT