Text

What is Financial Modeling in Excel?

Financial modeling in Excel is the process of building a financial model to represent a transaction, operation, merger, acquisition, financial information to analyze how a change in one variable can affect the final return so as to make a decision on one or more of the aforementioned financial transactions.

0 notes

Photo

A distribution waterfall is a method in which capital gains of the fund are distributed between or among investors or partners, typically between limited partners (LPs) and general partners (GPs). The profits earned are distributed according to the cascading structure of sequential tiers with reference to waterfall. Basically, when the first tier's allocation requirement is satisfied, the excess funds will be subjected to the next tier's requirement.

0 notes

Text

What you need to know about Private Company Valuation

Private company valuation poses some specific challenges not encountered in the valuation of publicly-traded companies. Because private companies aren’t publicly traded, they are not required to publicly disclose their financials—and obviously, there are no stock metrics available for comparison to other similar companies. In addition, accounting standards for private companies are often less stringent, so their financial statements may be less standardized and lack the clarity of a public company’s metrics. In family owned and operated businesses, it’s not uncommon for there to be some intermingling of business and personal funds which needs to be resolved before performing the valuation. All of these factors equate to less transparency in the financials of private companies, and make private company valuation more challenging than determining value for a publicly-traded company.

0 notes

Photo

The discount rate at which the net present value of an investment is equal to zero. The internal rate of return is a time value of money metric, representing the true annual rate of earnings on an investment. In real estate practice, IRR is used together with other return metrics such as equity multiple, cash-on-cash return, and average rate of return to compare real estate investments and make investment decisions.

0 notes

Text

What is Sensitivity Analysis?

Sensitivity analysis is a very useful tool to analyze the impact of any changes in key assumptions on the key output of the model, such as the NPV and IRR. It is also known as the “what-if” analysis since you have to go through a series of what-ifs to run different simulations and determine the impact of each assumption. By running a variable through different scenarios or circumstances, you’ll be able to determine how sensitive the output is and also find out how to keep the inputs constant. In other words, sensitivity analysis is the task of calculating the uncertainty of a financial model while considering different sources of inputs.

0 notes

Text

Grocery Store Financial Model Excel Template

Grocery Store Five Year Financial Projection Template for startups or established companies is the right choice when they need to raise funds from investors or bankers and calculate funding requirements, make cash flow projections, develop budgets for the future years, or to enhance a business plan

0 notes

Photo

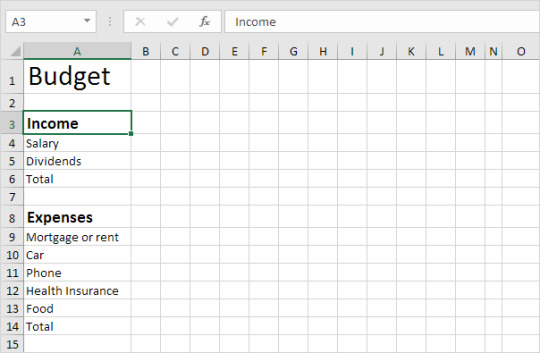

A budget is also needed when estimating the future funding requirements and figure out if they can be funded internally or require external sources of financing. Internal financing means using the cash generated from the business’ normal operating activities. On the other hand, external financing refers to the capital provided by parties external to the company such as banks or investors. Therefore, you need to use your budget to analyze how much external financing you will require.

#budgetingspreadsheettemplates#budgetingsheettemplate#budgetingexceltemplatefree#budgetingspreadsheetexample

0 notes

Photo

It may not sound like the most enjoyable task in the world to create a budget, but it’s an essential part of maintaining your finances organized while attempting to control the level of funds you might need to live the way you want. Budgets help you manage your monthly spending, your vacations, your desires, and even your future finances.

Because budgeting allows you to create an expenditure plan for your money, it ensures you’ll always have enough money to cover all your expenses. If you are actually in debt, implementing a budget or spending plan can also keep you out of debt or help you find your way out of debt.

0 notes

Text

Consulting Services Industry – Starting a Consulting Firm

Efficiency is the best trait not just for large businesses but it also applies to small businesses, to manage the flow of the business productivity in a given time. Consulting Firms such as Consultants, Accounting, Legal Services, and other professional consulting services firms, also need proper financial planning and staff management to run the firms smoothly.

Consulting firms target companies or executives to provide consultants or industry-specific specialists and subject-matter experts, which are trained and an expert professional in their field. Providing services to complement strategies and be implemented for better results. This has been perceived and accepted by companies as “outsourcing”.

Starting a consulting firm is a win-win to both the clients and the firm. Getting results without the hassle of hiring new staff for a lesser cost and sometimes, specialized experts do a much better job compared to new staff that still needs training and instructions.

Usually, the main area of work in consulting service includes:

Project Handling

Providing expertise solution in the respective department

Creating, executing and managing plans

Handling various company operations

These service providers are the superheroes that ensure a seamless integration and smooth operation for companies in different industries. So, it is guaranteed that starting a consulting firm or a business for consulting services is potentially profitable. How to make sure that it will be successful? Just like any business, creating a business plan or a financial model.

0 notes

Text

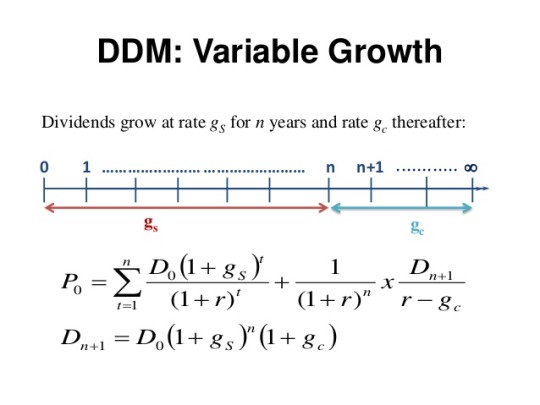

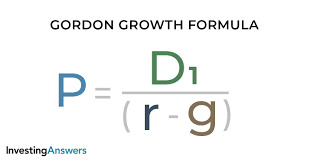

The DDM Formula

The Dividend Discount Formula requires the following components:

Annual Dividend Per Share – The amount each investor receives as compensation for investing in the company.

Dividend Growth Rate – Represents the rate at which the dividend is increased from year to year. The dividend growth rate can undergo a stable or constant growth and it can also undergo a combination of different stages:

A high, aggressive and unsustainable growth rate for a finite period of time.

A slower and declining growth rate for a finite period of time.

A stable growth rate for an indefinite period of time (perpetuity).

Required Rate of Return – Also called “cost of equity”, is the minimum rate of return an investor requires to compensate him for the risk undertaken in investing in the stock. The Capital Asset Pricing Model (CAPM) is often used to determine the rate. The rate calculated should be higher than the dividend growth rate otherwise the stock will have a negative intrinsic value.

#dividenddiscountmodel#dividenddiscountmodelformula#dividenddiscountmodelcalculator#dividenddiscountmodelinexcel

0 notes

Text

Understanding the Dividend Discount Model (DDM)

The dividend discount model works on the theory of calculating the net present value (NPV) of a company’s future cash flows using the time value of money concept (TVM). Basically, the DDM is based on estimating the present value of all potential dividends expected to be paid by the firm using a net interest rate factor or also called discount rate.

Estimating a company’s potential dividends can be a challenging job. To predict future dividends, analysts and investors may make certain assumptions or attempt to identify trends based on past dividend payment history. One can conclude that the company’s dividend growth rate will remain constant in perpetuity, which refers to an endless stream of similar cash flows with no end date.

Another thing is that shareholders who put their money into stocks run the risk of losing money because their investments can lose value. They anticipate a return/compensation in exchange for this risk. The market and investors expect reimbursement from a company’s cost of equity capital in return for owning the asset and bearing the burden of ownership. The Capital Asset Pricing Model (CAPM) or the Dividend Growth Model can be used to estimate this rate of return, which is expressed by (r). This rate of return, on the other hand, can only be realized when an investor sells his stock. Due to investor discretion, the appropriate rate of return can vary.

0 notes

Link

A private company, privately-held or closed company is simply a company under private ownership. Private companies do issue shares of stock to their shareholders however these are offered (“private offering”), owned (usually by a limited number of individuals predominantly by founders) and exchanged or traded privately (not at a stock exchange).

0 notes

Photo

The internal rate of return (IRR) calculation is based on projected free cash flows. The IRR is equal to the discount rate which leads to a zero Net Present Value (NPV) of those cash flows. Important therefore is the definition of the free cash flows. There are two main types of free cash flows which can be referred to:

Unlevered free cash flows (free cash flows to firm): EBIT * (1-tax rate) – CAPEX + Addback Depreciation – Change in Net Working Capital

Levered free cash flows (free cash flows to equity shareholders): Unlevered free cash flows + change in financial debt – interest + correction for effective taxes paid

EBIT = Earnings before Interest and Taxes

CAPEX = Capital Expenditures

While unlevered free cash flows refer to the cash flows generated by the company without considering its financing structure, levered free cash flows are impacted by the amount of financial debt used. Using financial debt – especially in low-interest-rate environments – is much cheaper than financing solely with equity and allows to enhance the returns on their investment. This is called “financial leverage, “gearing” or “financial engineering”. The resulting IRR calculations now can be differentiated as follows:

IRR Unlevered uses the unlevered free cash flows and is subject to the operating risks of the company. The unlevered IRR is not supposed to be affected by any change in the company’s financing structure. The IRR Unlevered often is also called the “Project IRR”.

IRR Levered is calculated based on the levered free cash flows (another variation of this is to use a cash-in / cash-out consideration based on the initial equity investment made, dividends and exit proceeds). IRR levered includes the operating risk as well as financial risk (due to the use of debt financing). In case the financing structure or interest rate changes, IRR levered will change as well (whereas the IRR unlevered stays the same). The levered IRR is also known as the “Equity IRR”.

Calculating and understanding the IRR levered can be tricky. Therefore, let us review an internal rate of return example calculated in Excel for two different investment cases. Both investment projects, A and B, show similar operating risks and require a 10% opportunity cost on invested capital to compensate investors for the operating risks involved.

0 notes

Text

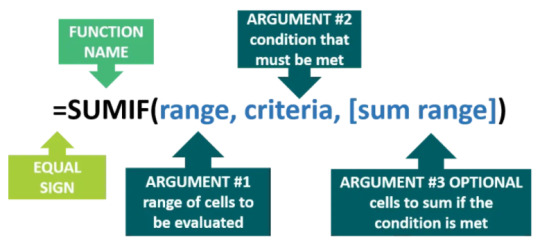

Knowing the Basics of the SUMIF Function in Excel

Similar to its more rudimentary peer, SUM function, the SUMIF function in Excel is built-in and categorized under Math and Trigonometry function. It is also known as the conditional sum and is used to add cells based on the single condition or criterion you provide.

The SUMIF function in Excel has the following arguments:

Range (Argument#1, required) – Specifies the scope of cells in which the criteria must be applied.

Criteria (Argument #2, required – The single condition or criterion used to determine which cells will be added. Common SUMIF examples in Excel of a criterion for argument#2 are:

Sum_range (Argument #3, optional) – is the scope of cells with the numeric values that are to be added if the single condition or criterion is satisfied. Take note this is optional; use it only if you want to add cells other than the Range argument (#1). Otherwise, values from the Range argument (#1) are added instead.

Any numeric value such as an integer (100 or -100), decimal (.001), date (01/01/2019), time (9:00:00 AM) or logical value (TRUE/FALSE).

A text string such as “Sales”, “Customer Name”, “Product ID”. The double quotes enable Excel to interpret everything inside as text.

An expression such as “>100”, “<>0”.

0 notes

Text

How to forecast the Balance Sheet?

Many companies focus on the income statement when forecasting their future cash flows but neglect to also include important aspects from the balance sheet.

0 notes

Text

Hair Salon Financial Plan | Beauty Salon Business Plan

Do you need a financial model to come up with a business plan for a hair/beauty salon? This financial model template in Excel makes it easier to build your business plan.

#businessplanofbeautysalon#abusinessplanforabeautysalon#businessplanofabeautysalon#businessplanbeautysalontemplate

0 notes

Photo

This financial model can be used to evaluate the financial feasibility of a real estate development project and present it in investor grade quality to your partners. There is everything in there which is needed to project the project’s cash flows and calculate the project returns.

#realestatevaluation#realestatevaluationmethods#realestatevaluationmodel#realestatevaluationwebsites

0 notes